KATHMANDU, Aug 26: The Nepal Stock Exchange (Nepse) benchmark index rose 8.19 points this week despite volatility in the market throughout the week.

While the stock market plunged 40.57 points during the first three trading days, the benchmark index bounced back 48.76 points on the trading day of trading on Wednesday.

The stock market remained closed on Thursday due to a public holiday to mark the Krishna Janmastami festival.

Many stock brokers say it is normal for the stock market go into correction mode after the benchmark index reaches a peak.

Nepse in weekly correction but selling pressure eases off

A decision by Nepal Rastra Bank (NRB) to increase the paid-up capital of bank and financial institutions (BFIs) last year further accelerated the bull market to hit a record high of 1,881.45 points on July 27 as investors have been trying to amass shares hoping to rake in dividends -- particularly bonus shares -- from BFIs rushing to meet their paid-up capital target by the mid-July 2017 deadline.

In addition, expectations that insurance companies will also be told to raise their paid-up capitals has made investors bullish as they are likely to pursue the strategy of offering bonus and making rights issue, increasing investors’ assets.

However, the market had been seesawing since hitting a new high in the last week of July. While it dipped to 1,675.91 points on August 8, the market has recovered to some extent.

“It looks like many investors wanted to book some profits from the rise in share prices. Otherwise, there is no reason for the market to go down. The fall in share prices seen in the recent days is a natural phenomenon,” Gunanidhi Bhusal, the managing director at Aryatara Investment and Securities Pvt Ltd, says. “It might have seemed like a big plunge because share prices had hit record highs. The stock prices care again in recovery,” he adds.

The Insurance group led the gains this week as its index rose 295.63 points to close at 8,614.42 points. The Hotels and the Banking groups also ended with their indices up 10.14 points and 8.43 points respectively, at 2,210.41 points and 1,631.95 points. The Development Banks group inched up 1.13 points to settle at 1,795.9 points. The indices of the Manufacturing and Processing group, however, plunged 71.2 points to finish at 2,431.19 points.

Sub-indices of HydroPower group and the Finance group also dipped 26.25 points and 19.01 points, respectively, closing at 2,421.12 points and 817.44 points. The index of the Trading group remained unchanged at 202.79 points.

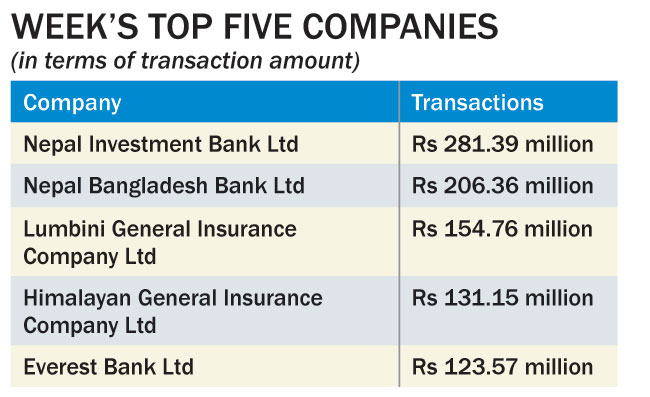

A total of 4.78 million units of shares of 156 companies worth Rs 3.45 billion were traded in the stock market this week through 19,954 transactions.