Nearly 10,000 youths get Rs 14.39 billion in concessional credit in 5 yrs

KATHMANDU, Jan 20: The government has disbursed Rs 758.2 million in interest subsidy for loans floated under a concessional credit scheme for certain agricultural and livestock businesses. It bears five percent of the interest for loans disbursed by banks and financial institutions.

According to Nepal Rastra Bank (NRB), the outstanding subsidized loans aimed at encouraging youths to pursue agriculture and livestock businesses through BFI loans stand at Rs 14.39 billion as of mid-December.

A total of 9,749 beneficiaries have borrowed under the scheme, according to NRB data. The scheme was introduced by the government in fiscal year 2014/15 and the subsidy rate was revised after two years.

Revised interest rate corridor system introduced

Those who want to start or expand certain agriculture or livestock businesses can get the concessional loans from BFIs.

The government subsidizes five percent of the interest on the loans under the scheme. The data shows that the government has so far spent Rs 758.2 million on subsidizing the interest.

For example, if a bank charges 10 percent interest on loans for mushroom farming, NRB will bear 5 percent interest while the borrower will have to pay the remaining 5 percent.

The government introduced the scheme to encourage youths to take up farming and ameliorate the rising unemployment and manpower exodus from the country while also contributing to the economy by channelizing more resources into the modernization and commercialization of agriculture.

Though there were not many takers for the subsidy scheme in the initial months, the number of youths taking advantage of it is now on a rising trend, according to bankers.

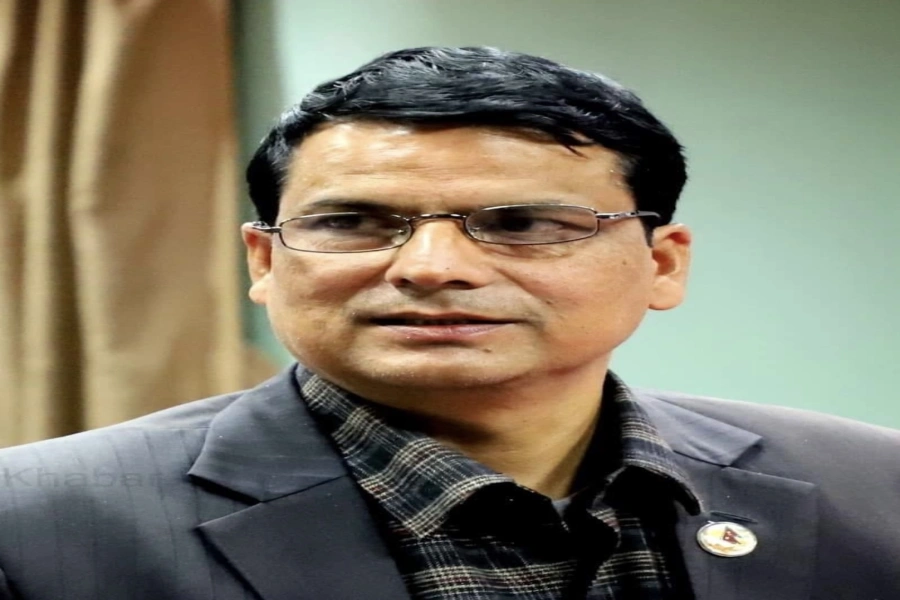

“The figure for disbursement of loans under this scheme is a pittance compared to the total outstanding loans of BFIs. However, there has been a rise in lending under the concessional agro loan scheme in recent months due to growing publicity,” said Kiran Kumar Shrestha, CEO of state-owned Rastriya Banijya Bank.

“The push factor from Nepal Rastra Bank also seems to be working,” he added, referring to the central bank’s lending requirement. NRB requires commercial banks to float at least 10 percent of their total loans in the agriculture sector.

The upper limit for concessional loans under the subsidy scheme has been fixed at Rs 700 million with a maximum payback period of five years. BFIs have to provide loans under the scheme against the collateral of land used for the agro or livestock undertaking or the crops. Loans can be disbursed against group guarantee up to a limit of Rs 1 million.