OR

Krishna Sharma

The author is a consultant at National Institute of Public Finance and Policy, New Delhinews@myrepublica.com

Nepal may introduce postal payment services for reviving its postal services and facilitating financial inclusion

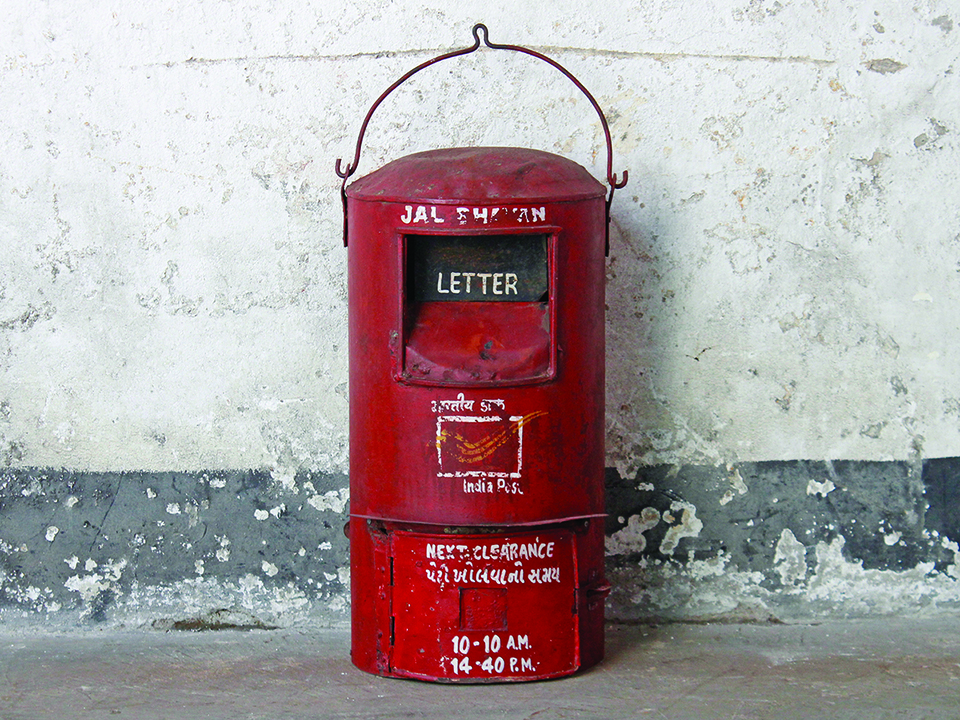

When I was a child, first Sunday of every month used to be a special day. I along with my mother enthusiastically used to wait for hulaki-dai—the postman—to receive the letter sent by father working outside the country. No pin code, no house number and no specific addresses but friendly hulaki-dai always made sure that the letter reached the rightful receiver. For this, we were indebted to him. And we were grateful to the government for running such good services—the postal service used to be such a charm for us. The letter, hulaki-dai and postal service form the childhood imagination of many citizens.

Nepal has not been able to deliver the taste of federalism to its fullest as it is still in incipient stage, but the postal service is the epitome for ‘spirit of federalism’ since its establishment. It is unfortunate that such a historic institution has lost charm and has been isolated from the advancement of technology. There has not been required effort to boost the spirit of Nepal’s postal service. Postal service should be resurrected for enhancing economy and making the government assertive.

A committee was formed to this effect a year ago, which suggested downsizing offices and staff numbers in federal set up. Even though the postal service has expanded through adoption of express mail service, post box subscribers, financial services (money order service, postal saving bank and remittance service) in the recent times, it has not been able to do much.

Globally, measures have been taken to revive age-old governmental institution. Amazon has inked a contract with United States Postal services for delivery services amidst critics from pundits about the deal being unfavorable to the government. In September 2018, India introduced the postal payments services to its citizens, meant for the unbanked masses (around 40 percent). Banking of unbanked population has been one of the major works of Prime Minister Narendra Modi’s government in India.

Postal payment services could be something for Nepal to learn from India. It is relevant for Nepal for two main reasons—reviving Postal Services and facilitating financial inclusion.

Postal banking

Post Payment Bank (PPB) will have elaborate physical presence and will handle saving and transfer mechanism. A biometric authenticated QR code card which can be scanned and can be used for making payments or withdrawing money will be secured digital payment system given that Nepal develops required technological support for that. The payments bank can be installed in each district post office. PPB is designed to offer most regular banking facilities such as remittance services, cash withdrawals/deposit, net banking, third party fund transfers, and mobile payments/transfers/ purchases.

The major difference between payments bank and a traditional bank is the former can only receive deposits and remittance and cannot offer any financial products such as credit cards, of their own. For this, PPB has to tie up with other financial services providers to offer third-party products like loan and insurance to the customer. Unlike other traditional banking which requires a lot of documentation and verification, PPB will be driven by mobile technology which simplifies the process and, makes a financial integration process hassle-free and paperless.

Nepal is largely a cash-based economy and weak in payment infrastructure. Developing payment infrastructure, enabling regulatory framework and expanding branchless, mobile and internet banking are challenging. Our country has adopted the roadmap recently to augment the financial inclusion from 60 percent to 75 percent by 2022. The first budget of federal Nepal (2018-19) also aims to digitalize government payments, revenue collection and has launched an ambitious campaign of opening bank accounts for every Nepali citizen within a year. The overall objective of the roadmap and the federal budget policy is to expand financial inclusion, payments, and transfers to credit and insurance, through formal financial institutions.

According to global financial index of World Bank distance to financial institutions is one of the reasons why people remain unbanked. Likewise, unwillingness of banks and other financial institutions to open their branches in rural areas despite Nepal Rastra Bank asking commercial banks to establish their branches in local levels is another factor. We have not been able to expand the branches of banks.

Poor infrastructure, low literacy and high transportation cost have deprived rural adults from accessing financial services. Financial inclusion is generally measured using number of bank branches per inhabitant. This method fails to capture the true sense of financial inclusion. Most of the rural people or low income households hesitate to establish contact with formal financial organization such as bank and, also they hesitate to continue the relation with the bank once their account is opened due to the formal structure of the banking system. Only 45 percent of adults in the country reported having an account with formal financial institutions. And many people hesitate to operate their financial activities through existing bank accounts.

Bring hulaki-dai back

Since the majority of unbanked masses, concentrated in rural areas, have easy access to postal services, if not the postman, PPB could become a game changer in overcoming the distance barriers. Secondly, cordial relation with hulaki-dai will influence the households to approach them for the financial activities as the unbanked masses seem reluctant to approach banking staffs and services because of rigid procedure and formal structure. Thirdly, educating and empowering consumers can be a key in driving up the demand for financial services. I can’t think of a better person than hulaki-dai for this job. Features such as door-to-door step delivery, wide network with physical presence, and familiarity with postal system will make PPB an articulate mechanism for financial inclusion.

Postal payments are not only meant for low-income households. With extensive distribution network, the government can facilitate its use at retail outlets, fuel stations, post offices, government services payments and a mini bank branch.Thus, this can also aid in digitalizing the payment system. PPB can be a watershed for the concerned authority worrying about the postal services, financial inclusion and digitalizing the economy.

I hope I can wait for my hulaki-dai to be back in my village to pay for my electricity bill, marriage certificate fees and school fees.

As for the government, if it can introduce PPB, it may go a long way in reinvigorating Nepal’s postal services and contribute to its economy as well.

The author is a consultant at National Institute of Public Finance and Policy, New Delhi

krish.sharma533@gmail.com

You May Like This

What China can gain

Trump thinks attacking China through trade will help to “Make America Great Again.” But it is more likely to make... Read More...

Education for economy

Countries with educated people have achieved economic growth faster. Countries with limited skilled people lag behind ... Read More...

Learn from Imran Khan

Why cannot career politicians of Nepal Communist Party, who face much less challenge than Pakistani leader, make pledges for drastic... Read More...

Just In

- Challenges Confronting the New Coalition

- NRB introduces cautiously flexible measures to address ongoing slowdown in various economic sectors

- Forced Covid-19 cremations: is it too late for redemption?

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

- NC defers its plan to join Koshi govt

- NRB to review microfinance loan interest rate

Leave A Comment