OR

Daily market commentary

Nepse closes above 2500 mark

Published On: March 4, 2021 06:50 PM NPT By: Republica | @RepublicaNepal

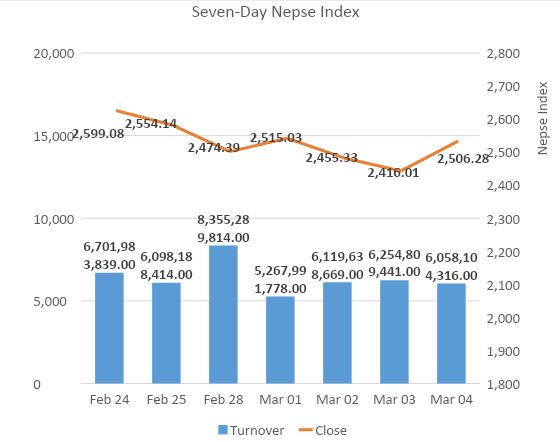

KATHMANDU, March 4: The local equity market saw upbeat trading throughout the last trading session of the week. The index opened the trading session in positive note and maintained its foothold in green for rest of the session. At the end, equity market closed at 2506.28- up 90.27 points.

Investors showed notable enthusiasm on last trading of the week with the benchmark index closing above 2500 mark. Total turnover stood at Rs. 6.058 billion.

All the sectors ended on positive territory. Trading, Others, Investment, Microfinance and Hydropower sub-indices jumped 7.1%, 5.44%, 5.26%, 5.06% and 4.78% respectively. Likewise, Manufacturing & Processing and Life Insurance sub-indices rallied above 3% each. Banking, Hotels and Tourism, Development bank, Finance, Non-life Insurance and Mutual Fund also closed in the higher note.

Among actives, Nepal Infrastructure Bank Ltd’s shares were heavily traded with turnover of Rs. 532 million. Shikhar Insurance Company Ltd and Nabil Bank Ltd followed suit with transactions of Rs. 244 million and Rs. 201 million respectively. Nepal Doorsanschar Company Ltd, Nepal Life Insurance Company Ltd, Global IME Bank Ltd, Nepal Reinsurance Company Ltd and Nepal Bank Ltd were among other actively traded shares.

Among gainers, Suryodaya Laghubitta Bittiya Sanstha Ltd, Liberty Energy Company Ltd and Chandragiri Hills Ltd were the major winners with gains of 10% each. Kisan Laghubitta Bittiya Sanstha Ltd, Infinity Laghubitta Bittiya Sanstha Ltd, Himalayan Power Partner Ltd, Shree Investment Finance Co. Ltd, National Hydro Power Company Ltd, Nerude Laghubitta Bittiya Sanstha Ltd also remained locked in the upper circuit limit with a gain above 9% each.

On the other hand, NMB 50’s unit price suffered the most and decline 3.45% on the day. Similarly, 12% ICFC Finance Ltd Debenture 2083, Global IME Samunnat Scheme-1, Soaltee Hotel Ltd, 10.5% Nepal Investment Debenture 2082, Nabil Equity fund shares tanked above 1% apiece. Siddhartha Investment Growth Scheme-2, 10% Nepal SBI Bank Debenture 2086, 10% Himalayan Bank Debenture 2083 and NIC Asia Growth fund also closed in red with meager decrement.

As per the ARKS technical analysis, the market formed a strong bullish candlestick on the day, which helped the index recoup prior day losses. Consequently, the index has shown some sign of recovery but the next week trading is still crucial in determining the possible move of the market. A breach below 2500 mark can see some corrective move towards downside, while another day of gain supported by significant volume can see the index substantiate the rebound.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

www.arkscapitaladvisors.com

You May Like This

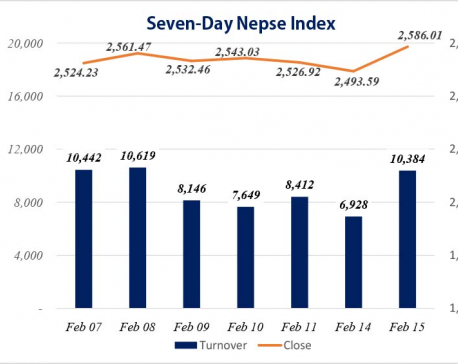

Stocks rally erasing four-day losses

KATHMANDU, Feb 16: Stocks witnessed a sharp rally in the morning with the benchmark reaching as high as 2,565 mark.... Read More...

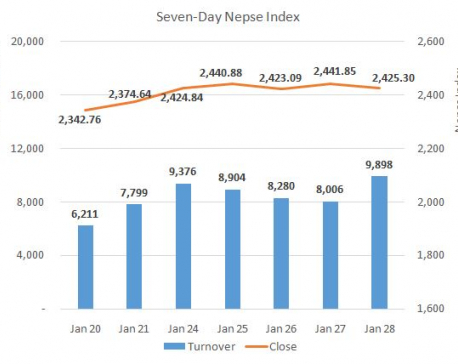

Stocks end lower as BFIs weigh on the broader market

KATHMANDU, Jan 28: The equity market witnessed selling pressure throughout Thursday’s session. After trading higher briefly in the morning, the... Read More...

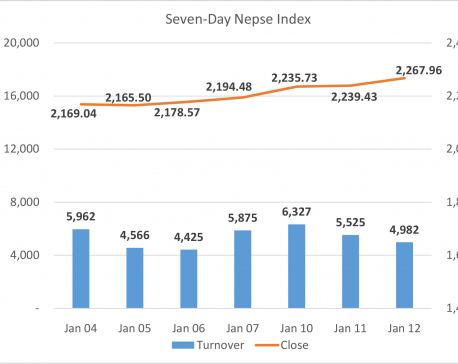

Nepse ends in green for a fifth straight day

KATHMANDU, Jan 12: The equity market opened the day slightly in green and witnessed minor correction in the morning. The... Read More...

Just In

- Biratnagar High Court orders Krishna Das Giri to appear before court within one month in disciple rape case

- Ilam by-election update: UML candidate Suhang maintains lead

- Korean embassy and NTB commemorate 50th anniversary of Korea-Nepal Diplomatic Relations

- SC administration files contempt of court case against SidhaKura

- Second day of Nepal Investment Summit to feature diverse discussions

- Ilam-2 by-election: UML’s Nembang leads by 4,523 votes

- UML’s Bhandari secures victory in Bajhang-1 by-election

- CIB probe into fake DL distribution case: PMO pressures public prosecutor to free arrested govt employees

Leave A Comment