OR

CNI urges IMF not to intervene unnecessarily in Nepal’s policy formulation process

Published On: October 4, 2023 08:00 AM NPT By: Republica | @RepublicaNepal

KATHMANDU, Oct 4: The Confederation of Nepalese Industries (CNI) has suggested the International Monetary Fund (IMF) not to intervene unnecessarily in Nepal’s policy formulation process.

At a time when the IMF has been blamed for imposing unnecessary pressure on Nepal Rastra Bank (NRB) on its policy formulation, the umbrella organization of the private sector advised the international watchdog to refrain from its over exposure in policy formulation. According to a press statement issued by CNI, its President Rajesh Kumar Agrawal urged the IMF not to impose unnecessary rulings on the government's policy and direction.

During a meeting held between the officials of CNI and the IMF on Tuesday, the confederation expressed its concern over the issue. IMF's mission Chief Tidiane Kinda, Country Representative in Nepal, Teresa Daban Sanchez and others held the discussion with CNI. “Nepali economy has its own features and that all the principles or any practices abroad cannot be replicated identically in Nepal,” Agrawal said.

The pressure of the IMF over the NRB has been visible since November last year. Showing its dissatisfaction over the central bank’s step on restricting imports last year, the international organization had even delayed its second installment of the Extended Credit Facility (ECF) offered to Nepal.

In January 2022, the IMF approved a US $ 398.5 million loan under the ECF for Nepal. The 38-month financing package was provided to Nepal to mitigate the Covid-19 pandemic’s impact on health and economic activities, protect vulnerable groups, preserve macroeconomic and financial stability, and support sustained growth and poverty reduction.

The IMF was supposed to provide around $ 52.80 million in the second disbursement. However, it put it on hold for about a year and released the amount only in May, 2023.

The umbrella organization of the private sector has also expressed its concern over the IMF’s influence on the NRB’s policy on management of liquidity and interest rates. According to Agrawal, only increasing the interest rate to control price hike is not a proper measure.

Agrawal claimed that the country's economy was facing problems due to the policy the government adopted to increase interest rate while containing inflation and decreasing demand. “Although loan was misused to some extent for lack of oversight following the COVID-19, the regulatory body adopted the policy in haste rather than in a gradual manner,” he blamed.

Agrawal further commented that the NRB’s policy and direction only favor banks rather than manufacturing businesses. “It was agreed between NRB and IMF on restructuring the loan for addressing liquidity, but the NRB's recent policy is against it,” he added.

You May Like This

Performance of Nepal’s manufacturing sector improved during mid-April and mid-July: CNI report

KATHMANDU, Oct 2: Nepal’s manufacturing sector, which struggled for more than one year of the impacts of the coronavirus, was able... Read More...

Pakistan's currency plunges against U.S. Dollar as it seeks IMF bailout

PAKISTAN, Oct 10: Pakistan's currency plunged by nearly 7 percent after the government said it would seek emergency bailout loans... Read More...

FNCCI, CNI extend Workers' Day greetings

KATHMANDU, April 30: Federation of Nepalese Chamber of Commerce and Industry (FNCCI) and Confederation of Nepalese Industries (CNI) have extended best... Read More...

Just In

- Political party leaders express commitment to ensure consensus to promote investment in the country

- Ilam by-election update: UML's Nembang continues to lead in vote count

- Demystifying labeled Feminism

- Japanese Foreign Minister to visit Nepal next week

- Bajhang by-election update: NC candidate ahead by 249 votes

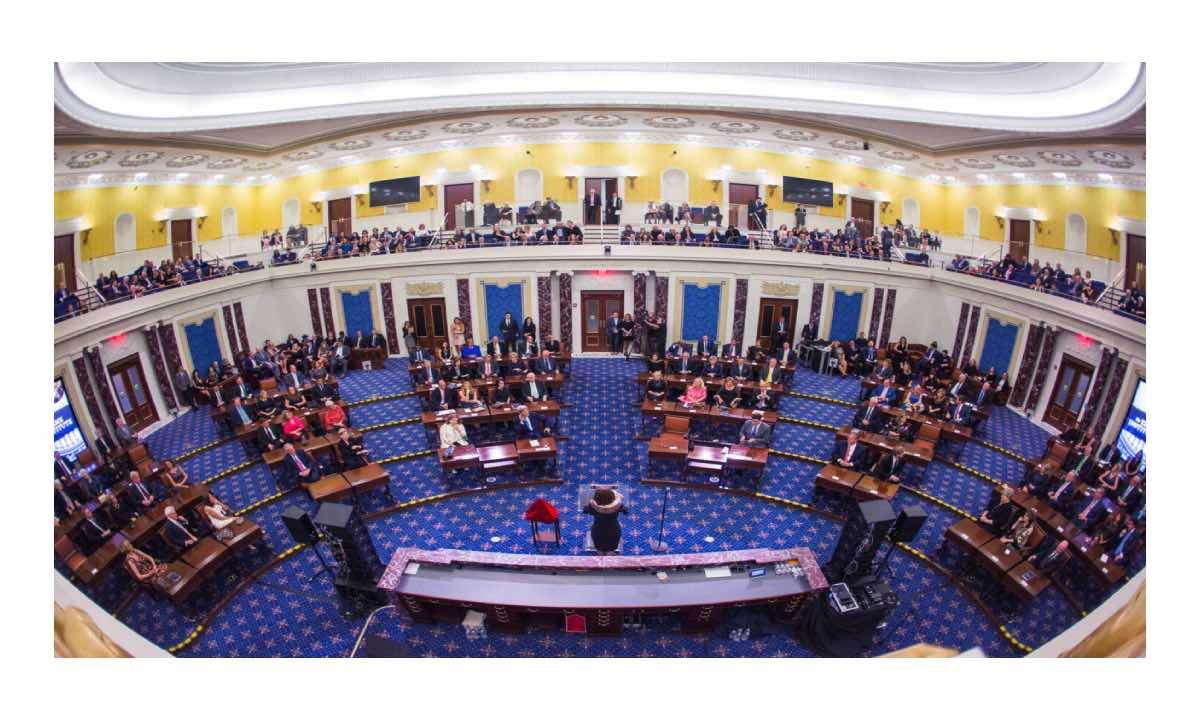

- Aid for war: On the United States Senate and aid package

- NEA Provincial Office initiates contract termination process with six companies

- Nepal's ready-made garment exports soar to over 9 billion rupees

Leave A Comment