OR

Weekly Market Commentary

Nepse up for a fifth consecutive week

Published On: June 4, 2021 08:06 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, June 4: Following the unveiling of the budget for the coming fiscal year, the stock market witnessed substantial enthusiasm on Sunday with a record turnover of over Rs. 17 billion. The benchmark Nepal Stock Exchange (Nepse) index rose 12.53 points on Sunday. Nonetheless, with profit taking seen in most of the sectors on the following day, Nepse gave up 45.07 points on Monday extending its losses to Tuesday where it lost another 11.71 points. The equity market made a significant recovery towards the end of the week registering gains of 55.98 points and 29.64 points on Wednesday and Thursday. Nepse rose 41.37 points or 1.47% in the week to finish at a fresh record at 2,856.77.

The equity market marked its fifth straight week of gain on the back of record volumes. Sector rotation has mainly been the key factor in driving the equity market to fresh high, with investors switching to different sector after booking gains in one. Flow of funds into the market has also been at record levels as reflected by huge market participation of late. This week over Rs. 67 billion worth of shares changed hands, higher than any other week in Nepse’s history.

Sensitive Index rose 1.87% reflecting strength in Class ‘A’ stocks. Mainly BFIs were the major winners in the review period’s trading. Development Bank and Finance segments saw considerable strength and rallied over 17% each. Hotels & Tourism sub-index also shot up by 7.86%. Mutual Fund segment rose 5.52%. Banking, Manufacturing & Processing, ‘Others’ and Microfinance sub-indices also ended the day in green. On the other hand, Trading and Hydropower segments suffered the most, ending with declines of 5.46% and 4.49%. Investment sub-index also dipped 1.08%. Non-Life Insurance and Insurance segments dipped slightly.

On the corporate front, Nepse suspended trading of Khani Khola Hydropower Company Ltd citing failure to publish financial reports. The energy company reported negative book value as per its last financial report. The hydropower stock had surged almost 100% in the past month.

As per the ARKS weekly technical analysis, the market formed a bullish candlestick with long lower wick reflecting strength and recovery from the week’s low. Following a breakout from the previous weekly high, sentiment remains firmly positive in the current context. While some correction is due, strength seen in the BFIs will likely assist the market in maintaining ground in the coming week. Technical indicators also reflect extension of the uptrend with the formation of higher highs and higher lows in the weekly timeframe.

This column is produced by ARKS Capital Advisors Ltd.

www.arkscapitaladvisors.com

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

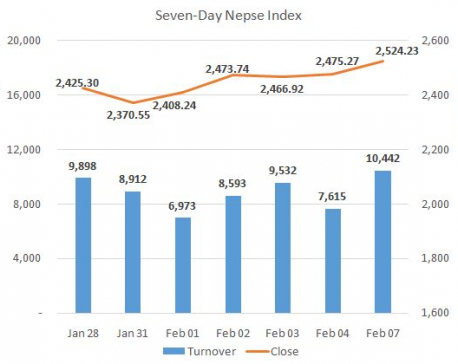

Nepse closes above 2,500 mark on record volume

KATHMANDU, Feb 7: The equity market opened week on an upbeat note as stock traded in green since the beginning... Read More...

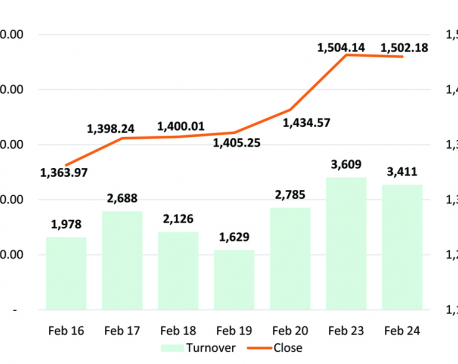

Nepse witnesses modest drop but volumes stay upbeat

KATHMANDU, Feb 25: Despite an early attempt by the bourse to stretch its rally, gains remained truncated throughout Monday's trading... Read More...

Nepse suffers double-digit fall

KATHMANDU, Aug 19: The domestic share market was hit by a double-digit fall, today, the opening day of the week, making... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

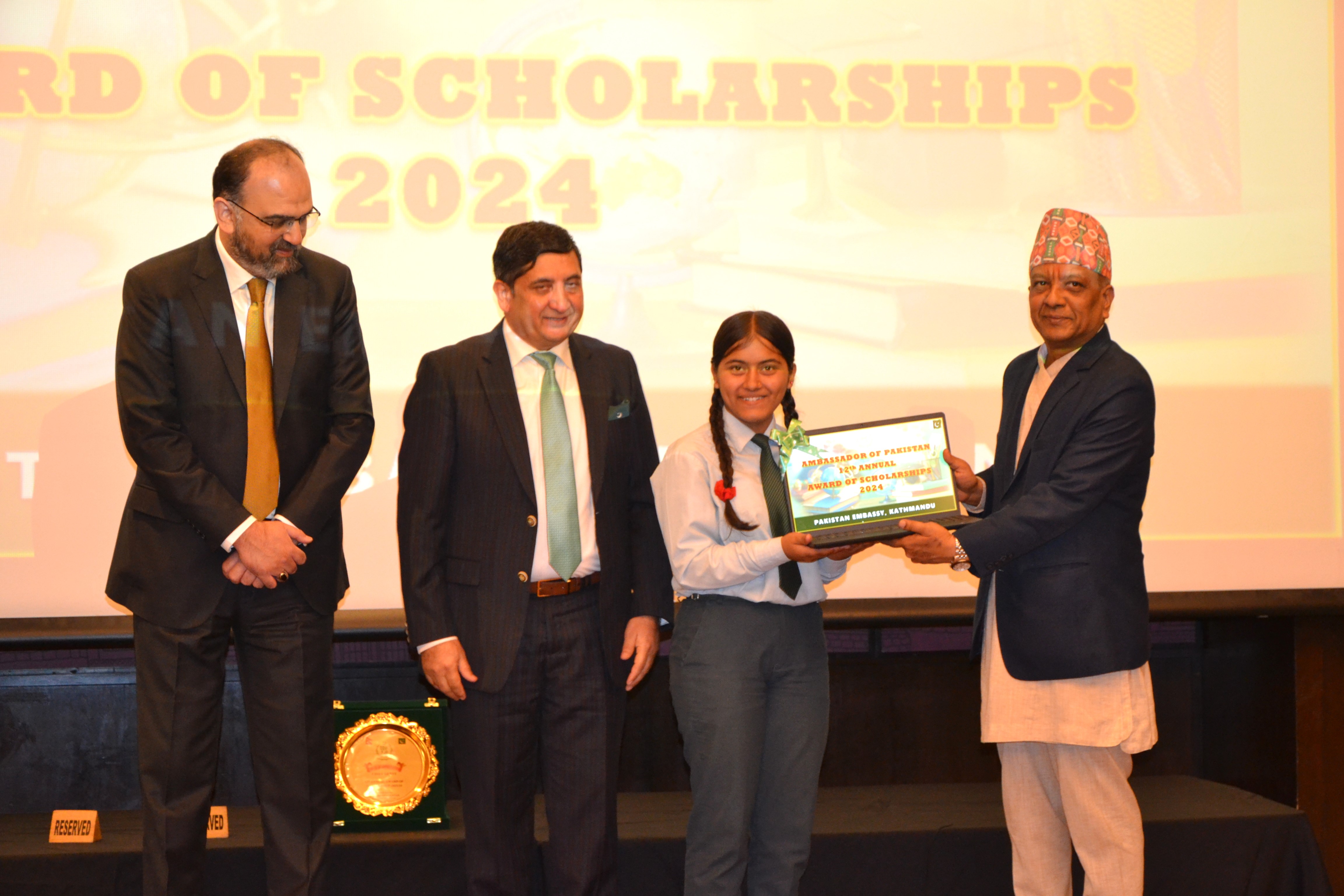

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment