KATHMANDU, August 11: Small businesses and people in Nepal will have better access to financing, with IFC’s broader strategy for small and medium enterprises (SMEs) aiming to reach over 30,000 SMEs by 2023 while helping to improve inclusiveness, competitiveness, and sustainability of the financial sector in the country.

IFC is investing $45 million in the nation’s recovering financial sector as part of a wider SME strategy, which aims to help spur a greater range of financial products and services such as psychometric scoring solutions and payment systems reforms. At the same time, IFC is also extending a trade finance facility as part of Global Trade Finance Program (GTFP), which includes a special provision for green trade financing. This is the first Green GTFP for IFC globally.

“The COVID-19 pandemic has had a massive impact on Nepal’s small and medium sized enterprises, a key pillar of the country’s economy. As these businesses need urgent attention, IFC’s investments will help show that SME lending is both viable and sustainable. We are optimistic it will lead to an increase in overall banking credit for these businesses, allowing SMEs to grow and accelerate recovery in Nepal,” a statement quoted Allen Forlemu, IFC's Regional Industry Director for Financial Institutions Group, as saying.

IFC provides $25 million support to NMB Bank to boost green fin...

SMEs are the growth engine of Nepal’s economy, employing 1.8 million people and contributing around 22 percent of the gross domestic product (GDP). Yet, access to finance is a major constraint for 44 percent of SMEs, especially small and women-owned firms in remote areas, with the finance gap estimated to be at $2.9 billion. With limited financing facilities, small business owners in Nepal are forced to operate on a cash basis. As a result, they struggle to grow given the massive gap between the financing they need and the funds they can currently access.

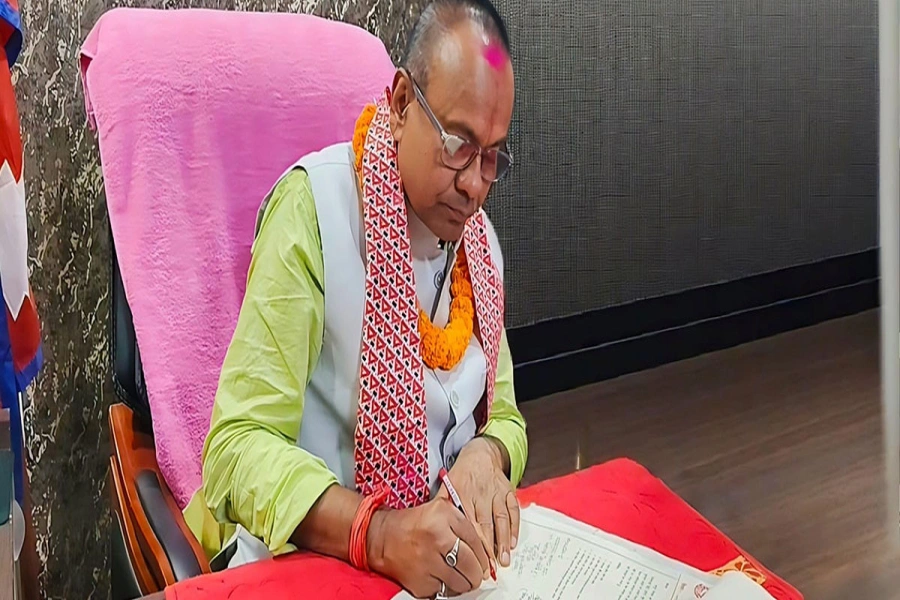

In response, in this fiscal year, IFC provided a $20 million loan to Sanima Bank—one of Nepal’s youngest and fastest-growing commercial bank—and $25 million in NMB Bank Limited, a premier bank in the country. This is the third investment in NMB Bank in the last four years. These fundings will allow the banks to on-lend to hundreds of SMEs, expanding their outreach to these businesses in rural areas, and creating thousands of jobs, the IFC said in a statement on Thursday.

Developing economies like Nepal also face a shortage of trade finance, which is why IFC is providing support to Global IME Bank Limited—the second largest commercial bank in Nepal by total assets—under the GTFP.

"The current financing model of banks for SMEs still relies on lengthy credit processes and high collateral requirements. As a result, smaller businesses continue to be underserved, impacting their growth potential," the statement quoted Hector Gomez Ang, IFC’s Regional Director for South Asia, as saying. "Given the scenario, IFC’s support to leading financial institutions in the country will contribute to strengthening the small business ecosystem, creating jobs and revving up the economy."

Nepal is a priority country for IFC, with efforts focused on boosting inclusive and sustained growth—including energy and infrastructure development and helping deal with the impacts of the COVID-19 pandemic. IFC has been investing in Nepal since 1975—creating opportunities where it is needed the most. As of June 2022, IFC’s outstanding committed portfolio in Nepal is about $600 million.