OR

Daily Market Commentary

Nepse fails to add to previous gains, posts a marginal decline

Published On: November 29, 2018 09:16 AM NPT By: Republica | @RepublicaNepal

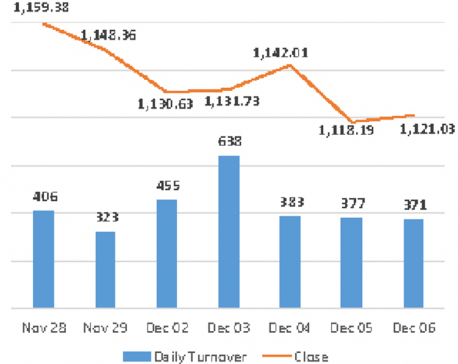

KATHMANDU, Nov 29: The Nepal Stock Exchange (Nepse) turned in a choppy trading session on Wednesday. Stocks initially traded in the upside with the benchmark index reaching an intra-day high of 1,163 points in the morning. However, stocks fluctuated thereafter maintaining negative bias over the course of remaining trading hours. At the close, Nepse posted a marginal loss of 2.10 point to settle at 1,159.38 points.

Lackluster trading continued in the local bourse in absence of any major news. Nonetheless, majority of the listed companies are yet to announce dividends after which the equity market might see an improvement in the overall trading activity. On the day, the exchange posted a total turnover of Rs 405 million, with shares of Nepal Bank Ltd accounting for majority of the total transaction amount.

All major sub-indices followed the broader market except the 'Others' sub-index which gained 0.29 percent in the session. Microfinance scrips were the biggest drag of the day as the group's sub-index fell 1 percent. Non-Life Insurance and Hydropower sub-indices, correspondingly, fell 0.48 percent and 0.42 percent. Meanwhile, sub-indices of Banking and Hotels sectors shed 0.18 percent each.

Nepal Bank Ltd's shares led the Wednesday's market participation. More than Rs 156 million worth of the bank's shares changed hands on the day. Next, shares of Soaltee Hotel Ltd registered turnover of over Rs 37 million. NMB Bank Ltd's shares also traded actively and posted a total transaction of Rs 20 million. Insurance stocks followed with Nepal Life Insurance Company Ltd and Nepal Insurance Company Ltd logging in turnovers of Rs 11 million and Rs 10 million, respectively.

Citizens Mutual Fund-1 was the biggest percentage gainer in the session as it saw its share price jump almost 4 percent. Similarly, Grameen Bikas Laghubitta Bittiya Sanstha Ltd's share price rose 3.46 percent. Karnali Development Bank Ltd, Ngadi Group Power Ltd and Chhyangdi Hydropower Ltd were among other advances with gains of over 3 percent each.

Conversely, shares of Samata Microfinance Bittiya Sanstha Ltd suffered as its respective price tumbled 5.41 percent. Similarly, other micro-sector lender's stocks came under pressure as Nirdhan Utthan Laghubitta Bittiya Sanstha Ltd and Nepal Seva Laghubitta Bittiya Sanstha fell 5.09 percent and 4.42 percent, respectively. Besides, IME General Insurance Ltd, Nadep Laghubitta Bittiya Sanstha Ltd and Mirmire Laghubitta Bittiya Sanstha Ltd sank over 3 percent apiece.

In the corporate space, the initial public offering (IPO) shares of Upper Tamakoshi Hydropower Ltd, which was worth over Rs. 1.58 billion, were allotted to general public on Tuesday. All valid applicants were allotted a minimum of 40 shares each. The hydropower company is constructing the largest hydropower project of Nepal with capacity of 456 Megawatts (MWs).

As per the ARKS technical analysis, the equity market has witnessed a short term consolidation as the index has hovered around 1,160 points mark for a third straight day.

The aforementioned level also acts as a support for the equity market. However, the market is experiencing significant weakness of late with technical indicators suggesting bearish sentiment dominant in the present context. The breach of the support at 1,160 points might see the index stretch its downtrend further.

This column is produced by ARKS Capital Advisors Ltd www.arkscapitaladvisors.com

(Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

Nepse posts modest gains after initial slump

KATHMANDU, Dec 7: The Nepal Stock Exchange (Nepse) index started the session on a weak note, losing almost 10 points... Read More...

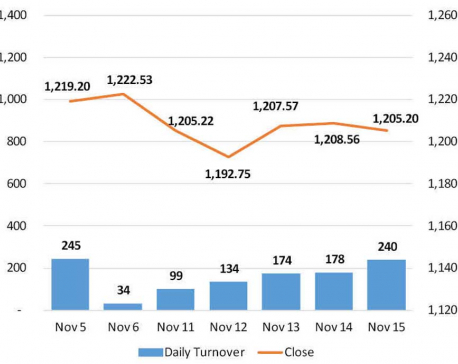

Stocks end week with a modest drop

KATHMANDU: Nepal Stock Exchange (Nepse) posted a loss of 3.36 points to settle at 1,205.20 points on Thursday. Though the... Read More...

Nepse snaps four-day losing run

KATHMANDU, Nov 22: Stocks came under pressure in the beginning of Wednesday's session with the Nepal Stock Exchange (Nepse) index... Read More...

Just In

- Two children found infected with measles in Shuklaphanta

- Four NC ministers take oath of office and secrecy

- Dr Ruit and Journalist Chandra Kishore feted

- Kathmandu records highest number of divorce cases with 13 couples filing for divorce daily

- Rapid response team mobilized in Dhangadhi to contain cholera outbreak

- 28 workers held hostage in India rescued

- Simaltal bus accident: 40-kg magnet deployed to trace missing buses

- Youth of eight districts lead in foreign employment

Leave A Comment