OR

Navigating Nepal’s Trade Deficit

Trade Deficit's Present and Future Situation in Nepal

Published On: October 11, 2023 09:00 AM NPT By: Prajwal Chand

More from Author

Tucked between the towering Himalayas, Nepal has a rich cultural heritage and spectacular natural scenery. However, underneath this lovely frontage lies a complex economic issue – a persistent trade deficit. A country is considered to have a trade deficit, indicating an imbalance in international trade, when its imports exceed its exports. For years, Nepal has struggled with an economic barrier caused by several factors that contribute to this imbalance. Numerous challenges brought forth by the trade imbalance affect employment, growth in general, and economic stability. For a considerable stretch of time, Nepal's trade deficit was NPR 157.140 billion in exports compared to NPR 1.611 trillion in imports in FY22/23. This makes it clear that Nepal depends entirely on imports. In FY22/23, Nepal had a staggering trade imbalance of NPR 1.454 trillion. The trade imbalance has decreased by 15.45% as a result of restrictions on luxury goods that took effect in April 2022 and prevented the use of foreign exchange reserves. Controlling the trade imbalance is the primary motivation. During the review period, Nepal’s exports had decreased by 21.44%. In the first month of FY23/24, the trade imbalance was NPR 115.71 billion, and every government action attempted to limit it failed. As of July 2023, the overall trade balance is -115,710.30 million rupees (NPR). In other words, it gives a clear picture that trade deficit occurs when a nation purchases more products and services than it exports. This might occur for a number of reasons, such as when the national currency is overvalued, which drives up import and drives down export prices. There is an enormous demand for imported products and services that domestic producers cannot fulfill.

The World Bank's April 2023 report on Nepal Development Update states that real GDP growth dropped to an estimated 1.9% in FY23, the slowest pace since FY20, which is 10 years below the average growth rate. This is a result of both import restrictions and financial tightness. While the industrial sector of Nepal's economy is experiencing a downturn, the agricultural sector remains robust. Imports of goods were sharply reduced as a result of domestic regulations and trade restrictions imposed by India. In order to facilitate the repair of external imbalances and reduce the growth rate of lending to the private sector, Nepal Rastra Bank increased its policy rate early in FY23. Compared to FY22, the private sector seems to be smaller. Since commerce accounts for more than half of the overall income, the import rate precipitously reduced those revenues. The fiscal deficit almost doubled to 6.1% of the GDP, the largest level in more than 20 years, as spending shrank much more slowly than income. The World Bank's growth estimate increased to 3.9% in FY24 and 5% in FY25, with the benefit of removing import restrictions and gradually relaxing monetary policy helping to offset the lag. The industrial sector seems to be producing more hydroelectricity, and the growth rate of imports is anticipated to assist wholesale and retail commerce. However, the drop in rice and paddy output in FY24 and the disease outbreak on cattle seem to be slowing down the agricultural sector.

The import limits imply a rise in goods imports over the medium term in terms of monetary policy. It is not anticipated that the substantial medium-term remittance and labor inflows from Nepal would be sufficient to close the trade imbalance in commodities and services. The current account deficit is predicted to increase to 3.7% of the GDP in FY24 and 4.6% of the GDP in FY25. Taxation places a strong emphasis on commerce, and revenues are predicted to rise in tandem with the import of products.

According to the Asian Development Bank's September 2023 macroeconomic bulletin, Volume 11, No 1, the market price of the Nepalese economy is expected to expand by 4.3% in FY24 compared to an anticipated 1.9% growth in FY23. According to the report, average inflation on Indian oil imports is expected to drop from 7.7% in FY23 to 6.2% in FY24. Remittance inflows has been increasing by 4.38% and reached NPR 1220.56 billion in the year FY22/23

Central bank’s monetary policy and trade deficit correlation

According to NRB, the current account deficit decreased from 12.08% to 12.03% in the last fiscal year as a result of a significant remittance inflow and a decrease in imports. Foreign reserve accumulation rose by USD 9.5 billion in July 2022 and USD 10.1 billion in mid-June 2023.The cash reserve ratio (CRR) and the statutory liquidity ratio (SLR) have also increased. The percentage of deposits that banks must invest in government securities is known as the SLR, while the percentage of deposits that banks must keep with the NRB is known as the CRR. The NRB also provides a number of incentives to promote exports. The NRB, for example, has introduced a brand-new exporter refinancing scheme. Under this scheme, exporters may apply for loans at a reduced interest rate.

Measures to control trade deficit in Nepal

The best way to do this is by offering exporters with financial incentives like tax exemptions and subsidies. To increase the exporters' competitiveness and open up new markets, the government may also assist them. When feasible, imported items can be replaced with native ones to help Nepal lower its import bill. This may be achieved by encouraging the growth of sectors like manufacturing and food processing that can replace imports. The government may also put tariffs or other limitations on imported products. However, this should be done wisely. By establishing stronger trade agreements with its trading partners, Nepal may increase the balance of trade. Reducing tariffs and other trade restrictions would be necessary for this.

In a speech on September 22, 2023, Maha Prasad Adhikari, the Governor of Nepal Rastra Bank (NRB), listed some of the most important steps that may be made to reduce Nepal's trade deficit. Nepal should prioritize growing and advancing its export-oriented sectors, including tourism, hydropower, and agriculture. To increase its access to markets, Nepal may potentially join regional trade blocs like the Asia Pacific Economic Cooperation (APEC).

It is challenging for companies to operate and transact in Nepal due to the inconvenient bureaucratic processes. The government must cut red tape and simplify its processes. Improved education and skill levels are necessary for Nepal's labor force to remain competitive in the international market. Programs for training and education must be funded by the government.

Nepal must make its surroundings more attractive to international businesses. Reducing red tape, enhancing infrastructure, and offering tax benefits and other incentives are some ways to do this. Nepal can lower its imports and grow its export-oriented sectors with the aid of foreign investment. Devaluing the rupee will increase the cost of imports and increase the competitiveness of Nepali exports. However, this is a hazardous move as it may also result in inflation and a drop in living standards. One way to restrict Nepal's outflow of foreign currency is via capital restrictions.

You May Like This

Nepal’s trade deficit reaches Rs 1.337 trillion in first 11 months of current FY

The country spent a hefty amount on imports of petroleum and agricultural products ... Read More...

Nepalis spent Rs 313 billion more on imported goods in first five months of this FY

KATHMANDU, Dec 23: Nepal’s trade balance in the first five months plunged to a negative Rs 735.48 billion, despite the country... Read More...

Dhurmus, Suntali to build ‘a Nepal within Nepal’

KATHMANDU, June 5: After successfully completing three settlement projects for earthquake victims and other communities, the actor couple Sitaram Kattel (Dhurmus)... Read More...

Just In

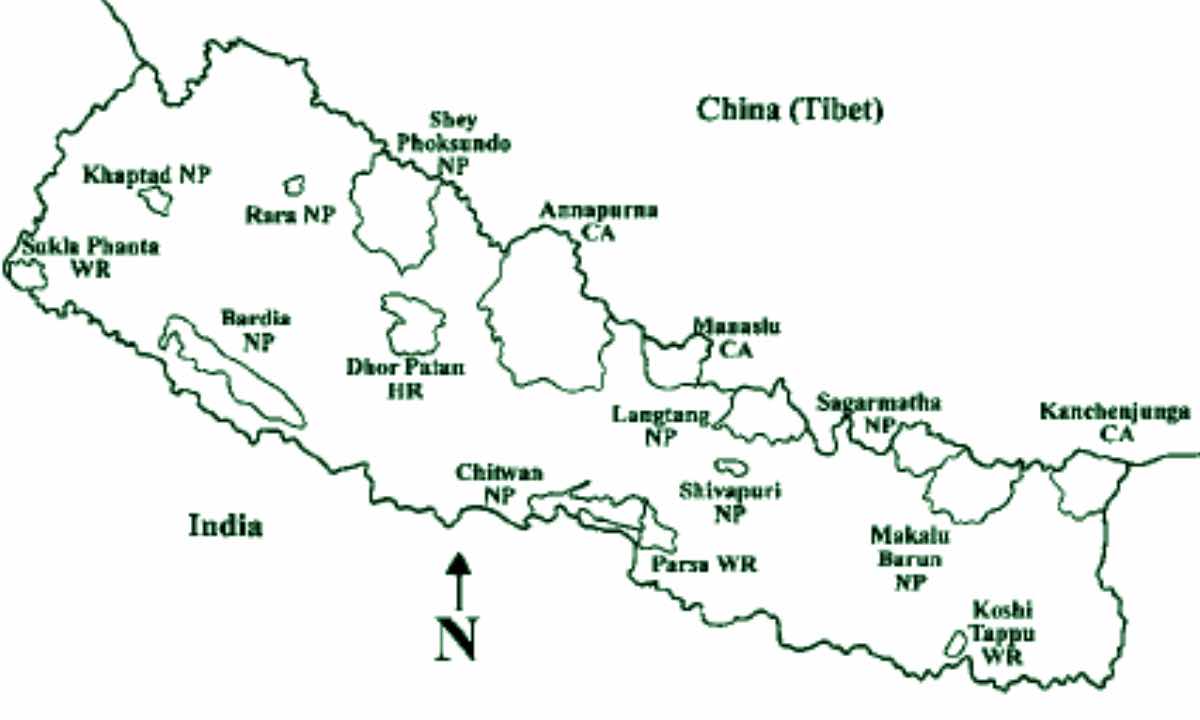

- Urgency of policy update for Nepal's National Park buffer zones

- Investment summit concludes with govt signing over a dozen MoU with prospective investors

- UML's Nembang elected in Ilam-2

- Ensure follow-up for increased FDI

- Nepal and Vietnam could collaborate in promotion of agriculture and tourism business: DPM Shrestha

- Govt urges entrepreneurs to invest in IT sector to reap maximum benefits

- Chinese company Xiamen investing Rs 3 billion in assembling plant of electric vehicles in Nepal

- NEPSE inches up 0.07 points, while daily turnover inclines to Rs 2.95 billion

Leave A Comment