OR

Weekly Market Commentary

Nepse ends week higher as majority of indices see gains

Published On: July 30, 2021 06:53 PM NPT By: Republica | @RepublicaNepal

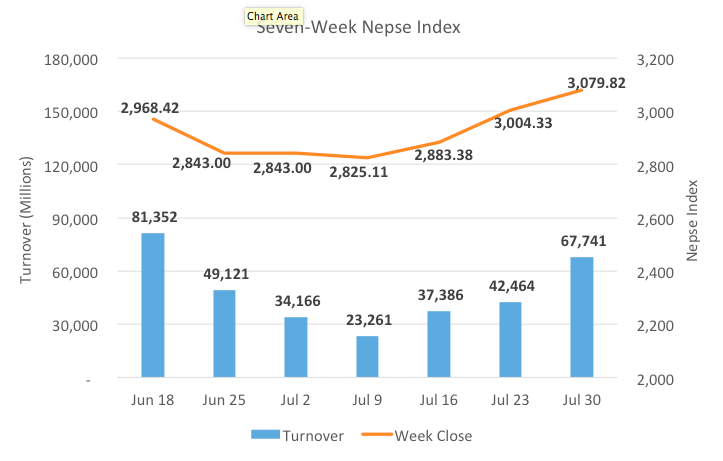

KATHMANDU, July 30: The Nepal Stock Exchange opened the week on a strong note as the index saw a gain of more than 54 points on Sunday. After a modest correction of 8 points on Monday, stocks stretched its gaining momentum. On Tuesday, Nepse added 29 points followed by a gain of 15 points on Wednesday. The last trading day of the week saw minor selling pressure with the index ending around 15 points lower. Subsequently, Nepse ended the week 2.51% or 75.49 points higher at 3,004.33.

The review period’s advance saw the Nepalese equity market extend its gaining run for a third straight week. With sectors leading the charge sequentially, the index has continued to hold ground with intermittent correction of a few weeks. Turnover also improved as banking average made a fresh record. Over Rs. 67 billion worth of equities were traded.

The Sensitive Index also climbed 1.54%. In terms of sectoral performance, most ended the week in green. Hotels & Tourism and Hydropower segments led the market with both sectors closing more than 7% higher. Finance sub-index also rallied 6.49% followed by the Manufacturing & Processing sector, which rose 5.88%. The Investment Index climbed 4.43%. All other sectors saw strength, barring Mutual Fund and Banking sectors, which saw modest weekly losses.

Shares of United Modi Hydropower Ltd were traded the most followed by National Hydropower Company Ltd. Both scrips witnessed turnovers of almost Rs. 1.5 billion. NIC Asia Bank Ltd, Nepal Bank Ltd, Api Power Company Ltd and Arun Valley Hydropower Company Ltd saw transactions of over Rs. 1.3 billion each. Himalayan Distillery Ltd, Sanima Mai Hydropower Ltd and Global IME Bank Ltd were among other heavily traded stocks.

As per the ARKS weekly technical analysis, the index formed a bullish green candlestick, suggesting buyers in control. With the index making a fresh closing high this week, some correction is also on the cards reflected by overbought reading in Relative Strength Index (RSI) chart. However, any sign of loss of momentum is yet to be observed. Hence, given the market stays afloat above 3,000 mark, the market will likely stretch its upward move. Conversely, a breach of 3,000 mark to the downside might see the index falter further.

This column is produced by ARKS Capital Advisors Ltd.

www.arkscapitaladvisors.com

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

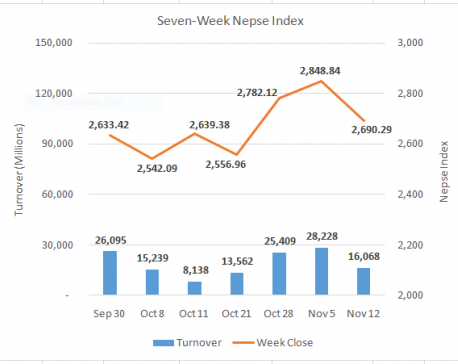

Stocks close week firmly lower

KATHMANDU, Dec 3: The Nepal Stock Exchange (Nepse) index opened this week’s trading on a weak note with the benchmark... Read More...

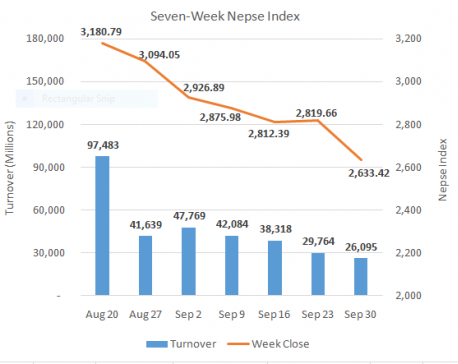

Weekly dip pulls index towards April’s low

KATHMANDU, Oct 1: After ending in green in the prior week, stocks opened with notable weakness on Sunday. On the first... Read More...

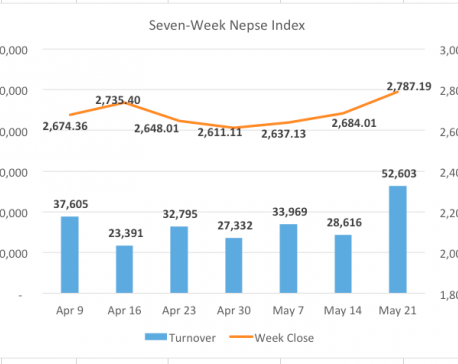

Nepse ends week 100 points higher, weekly turnover hits record

KATHMANDU, May 22: A rally of more than 54.29 points on Sunday helped Nepse index break its all-time high hit at... Read More...

Just In

- CM Kandel requests Finance Minister Pun to put Karnali province in priority in upcoming budget

- Australia reduces TR visa age limit and duration as it implements stricter regulations for foreign students

- Govt aims to surpass Rs 10 trillion GDP mark in next five years

- Govt appoints 77 Liaison Officers for mountain climbing management for spring season

- EC decides to permit public vehicles to operate freely on day of by-election

- Fugitive arrested after 26 years

- Indian Potash Ltd secures contract to bring 30,000 tons of urea within 107 days

- CAN adds four players to squad for T20 series against West Indies 'A'

Leave A Comment