Finance Minister Poudel faces a host of challenges to lift the economy which is marred by worsening macroeconomic indicators

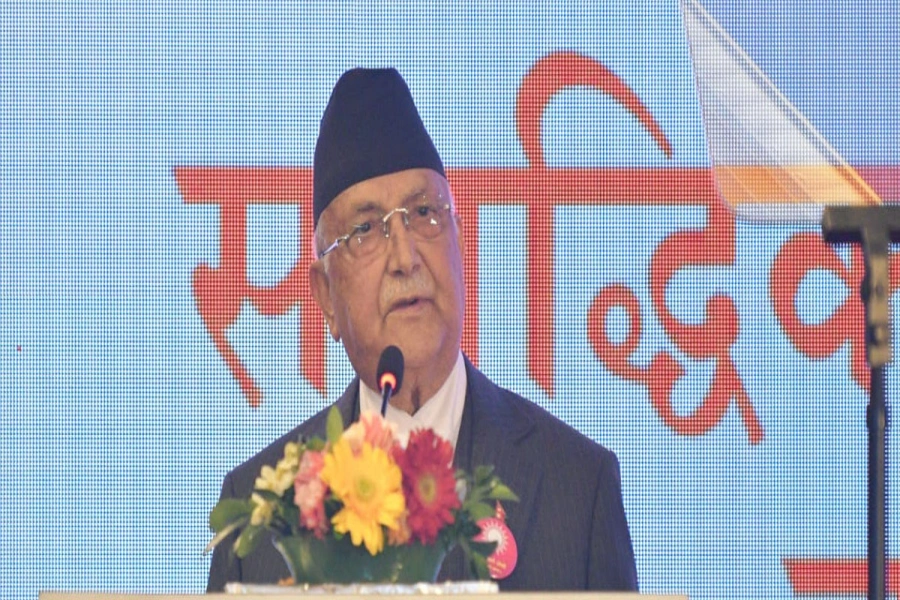

KATHMANDU, Dec 27: CPN-UML Vice-chairman Bishnu Prasad Poudel, who enjoys a merry time after being appointed as the finance minister for a third time, will have an uphill battle to lift the Nepali economy, which faces a number of challenges at present.

On Monday, Poudel was appointed a deputy prime minister and finance minister in the coalition government led by Maoist Center Chairman Pushpa Kamal Dahal. Poudel, who is often criticized for lacking vision to drive the country’s economy, faces a herculean task to lift the economy from the present turmoil.

Challenges at work

This is the third time that Poudel has got an opportunity to lead the apex financial body of the government. Almost every time of his tenure as the finance minister, Poudel faced the big challenge of taking the badly-affected economy back on track.

For the first time, Poudel became the finance minister back in October 2015, when the economy was largely affected by the earthquakes and Indian trade embargo. When he was appointed as the finance minister for the second time on October 14, 2020, the Nepali economy had been struggling against the impacts of the coronavirus pandemic. As he is appointed as the finance minister for a third time, the major macroeconomic indicators of the country’s economy do not look healthy.

Economists paint a bleak picture of the Nepali economy with ailing financial sector, real sector and external sector. Although the external sector has recovered marginally by a slight increase in the remittance inflow and import restriction measures, it is still uncertain for its long term stability. The crucial macroeconomic indicators like inflation rate, government expenditure, government revenue, interest rate, foreign direct investment (FDI), stock market index and aggregate demand are not satisfactory at present.

The consumer price index escalated by 8.08 percent in the first four months of the current fiscal year. This has made people struggle more to manage their daily requirements. The Nepal Rastra Bank itself has projected the inflation to cross 10 percent in the next few months.

While the revenue collection stood one-fourth of the annual targets as of mid-November, the recurrent expenditure soared 12 percent higher. This has led to a big challenge to the government to manage financial resources to manage its daily operation. Likewise, the capital expenditure is pathetic at less than 10 percent.

Banks are refusing to reduce their lending interest rate, which is as high as 18 percent; despite being cushioned in the liquidity position. According to the private sectors, the demand for consumer goods has plunged heavily, while the manufacturing plants are also compelled to run at below 50 percent of their capacity.

Economists said Poudel's record as the finance minister in the past did not seem promising. “Poudel will face immense challenges to manage resources amid a dearth in the government revenue collection and to tame the banks’ interest rate to address the problems of the private sector,” said an economist, keeping anonymity.

Meanwhile, the newly-appointed Finance Minister Poudel said he was aware of the economic challenges at present. “I will consult with the sector’s experts to make correct decisions,” he told the media after his appointment on Monday.