OR

#OPINION

Economic Renewal: The Time Is Now for Privatizing Public Enterprises

Published On: October 21, 2023 08:00 PM NPT By: Sindhuj Thapa

The establishment of public enterprises, both on a global scale and within the unique context of Nepal, has been a pivotal chapter in the annals of economic development. In the post-World War II era, a surge of state-owned enterprises (SOEs) emerged worldwide, driven by a myriad of motivations and expectations to address market failure. These public enterprises, often birthed in a spirit of post-war idealism and economic reform, held the promise of addressing socio-economic challenges. Yet, as realities have changed over time, the landscape of public enterprises has transformed considerably. Today, we journey through history and delve into the significance of establishing public enterprises back then, shedding light on their evolving performance, especially within the dynamic framework of Nepal's experience. From the early days of socialism's appeal to the contemporary challenges faced by these entities, we explore how public enterprises have shaped the socio-economic fabric of Nepal while acknowledging the shifting paradigms that have redefined the need for their existence in the modern world.

Nepal’s Rana regime's century of rule came to an end in 1951, paving the way for development and transformation. Before this, the government expenditures for public benefit did not exceed 1% of the revenue it generated. The nation was economically underdeveloped, with approximately only 2% of its citizens being literate. Additionally, the lack of accessible medical facilities for the general public resulted in a reduced life expectancy, and the majority of the population, engaged in subsistence farming, lived in poverty under the control of high rent-seeking landlords. Amidst the chaos of political turmoil following that year, the new government brought into action the first five-year development plan in 1956 and Nepal's first manufacturing industry, Biratnagar Jute Mill began its operations. The first plan lasted till 1961 through which the government established multiple public enterprises - National Trading Ltd, Timber Corporation of Nepal, and National Construction Company Ltd, to drive the development of transportation, power, and irrigation facilities in the nation.

It is worth noting that Nepal began its development journey from scratch, with very little infrastructure and resources. Public enterprises were established to provide basic goods and services at affordable prices to the public, promote a healthy competitive environment in production and distribution sectors, and act as a driver in the rapid development of the country through the optimum use of available resources. Although the establishment of public enterprises made sense in the 1950s when private enterprises were in their infancy and Nepal was starting its development journey from scratch, it does not make sense in today's context, and here's why.

Liberalization followed by a competitive private sector

During the same time in the early 1990s, the liberalization of Nepal started to take place. This brought a significant shift in the nation's economic and political landscape. Before this era, Nepal had maintained a predominantly closed and regulated economy. However, in 1990, a pro-democracy movement led to the restoration of multiparty democracy and subsequently, the initiation of economic liberalization policies. These reforms involved the reduction of trade barriers, privatization of state-owned enterprises, and the encouragement of foreign investment. Following the unsatisfactory performance of the public enterprises, the privatization process began from 1980 to 1985, which sped up after the incorporation of the Industrial Policy in 1992 and the Privatization Act in 1994.

Post-liberalization sectors like cement, milk, shoes, pharmaceuticals, entertainment, media, finance, and telecommunication have flourished. This growth has predominantly been driven by private enterprises, which have successfully secured significant market presence. Notably, private companies in this sector have demonstrated a competitive edge by offering products at prices equivalent to, or even lower than, their state-owned counterparts. For instance, paracetamol, a widely used pharmaceutical, produced by state-owned enterprises (SOEs), is uniformly priced at Rs. 1. Conversely, the production cost for the same medication stands at Rs. 1.5 within SOEs, indicating inefficiencies in state-run operations. Moreover, one might argue that health is a critical sector and the government should provide medicines at a subsidized price. However, government-run Nepal Aushadhi Limited was shut down for 8 years, starting from 2009 after failing to meet the World Health Organization Standards. Regardless, there was neither an increment nor a shortage of privately manufactured paracetamol available in the market. The divergence in pricing dynamics is also evident in the cement industry, where the state-owned Udaipur Cement retails at Rs. 850 per 50 kg, while the average selling price for the same quantity from private firms is Rs. 775. Comparable trends persist across other industries, such as milk where the government fixed the minimum purchase price of raw milk containing four units of fat at Rs 65 per liter for the farmers. Where DDC is buying milk at Rs. 775 per liter, private industries are buying milk by paying Rs 5-10 more per liter. Moreover, the private sector is giving advance payment to the cooperatives, but DDC has been buying milk on credit for two months.

Hence, the viability of these non-essential state-owned enterprises, operating in sectors devoid of critical importance, requires meticulous examination, particularly in light of the economic strain they impose on taxpayers. The rationale for their continued operation appears questionable, given their substantial losses, reliance on government subsidies, and financial bailouts, especially when the private sector exhibits greater competitiveness and resourcefulness, all of which ultimately affect the economic well-being of taxpayers.

Incompetent Enterprises Increasing Government Spending

There are 44 total public enterprises in Nepal among which 25 are profit-making, 17 are loss-making and two are closed. The escalating government spending on Public Enterprises (PEs) against a backdrop of mounting losses presents a noteworthy concern in the economic landscape. An analysis of government spending reveals an alarming trend. In the fiscal year 2017/18, the government disbursed 28.91 billion rupees, equivalent to 19.7% of total income tax, toward loans and subsidies. This figure increased to 21.15 billion rupees (13.23% of income tax) in 2018/19, surged to 39.4 billion rupees (20.3% of income tax) in 2019/20, and further ballooned to 53.9 billion rupees (24.5% of income tax) in 2020/21. The most recent fiscal year, 2021/22, witnessed government spending of 46.1 billion rupees, constituting 20.05% of income tax. This translates to a substantial 57.5% increase in government spending from 2017/18 to 2021/22.

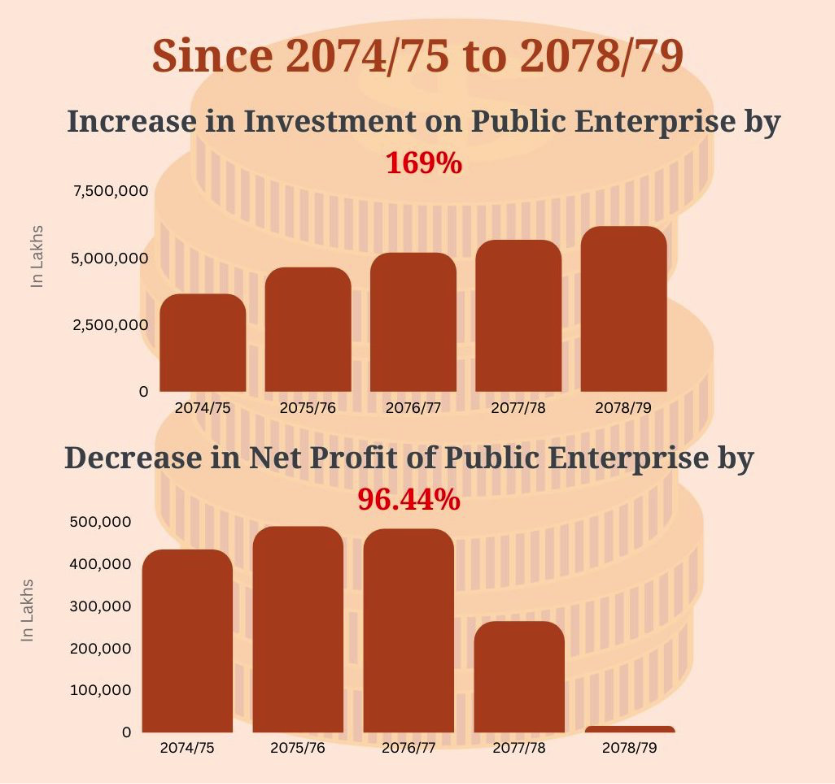

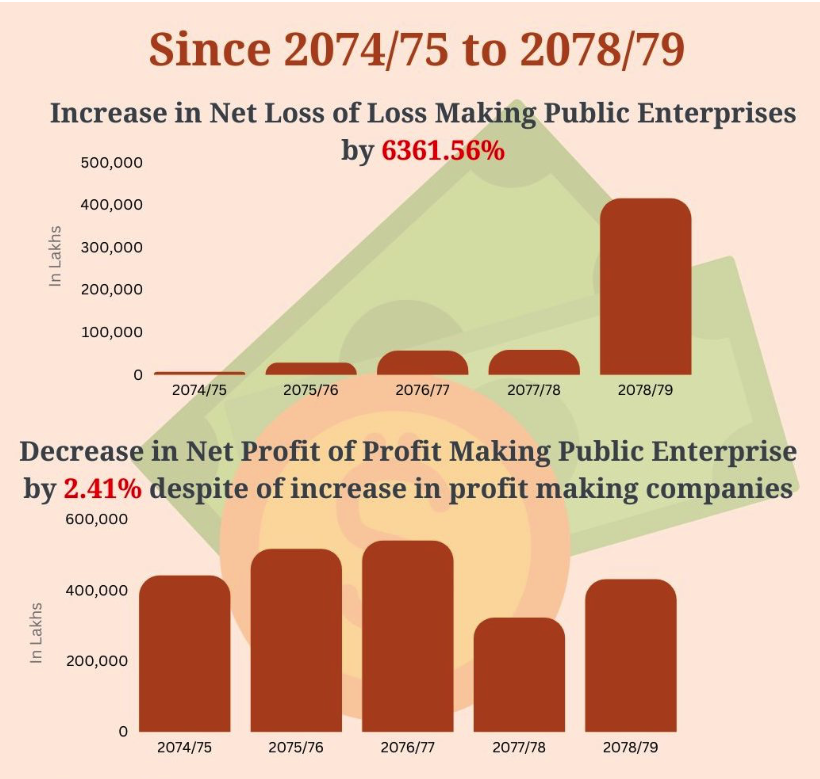

Moreover, an examination of government investments in PEs unveils an even more striking trend. In 2021/22, government investments reached a staggering 618.16 billion rupees, marking an extraordinary 169% increase over the past five years, specifically since 2017/18 when investments stood at 364.79 billion rupees. Paradoxically, despite substantial government support in the form of loans, subsidies, and extensive investments, the financial health of PEs remains precarious. Over the last five years, loss-making public enterprises have witnessed an astonishing 6361.5% increase in losses reaching 41.48 billion rupees in 2021/22, while profit-making companies have experienced a 2.4% decrease in profits even as their numbers expand reaching 43 billion rupees in the same year. This troubling scenario calls for a comprehensive reevaluation of the strategies and policies governing these enterprises to ensure a sustainable and efficient use of public resources.

Increase in Public Debt

In Nepal's economic landscape, the public enterprise sector has emerged as a notable contributor to the country's public debt, accounting for approximately 3% of the GDP in the fiscal year 2021/2022. However, the alarming issue lies in the fact that a majority of these public enterprises have been grappling with financial losses for over half a decade. This financial predicament raises pertinent questions about the rationale behind directing funds toward sectors incapable of repaying their debts. At the heart of this concern is the concept of opportunity cost, where resources allocated to struggling enterprises could have been more judiciously invested in sectors poised for growth and capable of generating returns to service the debt. Recognizing that this debt is essentially borrowed from future generations, the imperative now is to pivot towards investment in infrastructure and revenue-generating sectors, ensuring sustainable economic growth and fiscal responsibility.

Nepal's historical experience with public enterprises emphasizes the importance of a recalibrated government role. Rather than directly participating in business operations, the government should focus on creating a conducive environment for the private sector to flourish. This shift is essential for promoting innovation, efficiency, and economic growth. As we reshape our economic landscape, it is crucial to develop a well-defined exit strategy for state-owned enterprises that no longer aligns with the nation's evolving economic goals. Lessons learned from past mistakes, where many privatized industries faced losses, asset liquidation, or closure, underscore the imperative to reevaluate and improve our privatization practices. By implementing more effective approaches and embracing best practices, Nepal can chart a course toward a more prosperous and economically vibrant future, where the government's role is strategic and beneficial to all.

You May Like This

Economic Renewal: The Time Is Now for Privatizing Public Enterprises

Despite substantial government support in the form of loans, subsidies, and extensive investments, the financial health of Public Enterprises remains... Read More...

Nepal's public debt surpasses Rs 57 billion in the first four months of FY 2023/24

KATHMANDU, Dec 2: Nepal has accumulated more than Rs 57.71 billion in public debt in the first quarter of Fiscal... Read More...

Govt settled Rs 67.70 billion in interest and principal repayment of public debt in Q1 of current FY

Public debt surged to Rs 2.354 trillion in the review period ... Read More...

Just In

- Political party leaders express commitment to ensure consensus to promote investment in the country

- Ilam by-election update: UML's Nembang continues to lead in vote count

- Demystifying labeled Feminism

- Japanese Foreign Minister to visit Nepal next week

- Bajhang by-election update: NC candidate ahead by 249 votes

- Aid for war: On the United States Senate and aid package

- NEA Provincial Office initiates contract termination process with six companies

- Nepal's ready-made garment exports soar to over 9 billion rupees

Leave A Comment