If Nepal can diversify foreign investment it will contribute to enabling the country to balance regional and global powers and pursue an independent policy

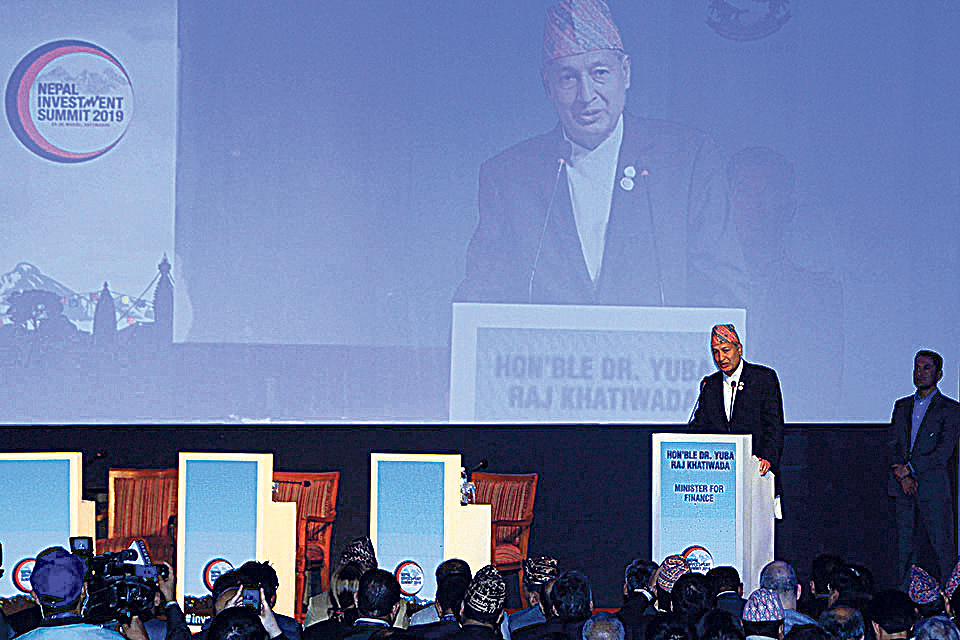

Nepal concluded Nepal Investment Summit 2019 this Saturday. With the participation of 735 delegates from 40 countries, the summit unleashed a new hope in attracting Foreign Direct Investment (FDI) especially in the field of infrastructure development, energy and information technology. According to the Investment Board of Nepal, 15 MOUs were signed in this event while there were pledges from different investors to invest in 17 different projects.

Nepal was a self-subsistence economy until the 1950s as it was in self sanctioned isolation from the outside world. This policy restricted Nepal from participating in global economy. After Nepal adopted liberal economic policy in the early 1990s, a number of measures were taken to boost the national economy. However, after Maoist declared insurgency in 1996, it shattered the hope of economic growth. Due to insurgency, Nepal failed to renew its focus on modernizing manufacturing and agro-industries. Rather it chose to make easy earnings through remittance and used the earnings in importing both essential and luxurious commodities. This turned Nepal into one of the hungriest market of foreign goods.

Investment needs

The current two-thirds majority government is apparently desperate to rejuvenate Nepal’s economy after 20 years (1996-2016) of political instability. Judging from the statements the government ministers have made in several national and international forums, the government appears committed to bringing in more FDI to Nepal.

The government has made commitments to uplift living standards of Nepali people. To fulfill these commitments, Nepal needs huge investment which it acutely lacks at the moment. Through this summit, the government gave the message to the international community that after promulgation of new constitution and formation of governments in local, provincial and central levels, phase of political instability has come to an end.

Foreign investment commitments decrease by over Rs 21 billion

The demand for constitution amendment is slowly losing steam. The priority of Madhes-based parties seems to have changed. The Hindu right and monarchists who want a Hindu state and constitutional monarchy do not enjoy popular support. In this context, the government has asserted that after consolidation of republicanism, secularism and federalism through constitutional provisions, the period of political struggle has concluded and the time has come to pursue a path of economic development. Toward that end, it has set the goal of achieving ‘Prosperous Nepal, Happy Nepali’ vision.

Katia Papagianni, an expert of post-conflict state building explains in her book Building States to Build Peace that for a post-war political order to gain public legitimacy, the state must first be able to perform its key functions such as delivering basic public services and maintaining social order. Massive investment is required for Nepal even to perform this function. Thus FDI is essential for Nepal to realize two purposes: Expediting economic growth and firmly institutionalizing political order envisaged by 2015 constitution.

Also, Nepal has made commitments in several international forums to graduate from the least developed status by 2022 and become a middle-income country by 2030. Double digit economic growth is necessary for this, which won’t be possible without sufficient FDI.

Isolation to opening up

About two centuries ago when various independent nation-states of South Asia were being annexed by British East India Company, Nepal was able to preserve its independence partly due to its isolationist policy. The policy however deprived Nepal from infrastructural development and industrialization. Brian Hodgson, the East India Company envoy to Nepal at the time, had approached Nepal in 1834 to enhance bilateral trade. But Prime Minister Bhimsen Thapa saw it as a British ploy to set a stage to interfere in Nepal’s domestic politics so as to bring Nepal under its firm control. In 1851, when another British envoy Claudius Erksine pressed Maharaja Jung Bahadur Rana to build better road connectivity between the two countries, Jung Bahadur rejected it citing that policy of isolationism has made Nepal different from other South Asian countries in terms of preserving national independence. Jung told the British envoy: “The prejudices of his countrymen were very strong against it [road connectivity], as they thought that while the roads remained in the present state no invading army could make its way to the [Kathmandu] valley.”

The isolationist policy restricted foreigners to conduct business in Nepal thus depriving Nepali entrepreneurs from learning new tricks of trade from them. Local entrepreneurs from British India who were allowed to do business had limited scope and had to endure many restrictions. The ruling elites were concerned mainly with the domestic politics and geopolitics. They were not much bothered about the plight of local entrepreneurs and foreign traders.

During the Rana regime, national coffers were not used for investment and collected revenues were exhausted by importing luxury goods. Banking system was not introduced thus depriving potential investors to get loan for business. As the British Empire began extending railway network toward Nepal’s Tarai, Ranas cleared forests of Tarai-Madhesh and sold it timbers. Construction of railway network along the border increased import of goods. Several customs offices were established at the border points to collect revenue. During the Second World War, Nepal tried to reap benefit from the railways network and established a handful of cotton, match and jute industries in Tarai. But that was not enough to unleash a wave of industrialization.

As Nepal failed to enhance entrepreneurship skills, people across the border gradually filled the gap. Rana rulers had established Nepal Trading Corporation in 1933 with an aim to promote local entrepreneurs. Sardar Bhim Bahadur Pandey writes in Tyas Bakhatko Nepal that in the aftermath of 1934 earthquake, Marwari communities in Kathmandu generously provided relief and rehabilitation support to the people. In a gesture of gratitude, Rana regime removed prerogatives of Nepali entrepreneurs and provided equal treatment to Marwari businessmen.

Peace and friendship treaty of 1950 served a severe blow to Nepal’s entrepreneurship development, which was still in its infancy. Article 6 of the treaty agreed to give national treatment to Indian nationals in Nepal with regard to participation in industrial and economic development and grant concessions and contracts relating to such development. Article 7 further allowed Indian nationals same privileges in matter of participation in trade and commerce. This made India a decisive player of Nepali economy.

Need to diversify

The freshly concluded investment summit has raised hopes in several ways. China surpassed other countries, including India, in terms of number of delegates. More than 260 delegates from China participated in the summit, whereas the number of Indian delegates was around 120. Furthermore, participation from countries of South East Asia, Middle East, and international financial institutions such as World Bank and Asian Development Bank was also encouraging. Active participation of delegates from the US, Canada, Australia, the UK and France has sent the message that Western investors are also keen to invest in Nepal, which is still a virgin land for mega-business activities.

Foreign investment is always welcome but the government should also think of its repercussions on Nepal’s politico-economy and geopolitics. Foreign investment may help Nepal realize its development goal but if we also succeed in diversifying investment in key sectors including infrastructure, energy, tourism, agriculture and information technology, it will contribute to enabling the country to balance the regional and global powers and pursue an independent and balanced policy.

sujitmainali@gmail.com