We will put some cap pricing: Sebon boss

KATHMANDU, July 25: The government is paving the way for public companies to adopt free pricing method for their initial public offering.

The proposal of the Securities Board of Nepal (Sebon) to amend the Securities Registration and Regulations, 2008, to allow companies to float their primary shares on free-pricing model is currently awaiting the approval of the Ministry of Finance. However, the Sebon will impose some cap on the pricing of primary shares.

Purwanchal Lube Oil to issue IPO

If the Ministry of Finance approved the proposal, companies no longer have to float their primary shares at face value of Rs 100. Currently, the regulation makes it mandatory for the public companies to issue shares at Rs 100. Though public companies, who are in profit for last three consecutive years, can also issue their shares at a premium rate, there are certain conditions like premium within the limit of net worth per share derived from latest audit which do not account of a company’s future growth scope which make it difficult for company to list their shares in the secondary market for the trading.

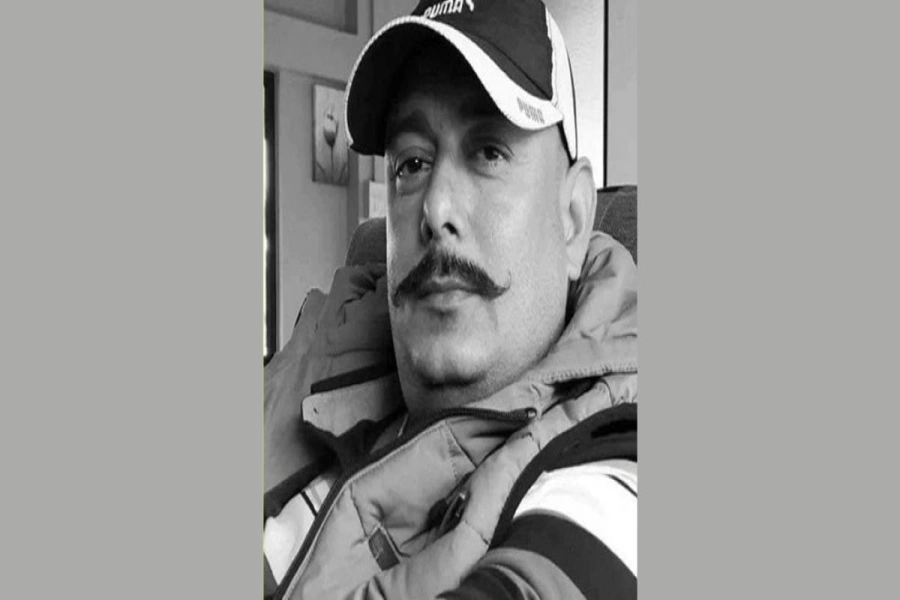

“We have already forwarded the amendment proposal to the ministry. Once it is approved, companies will be free to set price of their primary shares on their own. However, it would not be completely free pricing. There will be some cap on the pricing,” Rewat Bahadur Karki, chairman of the Sebon, told Republica.

The amendment in the regulation has come in the wake of the private sector complaining about the current pricing requirement which do not allow company to fix the price of shares on their own.

“The free pricing method will encourage the real sector companies to float their shares to the public and list it in the secondary market for trading,” Karki added.

Analysts attribute the long queue of investors to subscribe IPO of any company, irrespective of their financial condition, to the availability of shares at face value of Rs 100.

As the investors get share at face value of Rs 100, the IPO of the companies are getting oversubscribed by multiple times.

“Since the primary shares investors buy at Rs 100 gets at least doubled when it is traded in the secondary market, there has been such a long queue of investors. So it has been a bonanza for the investors,” said a stock broker. “The free pricing method can end such huge oversubscription of any type of companies as investors won’t get share at Rs 100 anymore.”