OR

Tax rise on electric vehicles will hit govt plan of making country self-reliant in energy use: Lawmakers

Published On: May 31, 2020 04:15 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, May 31: Lawmakers on Sunday criticized the government move to raise the taxes on electric vehicles, arguing that it will hit the aspiration of making the country self-reliant in energy supply and will aggravate the trade deficit further.

The budget for 2020/21 announced on Thursday has provisions to revoke concessions and subsidies, along with revising the customs duty and value added tax (VAT) on imported electric vehicles. “It will facilitate the import of fossil fuel based vehicles and hence contradicts the government norms to promote green development, just to benefit a handful of automobiles importers,” said lawmaker Prem Suwal speaking at the budget session of the federal parliament.

Earlier, only a 10 percent customs duty and VAT were levied on the import of electric vehicles. The government, in its budget announced Thursday, has increased the customs duty from 30 to 80 percent and excise duty from five percent to 80 percent. In the revised rate, the cost of electric vehicles is likely to increase multifold, according to the traders.

The government has set a target to provide electricity service to every household within 2022 and make the per capita electricity consumption to 700 units within four years. As of now, electricity supply has reached 4.681 million households while the per capita power consumption stands at 267 units. Suwal said the new provision will hit the government target to increase power consumption.

Apart from the government revising the taxes, Nepal Electricity Authority in addition has sought to increase the electricity tariff on the pretext of taking the electricity supply to automation and rising management costs. If the revised rates get approval, industries will have to pay 10-15 percent more tariff while the commercial sector will have to bear an additional five percent cost for the use of electricity.

Member of Parliament Pampha Bhusal said it is not appropriate to levy such heavy taxes on environment-friendly vehicles just on the pretext that a few high-income individuals import costlier vehicles in the segment. Bhusal also slammed the proposed new tariffs of electricity. “On the one hand, the government talks about increasing domestic consumption of electricity, while on the other, the government action is not consistent with its own policy,” she said. Bharat Kumar Shah said it is inappropriate for the government to raise the import taxes on electric vehicles while reducing the taxes on imported confectionery.

Lawmakers expressed their doubts on the budget’s plan to create a large number of employment opportunities in the country hit hard by the threat of coronavirus. Lawmaker Krishna Prasad Dahal said the budget has failed to introduce radical programs to address the soaring unemployment due to the ongoing crisis. “The budget has very little to do with creating job opportunities at a time when around 400,000 people from the domestic job market along with tens of thousands of people returning from foreign employment are likely to remain unemployed in the near future,” said Dahal, stressing the need for devising an effective action plan based on work evaluation to make the budget result-oriented.

Lawmakers were also skeptical of the government plan to manage necessary financial resources for disposal. The government has introduced a budget of Rs 1,474.64 billion for the upcoming fiscal year, less by Rs 58.33 billion of the funds allocated for the current fiscal year. Of the earmarked expenses, Rs 352.91 billion (23.9 percent) has been allocated for capital expenditure and Rs 948.94 billion (64.4 percent) for recurrent expenditure.

To finance its expenditure, the government plans to mobilize Rs 889.62 billion in revenue while expecting Rs 60.52 billion in foreign grants. For the remaining shortfall of Rs 524.5 billion, Finance Minister Khatiwada announced that the government will raise Rs 299.5 billion from external debt and Rs 225 billion from domestic borrowing.

Lawmaker Minendra Rijal said the heavy fall in revenue collection seen in the current crisis might not ensure the government with the excessive funds targeted under the heading for the next fiscal year. “In addition, the government has kept over expectation on receiving foreign grants and loans to finance the set programs in the budget as there is a slim chance that the donors will materialize their commitments in the wake of the ongoing global crisis,” Rijal said.

You May Like This

Lawmakers call for prompt relief to flood and landslide affected people

KATHMANDU, Aug 14: Lawmakers speaking in the meeting of the House of Representatives today have drawn the attention of the government... Read More...

Lawmakers seal deal on $1T plan government-wide funding bill

WASHINGTON (AP) — Congressional Republicans and Democrats forged a hard-won agreement Sunday night on a huge $1 trillion-plus spending bill... Read More...

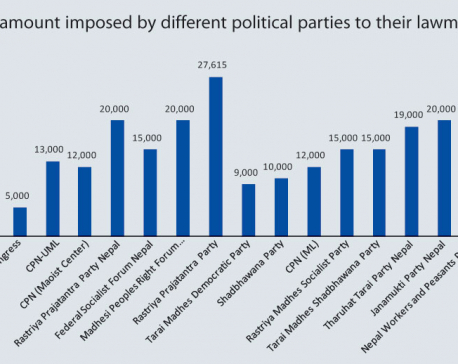

Political parties collect up to 50 percent levy from lawmakers

KATHMANDU, Nov 16: At a time when members of parliament are being criticized for lobbying to increase their perks and benefits,... Read More...

Just In

- CM Kandel requests Finance Minister Pun to put Karnali province in priority in upcoming budget

- Australia reduces TR visa age limit and duration as it implements stricter regulations for foreign students

- Govt aims to surpass Rs 10 trillion GDP mark in next five years

- Govt appoints 77 Liaison Officers for mountain climbing management for spring season

- EC decides to permit public vehicles to operate freely on day of by-election

- Fugitive arrested after 26 years

- Indian Potash Ltd secures contract to bring 30,000 tons of urea within 107 days

- CAN adds four players to squad for T20 series against West Indies 'A'

Leave A Comment