Using the basic income guarantee approach, around Rs 214 billion a year will

be needed to uplift the 25.2 percent of our total population still living in poverty

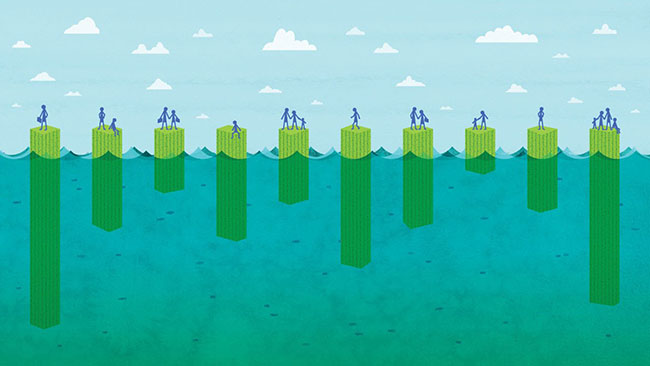

Guaranteed basic income, a topic that has of late drawn much attention of development stakeholders, is emerging as a viable tool to combat global poverty. While it exists in various forms, the fundamental idea behind basic income guarantee is to ensure minimum level of income to low income individuals or families for their daily livelihood, provided they meet certain conditions. The idea is that income guarantee for each individual is a basic human right. At the same time the program can be used as a tool to mitigate poverty. The approach is gaining popularity owing to its simplicity and low bureaucratic burden.

The proven example of successful implementation of such a program is Canada, while many other countries are also starting to adopt the approach in different forms. In Canada, the program had been implemented as early as 1970s, with encouraging outcomes. The program, however, was stopped by subsequent conservative governments owing to their desire to balance the budget. But the new liberal government has resumed the program from this year, aiming to replace some of its existing expensive social welfare programs.

The best strategy is to move gradually, first implementing the program only in the most

deprived regions.

But is Nepal ready to implement the guaranteed basic income program?

Using the basic income guarantee approach, an estimated Rs 214 billion a year will be needed to lift the officially declared 25.2 percent of total population living in poverty in Nepal out of poverty. This is based on UNFPA’s (United Nations Population Fund) total population estimate for Nepal of 28.9 million for 2016; according to which the number of people below poverty line turns out to be 7.3 million.

Controversial amendment to Income Tax Act: Manipulation to lega...

Each individual in this cohort needs to be paid Rs 29,441 a year to bring them out of poverty, according to the threshold poverty level income of Rs 19,241 (the income level for the census year 2011 was adjusted to compensate for roughly 53 percent inflation for past six years, as per Nepal Rastra Bank). The total cost of the program is based on the assumption that the poor earn nothing. This cost can be substantially reduced when the policy is to top-up incomes of those who earn something, which is the customary approach in places where such programs are implemented.

The money trail

Generally, it is recommended that such a program be implemented right across the country. But let us assume that we are to implement a pilot program only in 25 districts where government has already identified the poor and plans to distribute ID cards. In these 25 districts with 336,418 identified poor households, and assuming average household size of 4.86 as per government statistics, the number of poor in those districts is estimated to be 1,643,507. The total cost for these individuals amounts to Rs 48.4 billion annually, much smaller than the earlier estimate of Rs 214 billion for a full-fledged program for the entire country. Again, there would be a significant reduction in total amount when basic incomes are topped up.

One big concern is how the resources can be mobilized for an expensive program. In the context of Nepal, it should not be that difficult if we extract resources from the recurrent expenditure side of the budget. When basic income guarantee program is in place, some existing government welfare programs would be redundant and can be abolished. The government, for example, is spending nearly Rs 39 billion in social security programs as per 2017/18 budget, excluding scholarships and retirement benefits, of which all or the most part can be replaced by the new program.

This alone will be nearly enough to implement the program in 25 districts. Besides, retirement benefits amounting to Rs 63 billion a year is another budget item on recurrent side that is putting a heavy burden on the state amounting to Rs 63 billion a year. It has long been a demand of our development partners that these benefits need to be revised.

Similarly, it may not be that difficult to reduce the size of fiscal grant to local bodies, which amounts to a hefty Rs 225 billion a year as per the current budget. The government can convince local bodies that reduced allocation can actually be beneficial for them. This is because the money that will be channeled into basic income fund will be spent locally. This in turn creates a vibrant economic system at the local level, potentially helping raise tax revenues as well, which, at least partly, compensates reduced budget allocation. The good thing about making transfer to the poor is that they have high marginal propensity to consume, which means the society as a whole earns more, as demonstrated by the Keynesian multiplier effect.

Besides, a small sum (about Rs 1 billion) can be taken away from subsidies to public and private enterprises. This subsidy is unjustified as it rewards poorly performing public enterprises, while it is irrelevant for private enterprises.

Makes perfect sense

On the capital expenditure front, the government has allocated nearly Rs 75 billion under the title ‘construction of buildings’ which could potentially be reduced. Similarly, some amount can be taken from allocations under ‘civil works’ and ‘land acquisition’, with their current budgets of Rs 192 billion and Rs 23 billion respectively. All these adjustments are possible in the context of constant freezing of budget due to the government’s inability to spend. An improved tax system can also generate additional resources if the government is serious about it. In this context, resource mobilization isn’t an issue at all.

Adding fuel to the basic income debate, nonetheless, is the fact that governments may not have effective implementation mechanism. The concern is justified as Nepal has weak institutional base and as there is a big question mark over their ability to implement programs. Another challenge is to track the income of the poor people when the policy of top-up is in place.

To overcome such challenges, the best strategy is to move gradually, first implementing the program only in the most deprived regions. The program’s progress can be closely tracked and the lessons learned therein implemented elsewhere when the program is expanded.

The program of guaranteed basic income, when implemented well, can be a valuable tool to remove wide-scale poverty within a relatively short time. It is particularly important when current social welfare programs are ineffective and there is sluggish progress in poverty alleviation.

The author was with Nepal Rastra Bank for nine years. He is now based in Canada and is the chairman of KarmaQuest International, a research-focused international charity

bdpaudel@yahoo.com