OR

Quarter-term review of monetary policy

NRB optimistic about economic outlook after improvement in macroeconomic indicators

Published On: December 24, 2016 10:35 AM NPT By: Sagar Ghimire | @sagarghi

KATHMANDU, Dec 24: Nepal Rastra Bank (NRB) has become optimistic about the economic outlook of the country, citing that the most of the macroeconomic and financial indicators for the country are heading toward an improvement in the current fiscal year.

Releasing its quarterly review of its monetary policy for Fiscal Year 2016/17 on Friday, the central bank said favorable weather conditions and availability of agro fertilizers was likely to boost agro production. The services and manufacturing sectors were likely to gain traction from an improvement in the business environment in the country, it said.

“However, budget implementation, reconstruction, and supply management should be accorded priority to achieve the economic growth rate in the current fiscal year as per the target,” the quarter-term review of the monetary policy reads.

Against this backdrop, NRB said, it had decided to continue with the stance, direction and targets set in the monetary policy for Fiscal Year 2016/17.

The central bank did not change the inflation target, bank rates, policy rates, cash reserve ratio, and refinance rate, among others, that it had set earlier in the fiscal year.

“In order to maintain economic stability and pave the way for policy stability, the monetary stance and its direction has not been changed,” reads the review carried out by the central bank for the first time.

While NRB used to do mid-term reviews of its monetary policy, it started quarterly reviews from the current fiscal year ‘to make the monetary management effective and communication process more transparent in keeping the view the international practices’.

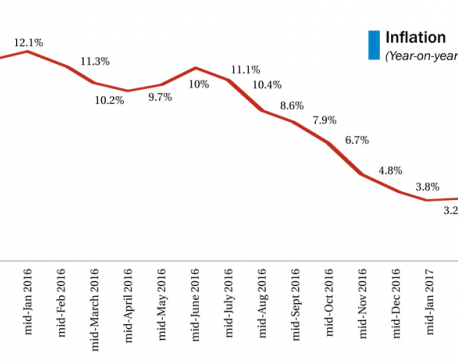

NRB is hopeful that inflation will likely remain within its target if there were no strikes or bandas in country that would hit the supply system as an improvement in agro production was likely to reduce inflationary pressures due to ease in the supply of food items. However, NRB also suggested the government step up market monitoring and make the supply system effective to tame inflation.

According to NRB, the major financial indicators for the country were positive in the review period.

Average inflation remained at 7.7 percent, compared to the central bank’s target of keeping it at 7.5 percent. Balance of payment remained at a surplus of Rs 19.70 billion, and foreign exchange reserves stood at Rs 1,054.61 billion, which is sufficient to finance imports of merchandises and services for 13 months, compared to a target of eight months.

The newly-introduced interest rates corridor system has helped address the problem of excess liquidity that the banking system was facing and short-term interest rates are gradually rising, according to NRB.

In line with the central bank’s aim of increasing loans to the productive sectors to support the government in meeting the economic growth target, lending toward such sectors has also been increasing in recent times.

In the review period, bank and financial institutions (BFIs) floated a total of Rs 240.89 billion to the productive sectors which include agriculture, energy, tourism, and small and micro enterprises. Lending to the productive sectors now account for 16.3 percent of the total loans of BFIs compared to 15.8 percent in the corresponding period of Fiscal Year 2015/16.

“FUTURE DIRECTIONOF PUBLIC FINANCES COULD WEIGH ON MONETARY POLICY”

NRB say the outlook of public finances of the country was likely to impact the direction of its monetary policy. The central bank’s assessment has come at a time when weak implementation of the fiscal policy is weighing on effective transmission of the monetary policy.

The central bank said a significant amount of surplus money in the government treasury reduced excess liquidity in the banking system.

As of the third quarter that ended on mid-October, the government has a surplus of Rs 196.62 billion in its accounts as it could not increase capital spending.

The recent slowdown in remittance inflow to the country also seemed to have unnerved the central bank.

“The remittance inflow growth has been squeezed as the number of outbound Nepali workers has been falling for the last one year while import has been widening, posing a risk to the balance of payment position of the country,” the quarterly review of the monetary policy warned. While it seems that there will be a pressure on foreign exchange reserves due to the remittance and import patterns, foreign exchange reserves of the country is at a comfortable position, according to NRB.

You May Like This

Bank of Korea to help NRB prepare model for economic forecasting

KATHMANDU, June 28: Nepal Rastra Bank (NRB) and the Bank of Korea -- the central bank of South Korea -- have... Read More...

Slowdown in price rises makes NRB optimistic on inflation

KATHMANDU, April 9: Price of goods and services has not gone up in the current fiscal year as much as... Read More...

India positive about resolving IC problem in Nepal: NRB governor

KATHMANDU, Nov 22: Nepal Rastra Bank Governor Chiranjibi Nepal said Tuesday that India has responded positively to Nepal’s request about resolving... Read More...

Just In

- Challenges Confronting the New Coalition

- NRB introduces cautiously flexible measures to address ongoing slowdown in various economic sectors

- Forced Covid-19 cremations: is it too late for redemption?

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

- NC defers its plan to join Koshi govt

- NRB to review microfinance loan interest rate

Leave A Comment