OR

India’s government on Tuesday withdrew the two largest-denomination banknotes from circulation in a bid to tackle tax evasion and corruption.

Here are answers to key questions surrounding the shock move:

What has happened?

Indian Prime Minister Narendra Modi announced late Tuesday that 500 and 1,000 rupee notes would be withdrawn from circulation.

As of midnight Tuesday, the notes were no longer legal tender. Customers have until December 30 to exchange their old bills for new ones or deposit them in bank accounts.

All banks and cash machines were ordered closed on Wednesday to prepare for the new notes.

Why has it happened?

Modi came to power in 2014 pledging to crack down on so-called black money financial transactions in which cash is used to avoid tax.

Tuesday’s announcement was part of that promise but there are also political reasons.

The ruling Bharatiya Janata Party faces key state elections next year and this decision may hinder attempts by its opponents to stockpile campaign cash.

The move is likely to curb the high use of fake notes, a common problem in an heavily cash-based economy. Modi particularly singled out militant groups, saying they finance attacks on India using counterfeit notes.

Has this happened before?

Yes. In January 1978 the government removed 1,000, 5,000 and 10,000 rupee notes from circulation at short notice, sparking a brief panic with consumers rushing to banks.

However, the overall disruption was limited to the monetary value of 1,000 rupees was so high back then that the move did not affect most Indians.

How has it been received?

Long queues formed outside ATMs ahead of the midnight deadline as customers made a last-minute dash to withdraw 100 rupee notes ─ the highest domination note left in circulation.

There was also a rush by motorists to petrol stations, which will continue to accept the old bills until the end of the week as will transport operators and hospitals.

The Bombay Stock Exchange plunged 6 per cent at the open Wednesday before stabilising at around three percent down in late-morning trade.

Despite the slump business leaders widely praised the move, saying it would force more money into the formal economy and boost GDP.

Who are the main winners and losers?

There were a lot of nervous Indians Wednesday, particularly those who hoard cash at home to avoid paying tax.

Only around three percent of Indians pay any income tax at all and they face the prospect of serious scrutiny if they cannot account for a sudden increase in their bank balance.

Temples and ashrams, where lavish donations can be a front for money-laundering, will be figuring out what to do next, as will those running illegal cricket betting rings and property dealers who often deal in black money.

Small traders who deal in cash transactions and workers such as maids and drivers who may not have bank accounts are likely to be hit in the short term.

The middle classes and companies who operate in the formal economy, however, will benefit from a reduction in the cost of doing business due to a drop in backhand payments.

What happens next?

Banks and ATM will reopen on Thursday when customers will be able to swap their old notes and withdraw the new 500 rupee and 2,000 notes ─ but there will initially be a limit on the value of transactions.

A newly-designed 1,000 bill will be also gradually reintroduced in coming months.

Analysts anticipate a massive drop in consumption over the next few days as consumers will be short of cash.

It will also likely take some time for the new notes to circulate widely.

You May Like This

At UN, Trump to face questions about Iran, Ukraine, allies

NEW YORK, Sept 23: Faced with growing tumult at home and abroad, President Donald Trump heads into his three-day visit to... Read More...

India's trade deficit widens to five-year high

NEW DELHI, July 14: India’s trade deficit widened to its highest in more than five years in June, the trade ministry... Read More...

Baahubali 2 becomes India's highest-grossing movie

An epic battle movie from one of India's lesser-known film industries has trumped Bollywood by becoming the country's highest-grossing film... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

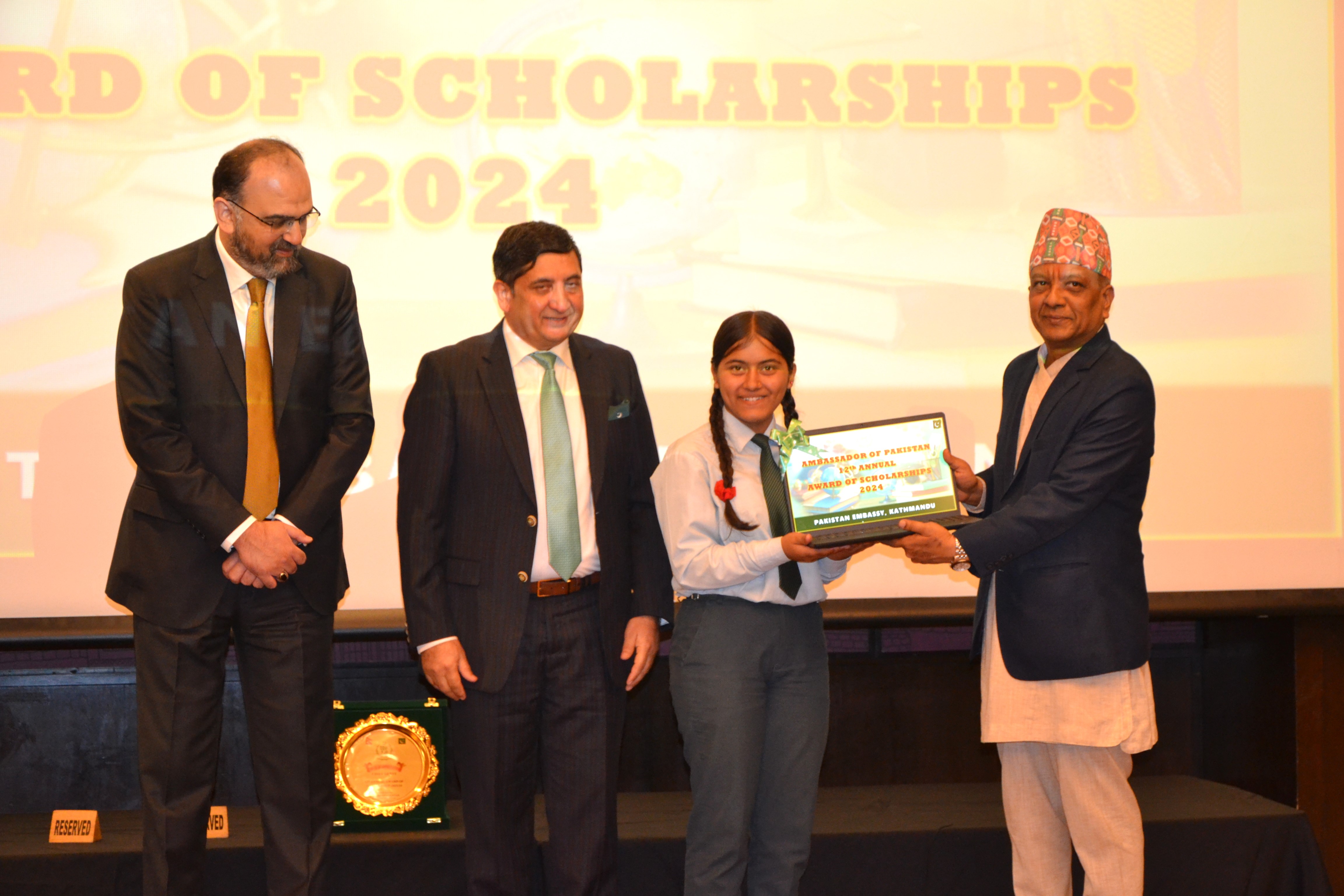

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment