OR

NRB simplifies bank account opening process to support financial inclusion campaign

Published On: April 11, 2019 05:30 AM NPT By: Sagar Ghimire | @sagarghi

Allows BFIs to deposit Rs 100 in accounts and count such expenses as CSR spending

KATHMANDU, April 11: Nepal Rastra Bank (NRB) has simplified the process of opening bank account as part of its effort to help the government in increasing people's access to finance.

The new rule introduced by the central bank not only requires bank and financial institutions (BFIs) to use simplified know-your-customer (KYC) form under 'Lets Open Bank Account Campaign, 2076', but also paves the legal way for allowing them to deposit Rs 100 on those accounts from the bank's side.

Issuing a circular to BFIs on Wednesday, the NRB introduced new provisions for the KYC to facilitate bank account opening to support the government campaign for opening bank accounts for all Nepalis. The campaign was announced through the budget speech of the current fiscal year with an aim to increase financial access and inclusion in the country.

The government is launching the campaign from the start of New Year 2076 i.e. April 14.

“The new provision is aimed at encouraging banks to help the government in its campaign to bring all people within the ambit of banking sector,” Narayan Prasad Paudel, the spokesperson for the NRB, told Republica.

With the new rule in place, banks can count Rs 100 deposited in accounts opened under this campaign as their corporate social responsibility (CSR) expenses.

BFIs are required to spend at least one percent of their total net profit in CSR activities. The central bank has also prescribed a list of activities where CSR fund can be utilized. Activities organized to achieve Sustainable Development Goals (SDGs) and direct donation to education and health for poor families are among the activities where banks can use their CSR fund.

Under the new rule, people can now open bank accounts by filling up a simplified KYC form and enclosing a copy of government-issued identity cards along with their photographs. However, the limit for annual transaction for accounts opened using the simplified KYC form has been set at Rs 100,000. If the transaction is higher than that, the bank should make the client fill up the full KYC form, according to the new rule.

There are 23.54 million deposit accounts as of mid-July last year, the central bank data shows.

According to The Global Findex of 2017 published by the World Bank, 45.4 percent of people aged 15 or above have bank accounts, compared to 68.4 percent of the population in South Asia. Though the central bank has been offering various incentives and facilities to BFIs for deepening financial penetration, their low presence in rural areas have not helped to meet the government's objective.

Financial sector experts say that the central bank's new circular will not only encourage BFIs to help in opening bank accounts but also attract public toward banking sector. “The central bank's decision to allow banks to count deposits that they made in clients' accounts as CSR expenses is a historical step. It will help in utilizing the CSR fund, while also attracting people to open bank accounts,” Sanjiv Subba, CEO of National Banking Institute (NBI), told Republica over phone from Malung village in Lamjung where he is organizing a financial literacy campaign. “The new move is relevant and timely also because more banks are now opening their branches at the local level,” he added.

You May Like This

Apex court stays new rule on age bar for bank CEO

KATHMANDU, Aug 14: The Supreme Court has stayed a new rule issued by the Nepal Rastra Bank (NRB) on setting the... Read More...

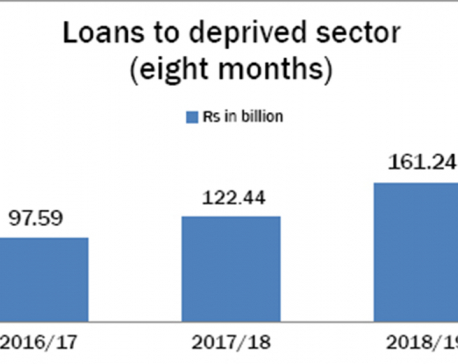

Expansion of network, definition drives up deprived sector lending of BFIs

KATHMANDU, May 12: Bank and financial institutions (BFIs) have floated a total of Rs 161.24 billion in loans to deprived sector... Read More...

NRB’s directive to banks and BFIs

KATHMANDU, Jan 14: Nepal Rastra Bank (NRB) has directed the banks and financial institutions to submit the details of all... Read More...

Just In

- Two children found infected with measles in Shuklaphanta

- Four NC ministers take oath of office and secrecy

- Dr Ruit and Journalist Chandra Kishore feted

- Kathmandu records highest number of divorce cases with 13 couples filing for divorce daily

- Rapid response team mobilized in Dhangadhi to contain cholera outbreak

- 28 workers held hostage in India rescued

- Simaltal bus accident: 40-kg magnet deployed to trace missing buses

- Youth of eight districts lead in foreign employment

Leave A Comment