OR

BFIs float Rs 41 billion in concessional loans

Published On: December 21, 2019 09:29 AM NPT By: Sujita Pradhan

Number of beneficiaries growing, albeit slowly, as NRB pushes BFIs to implement scheme

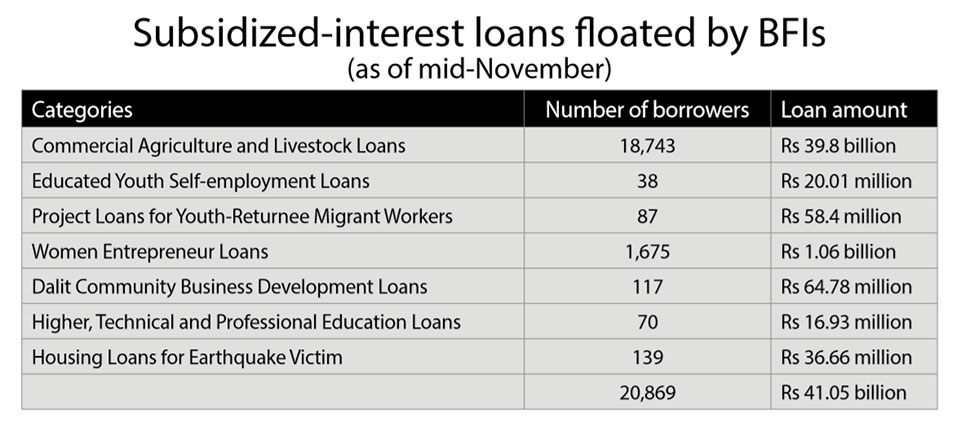

KATHMANDU, Dec 21: Bank and financial institutions (BFIs) have provided a total of Rs 41.05 billion in concessional loans to 20,869 individuals till mid-November under seven different categories.

These are loans disbursed by BFIs as part of a government scheme whereby a certain percentage of the interest is financed by the government if the loans are provided to targeted beneficiaries.

Under this scheme, the government subsidy goes to loans for commercial agriculture and livestock, self-employment of educated youth, projects of youth returnee migrant workers, woman entrepreneurs, dalit community business development, higher technical and professional education, and housing for earthquake victims.

This scheme was introduced to encourage youths to take up various occupations and create employment opportunities within the country.

While concessional commercial agriculture and livestock loan was introduced few years ago, the government had added the other six categories for concessional loans in the last Fiscal Year 2018/19.

Those applying for loans need to meet the criteria set by the government to qualify for the scheme. The government subsidizes seven percent interest rates for loans to woman entrepreneurs and five percent for loans under other six categories.

The NRB data shows 18,743 individuals received commercial agriculture and livestock loans—the highest among all categories as of mid-November. A total of Rs 39.8 billion was disbursed as loans under the agriculture and livestock category.

Under educated youth self-employment loan, 38 individuals received loans totaling Rs 20.01 million. Likewise, 87 youth returnee migrant workers received Rs 58.40 million in loans.

The women entrepreneur loan lies on the second position in terms of number of beneficiaries and loan amount, with 1,675 women entrepreneurs receiving loans totaling Rs 1 billion. Through this scheme, the government wants to create business opportunities for women entrepreneurs and promote their economic independence.

Likewise, 117 beneficiaries borrowed Rs 64.78 million from BFIs under dalit community business development loan. Similarly, 70 beneficiaries received higher technical and professional education loans of Rs 16.93 million.

A total of Rs 36.66 million was disbursed to 139 earthquake survivors to rebuild their houses damaged by the 2015 earthquake.

Rs 700,000 was disbursed in loans for educated self-employment youth, Rs 1 million for business projects promoted by returnee migrant workers, Rs 1.5 million for women-run enterprises, and Rs 1 million for business promoted by members of Dalit community. Earthquake survivors (up to Rs 300,000 to rebuild their houses) and youths (up to Rs 500,000 for higher, technical or entrepreneurship education) can also borrow from the BFIs at subsidized interest rates.

Though the scheme has failed to find expected number of takers, the number of beneficiaries has started to rise in recent months.

NRB officials say promotional campaigns along with regulatory push have helped in attracting more beneficiaries.

“The effort that the central bank is making for the implementation of this government scheme, and a realization from the BFIs that they should diversify their loan portfolios have driven up the BFIs' investments under this scheme,” said Laxmi Prapanna Niraula, spokesperson of the NRB.

Earlier in November, the NRB had fixed the minimum number of borrowers that BFIs needed to provide loans. The new rule that came amid concerns that BFIs were reluctant to extend concessional loans under this scheme requires commercial banks to disburse loans to at least 500 borrowers by mid-July 2020. 'B' class development banks must float loans to minimum 200 borrowers whereas 'C' class financial companies require floating loans to 100 borrowers.

BFIs that do not meet the new requirement by the given deadline will be fined by the central bank.

You May Like This

Govt announces 'Water from the Himalayas' program to brand mountain water

Kathmandu, May 29: The government has unveiled the 'Water from the Himalayas' program, aiming to brand the pristine water sourced... Read More...

UML leader Basnet to Balen: Don't be pampered just because you have a few hundred fans on Facebook

KATHMANDU, August 26: While the Mayor of Kathmandu Metropolitan City (KMC), Balendra Shah, is speeding up the work to demolish... Read More...

Govt restricts Chand group’s activities

KATHMANDU, March 13: The government on Tuesday outlawed the ‘political activities’ of the semi-underground Communist Party of Nepal led by... Read More...

Just In

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

- NC defers its plan to join Koshi govt

- NRB to review microfinance loan interest rate

- 134 dead in floods and landslides since onset of monsoon this year

- Mahakali Irrigation Project sees only 22 percent physical progress in 18 years

- Singapore now holds world's most powerful passport; Nepal stays at 98th

Leave A Comment