OR

Dear Finance Minister, you may choose not to believe in the future as you did by rejecting digital financial technologies, but in the process please don’t block our future

Honorable Finance Minister,

I read your disparaging comments about financial technologies with dread, horror and that terrible sinking feeling of hopeless. For many Nepalis seeking to imagine a better future, your remarks made it clear that you would not let them have one.

Addressing the inaugural session of the ‘Conference and Roundtable on Financial Consumer Protection and Education in Asia Pacific’ in Kathmandu on July 2, you spoke about the “growing risks posed by the new and disruptive technologies in financial sector like fintech, artificial intelligence and technology-driven financial services.”

Like you, many recognize and are seeking to address the risks. But you went further, stating that because you didn’t understand these risks, we should wait to see what happens before harnessing the most powerful developments of this century.

“I worked with the central bank for over 25 years. Still, I am hesitant to do something in the cloud. Is it safe?” You asked.

No, not entirely. There are always elements of risk, as the famous data breach of Facebook by Cambridge Analytics displays.

But airplanes are also risky with many air crashes every year. Yet we fly. How many times have you been on an aircraft this year? Like airplanes, digital financial technologies are already widely in use and are already a core component of the global financial system. In response to their growth and potential, many governments have been examining how to build adequate safeguards and protective measures.

You should be encouraging a national search for safeguards that would enable us to harness the power of cloud computing and digital technologies. When was the last time you directed your ministry to explore how we should build measures to protect data and information in the cloud?

“Many people like me do not have that much confidence in technology-driven financial services,” you stated nervously. Like “many people” you have a right not to have “much confidence in technology.” But many people who “do not have that much confidence in technology” should not lead. The 21st century Nepal needs 21st century leaders, not 16th century purists who are nervous about the transformative potential of digital technologies.

Perhaps, honorable minister, you confuse ‘ignorance’ with ‘lack of confidence’.

When was the last time you directed your ministry to examine how and why global financial systems are demonstrating “confidence” in digital technologies? Why are digital financial technologies transforming the way of doing business?

“So, we have to see how these disruptive technologies used in the financial sector will work in future. From the mode of payment to medium of exchange, and from cash to card and card to Internet banking, I do not know. Thank god, the virtual currency and cryptocurrency did not work well,” you asserted.

It is not clear what led you to conclude that “virtual currencies and cryptocurrencies did not work well.” Because you decided to unreasonably round up a few young Nepalis for mining bitcoins in Nepal doesn’t mean that virtual currencies did not work well. For the most part, those arrests reflected the fact that the government was inadequately prepared for this innovation.

On the contrary, you should be “thanking God” that virtual and cryptocurrencies have been working well—at least, globally. It holds tremendous promise, especially for countries like Nepal, where financial inclusion remains a key development goal.

You were right in describing these technologies as “disruptive.” But to see how these “disruptive technologies could work in the future,” you must first be willing to use them and then remain open to letting them be disruptive.

When was the last time you directed your ministry to examine the positive “disruptive” potential of technology-driven financial sector in forcing better governance, transparency and application of a rule-based economy?

State and market

In addition to your unreasoned nervous reservations about technology, it was the way you choose to conclude the speech that left many Nepalis wondering whether there is a future for them in Nepal.

“We have to give a level playing field to the market. If the market does not function properly, the state as a guardian has to intervene and that is exactly what Nepal is doing at the moment,” you stated as you concluded your speech.

You are right, if the market does not function, the state must act as a guardian and intervene. But ask yourself a much more difficult question: What would you do if the state doesn’t function properly, which prevents markets from functioning properly?

The challenge in Nepal today isn’t that markets are not working. The challenge is that government—your government at the moment—is not working. Market failures reflect the government’s own failures: Government’s inability to make laws, policies and implement them consistently. In the absence of a rule-based economy, the failure of markets to function is not the problems of the market alone.

This is where digital technology, such as “fintech, artificial intelligence and technology-driven financial services,” which you objected to in your speech, could all play a positive role.

Of the many possibilities, application of digital technologies in the financial sector could help introduce transparency and consistency. Virtual and cryptocurrencies, for instance, would require us to establish trust in a mechanism outside of government. The transformative power of digital technologies isn’t simply that it makes mechanical transactions easier.

The value of digital technologies is that it makes mechanical transactions easier. But its transformative power comes from the fact that it fulfills a trust deficit. It offers rules where rules don’t exist; it helps to enforce them consistently with a visible, traceable and transparent trail.

Application of digital technologies in the financial sector is ideally suited for countries like Nepal where government institutions are weak, where transparency is intentionally withheld, where trust is lacking, and application of rules is inconsistent. In such environments, digital technologies can help to create environments where all stakeholders know the rules and can participate with confidence.

But digital technologies, whether applied in the financial or other sectors, needs the government’s support. This is where your remarks, honorable minister, are troubling.

Your remarks reflect not only a lack of information about the current realities of digital technologies, but the casualness and completeness with which you discount the prospects of promising technologies undermining our future.

Leadership amidst change

Honorable minister, your remarks didn’t really highlight the challenges and risks of digital technologies in the financial sector. On the contrary, they highlighted the need for stronger leadership.

Your concern for the risk of digital technologies in the financial sectors is reasonable. But as a leader of the country, we need you to display greater confidence in new technologies and be willing to take stock of the changes sweeping through the world.

There is fraud everywhere. Bank robbers robbed banks long before data breaches and digital technologies. Your job as finance minister is to find safeguards that prevent fraudsters so that the rest of us—all of Nepal—can adopt the future.

You have a right to be nervous about disruptive digital technologies. But if you cannot find ways to manage these risks and embrace technology. You should make way for other leaders who can.

Honorable finance minister, you may not believe in the future. But Nepal needs the future.

Bishal_thapa@hotmail.com

You May Like This

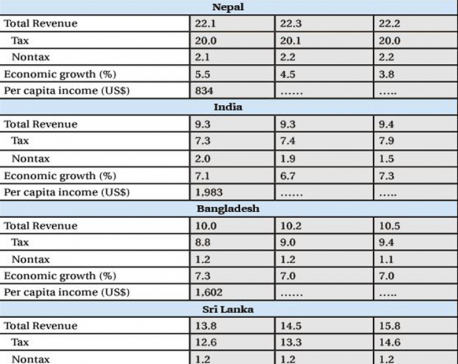

Tax exploitation in Nepal

High taxation policy pursued by Nepal has worked as a powerful drag on the economy by hurting private sector incentive... Read More...

Path of peril

Even though politics of here and now demands repositioning of Nepali Congress, playing to the religious gallery might prove to... Read More...

Tap the opportunities

Low level of economic integration combined with untenable trade deficit is making Nepal vulnerable to external shocks ... Read More...

Just In

- SC directs SidhaKura news portal to appear with evidences on May 2

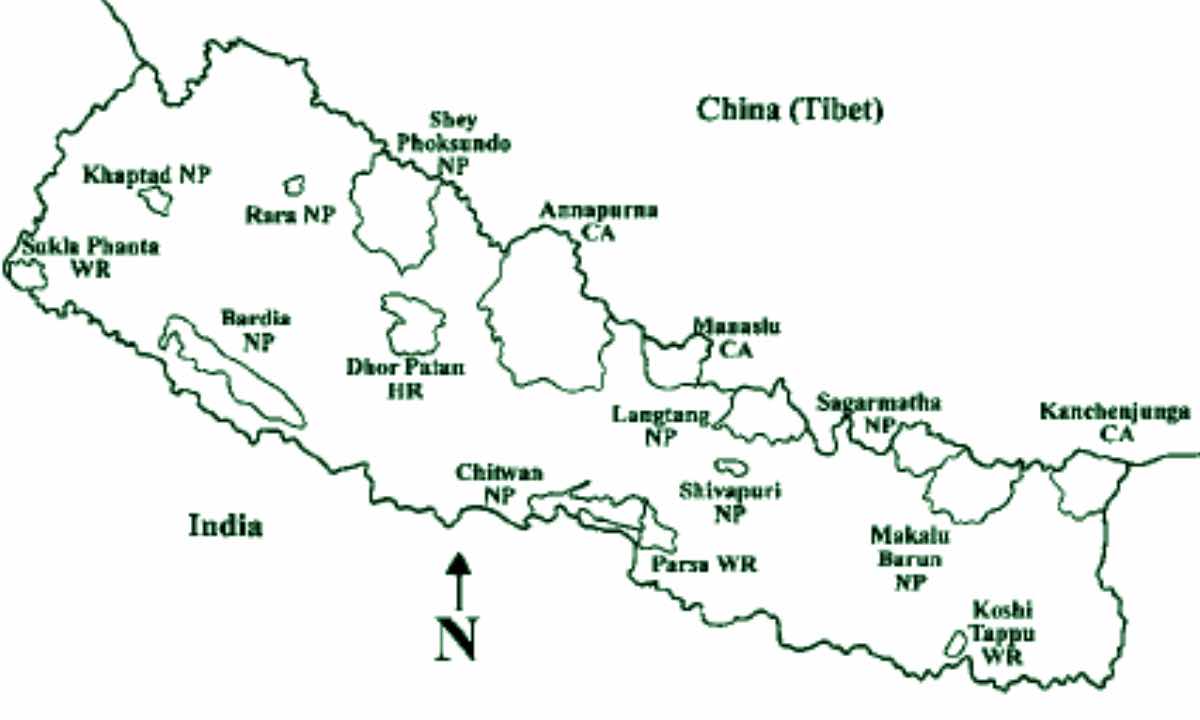

- Urgency of policy update for Nepal's National Park buffer zones

- Investment summit concludes with govt signing over a dozen MoU with prospective investors

- UML's Nembang elected in Ilam-2

- Ensure follow-up for increased FDI

- Nepal and Vietnam could collaborate in promotion of agriculture and tourism business: DPM Shrestha

- Govt urges entrepreneurs to invest in IT sector to reap maximum benefits

- Chinese company Xiamen investing Rs 3 billion in assembling plant of electric vehicles in Nepal

Leave A Comment