OR

Opinion

Exploring opportunities and Challenges of Increasing Online Transactions in Nepal

Published On: April 20, 2024 09:06 AM NPT By: Chinmaya Mishra

Recently, I embarked on an errand for my parents. Upon completing my purchases, I proceeded to the checkout. The cashier, instead of the usual cash register, presented a QR code card and placed it on the counter, expecting me to make a digital payment. I responded, "Cash, please." Her expression faltered slightly, and she reluctantly retrieved the QR code card and stored it back in the drawer. She then accepted my cash and diligently searched for the exact change. While the transaction was completed within a minute or so, her demeanor conveyed a subtle reluctance to handle cash.

The preference for digital payments has become increasingly evident, leaving cash transactions at a distinct disadvantage. This shift was particularly apparent during the COVID-19 pandemic, when contactless payment methods gained significant traction. Prior to the pandemic, large stores began offering incentives, such as discounts, to encourage customers to adopt cashless payment methods. This shift was driven by the logistical challenges of managing large volumes of cash in big establishments. As the trend gained momentum, customers began inquiring about card payment options, eventually prompting shopkeepers to proactively ask, 'Cash or card?' The COVID-19 pandemic further accelerated the adoption of online payments and transactions, as the desire to minimize physical contact became a paramount concern.

Online transactions, while convenient and relatively secure, are not without their drawbacks. The very nature of digital transactions makes them susceptible to monitoring by various entities, including governments, payment companies, and hackers. This collected information can be used for various purposes, such as fraud, targeted advertising, and even account hacking by particularly skilled individuals. This is the primary reason why drug cartels and illegal arms dealers prefer cash transactions, as it allows them to operate under the radar and avoid detection.

Payment companies, such as eSewa, can sometimes impose inconvenient restrictions and fees on transactions. These companies charge "transaction fees" for each transaction, increasing the overall cost of payments. Each company has its own fee structure, with eSewa charging a 1.75% fee for transactions it facilitates. Additionally, these companies often limit the amount of money that can be transferred at once. For instance, eSewa restricts payments to Rs. 10,000 per transaction, Rs. 25,000 per week, and Rs. 50,000 per month when using their card. These limitations can hinder the payment of large sums, such as hospital bills, causing inconvenience for users.

Card transactions can be a time-consuming affair, often extending beyond the duration of your favorite TV show. Imagine this scenario: you're at a bustling supermarket on a weekend, navigating through the crowds to reach the checkout counters. Each counter has a long queue, and you opt for the shortest one. As you wait your turn, the customer ahead of you initiates a card payment, leaving everyone in the line stranded while the transaction is processed. This process can easily consume up to five minutes, not to mention the time it takes for the cashier to mark and pack your items. Meanwhile, if one of the longer lines is exclusively handling cash payments, they might finish processing their customers much quicker. This can be a frustrating experience, leading many to prefer cash transactions in such situations.

Cash can be a surprisingly valuable tool for earning some extra income, especially for students or young individuals. By subtly rounding up the cost price of purchased items and collecting the difference as "commission," you can gradually accumulate a decent sum over time. This strategy is particularly effective in households with multiple members, large houses, or a tendency to leave cash lying around. In such environments, it's not uncommon to gather around Rs. 10,000 per year simply by collecting these round-ups. However, this method becomes less viable when everyone in the household relies on card or online payments, eliminating the opportunity to gather stray cash. In the absence of other income sources, such as a job or side hustle, this technique can be a surprisingly effective way to save money.

Online transactions, while offering convenience and security, may not be the most practical payment method in all situations. While they can be invaluable in emergencies, their complexity often outweighs their benefits in everyday transactions. The time spent entering card details, verifying transactions, and troubleshooting potential issues can be significantly longer than simply handing over cash or swiping a card.

Nepal is witnessing a rapid transition from traditional cash-based transactions to digital payment methods. While this shift offers convenience and efficiency, it raises concerns about the resilience of our financial system in the face of digital infrastructure failures. Even with Nepal's surplus electricity, power outages remain a reality, making such scenarios a possibility. The decline of coins is evident, with candies often replacing change for small amounts. While the government continues to mint coins, their use is discouraged through such practices. This trend is prevalent in Nepal and other developing countries, while developed nations like the UK still rely on coins, albeit with declining popularity. Coins possess intrinsic value, making them a practical form of currency even in remote communities with limited access to modern financial systems. In the event of an apocalypse, coins can be melted and repurposed, a feat impossible with paper bills. While we've largely abandoned coins, losing paper bills would be a significant setback.

You May Like This

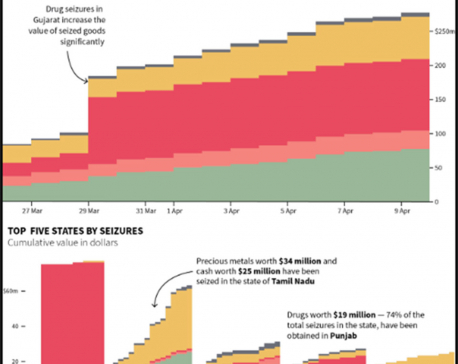

India gold smuggling slowed by election seizures of cash, bullion

MUMBAI, April 15: India’s gold smugglers have slowed their operations over worries their shipments will be caught up in seizures... Read More...

Funds collected for social security schemes already spent

KATHMANDU, April 17: Social Security Fund (SSF) has no cash to run social security programs immediately as the government has... Read More...

EC's Prado purchase plan hits a snag

KATHMANDU, July 11: Election commissioners' attempt to purchase five Prado jeeps has hit a snag after the Ministry of Finance rejected... Read More...

Just In

- Challenges Confronting the New Coalition

- NRB introduces cautiously flexible measures to address ongoing slowdown in various economic sectors

- Forced Covid-19 cremations: is it too late for redemption?

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

- NC defers its plan to join Koshi govt

- NRB to review microfinance loan interest rate

Leave A Comment