The finance company had landed in trouble after issuing Rs 445.96 million in loans to directors, promoters and individuals associated with them. It had come to light in April 2011 during an on-site inspection conducted by the regulator.[break]

“After making required loan loss provisions for the amount, the finance company had accumulated a cumulative loss of Rs 23.24 million and a negative capital adequacy ratio of 30.4 percent,” NRB said in a statement.

Following this, prompt corrective action was taken against the company and it was given a 35-day period to justify why it should not be listed as a “troubled” company.

Despite receiving commitment from the company to improve its financial health, the regulator in mid-July found it was still maintaining a negative capital adequacy ratio of 12.16 percent.

This violated the central bank provision, which requires category ´B´ and “C´ financial institutions to maintain 11 percent capital adequacy ratio -- a measure of capital reserves against assets at risk.

“Since the financial condition of the company has not improved, and considering the interest of depositors and investors, among others, the finance company has been declared troubled,” the statement said.

The finance company has now been given six months to improve its capital position and bring down the portion of non-performing loans to below 5 percent.

During this period, the company will not be able to collect new deposits or renew the old ones. It should also return matured deposits to its clients. But it has to take the regulator´s permission prior to releasing deposits or settling liabilities of over Rs 200,000 per day.

The “troubled” status also bars the finance company from opening new branch offices, extending loans and dividends, and working as a guarantor. This status also prevents the company from raising salaries and allowances of staff, while it has to take the regulator´s permission to hire new employees or promote existing staff members.

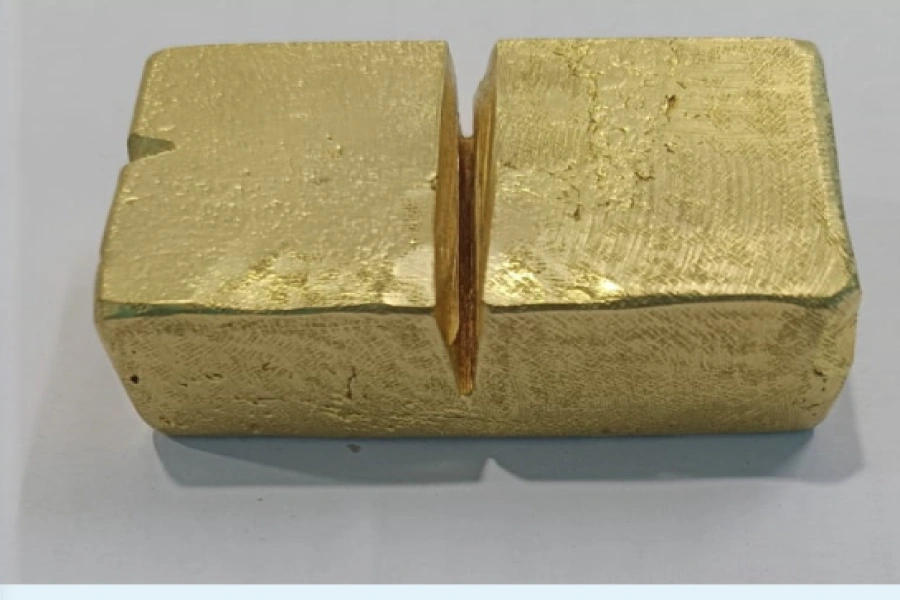

Rare quartz crystal to be kept at Gorkha Durbar