Licensing a step forward toward making payment system secure: NRB

KATHMANDU, Sept 8: Over 67 companies have sought license from Nepal Rastra Bank (NRB) to provide payment-related services.

According to Payment Systems Department of the NRB, over 67 companies, including banks and financial institutions (BFIs), payment service providers and payment system operators, who were providing payment-related services, applied for the license until Wednesday -- the deadline set by the central bank to submit application to acquire the permit.

Issuing a notice on August 4, the NRB had instructed all the companies, which have been providing payment-related services, to apply for the license within 35 days of the publication of the notice.

"We have received applications of nearly 67 companies so far. However, the final tally is likely to be higher as there could be applications in our other regional offices as well," Kedar Acharya, a deputy director at the department, told Republica.

While many companies were providing payment-related services without any legal or regulatory basis, the central bank recently came up with a legal framework on the payment system as well as licensing policy for the payment service provider.

SEBON grants broker license to 11 more companies

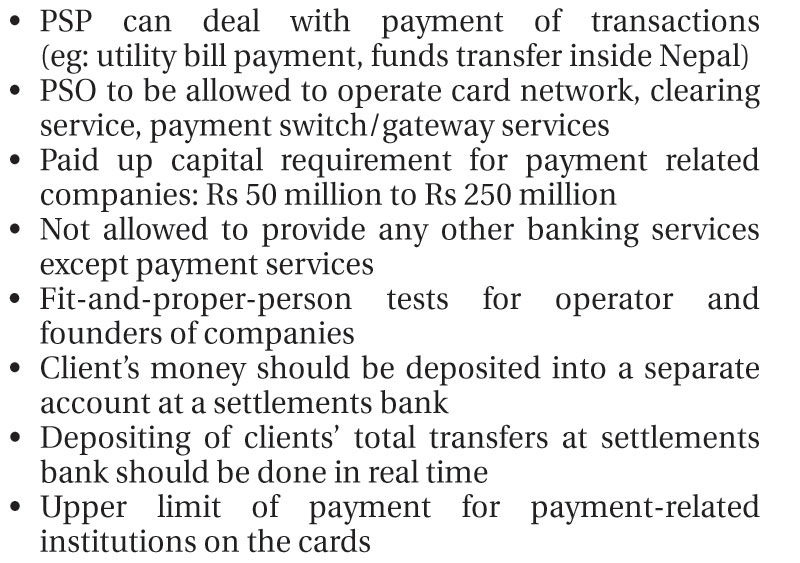

According to the policy, the central bank can issue license on two categories: payment service provider (PSP) and payment system operator (PSO).

Those companies acquiring PSP license will be allowed to provide payment service for the transactions made through electronic cards and transactions made through telecommunication networks. They can work as intermediary between clients and service providers to make and get the payment as well as provide domestic money transfer service.

Similarly, those mechanism or company having the license on another category, i.e. payment system operator license, will be able to provide payment-related clearing service, automated clearing house, large value/retail payments related services as prescribed by the NRB, and operate network of electronic card and payment switch/gateway services, according to the NRB.

The central bank, however, has said that it would not provide both PSP and PSO licenses to a same company.

Central bank officials say that licensing of companies providing payment services will help to meet the central bank's objective of developing a sound payments system in the country.

"The process is aimed at bringing such companies under the regulatory ambit. Once they are issued license, the central bank will be making offsite and onsite inspections on these companies. They will also be required to make regular reporting to the central bank. This will ensure that these companies are on sound financial footing," Nephil Matangi Maskay, the acting director at Payment Systems Department, told Republica.

Companies like iPay, ePay, eSewa and other BFIs, among others, have applied for the license as per the new requirement. As the department is yet to study the applications, the officials at the department could not provide much information about what type of licenses these companies have sought.

According to NRB officials, these applicants will be issued operation license within 90 days after completing necessary process like inspection of the company's electronic and technology infrastructure by the central bank.

Amid concerns about the possibility of money laundering through these payment systems, the new rules have introduced more measures, including requirement to register clients doing higher transactions through more elaborated know your customer (KYC) process, to check the flow of such money. However, the payment services companies can maintain the KYC of clients having transaction below Rs 500 or Rs 5,000 per month by registering contact number of the client while s/he signs up for the company's services.

The upper limit of transactions that these companies can make is yet to be fixed, according to the officials.

Payment companies also say that the licensing process will make them more trustworthy. "We were, so far, providing our services on good faith. It used to look like were were operating under banks' shadow. However, the licensing process will bring us under the regulation of the central bank, which will make us trustworthy among our clients and independent from the banks," said Asgar Ali, CEO of eSewa -- an online payment service provider which has also sought license from the NRB. "Now, NRB can regulate monitor or supervise and question our transactions and activities, making the payment system more secure and sound."

-1200x560-1771928761.webp)