OR

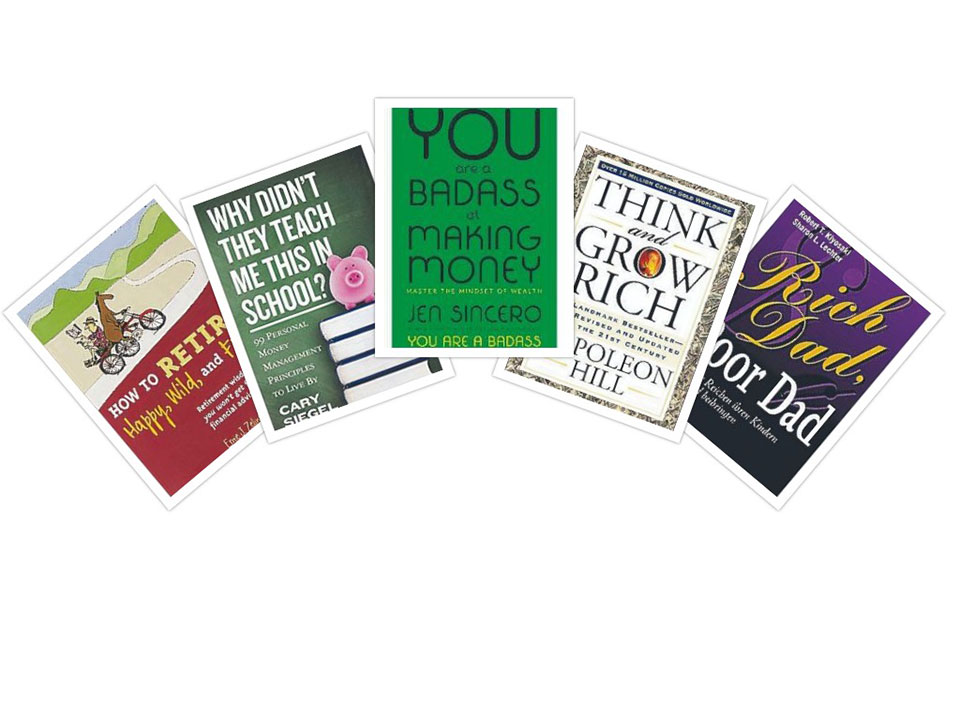

If you want to find out how other people approach finance management and gain another perspective on this then the best way to do so would be by reading a book on the topic. There are thousands of books written on this topic and because money is a very personal matter, not every book resonates with everyone. However, here are a few books that have apparently helped a lot of people manage their money better.

Think and Grow Rich by Napoleon Hill

Think and Grow Rich might be one of the oldest personal development and finance management books of the modern world. First published in 1937, the book has some very effective tips, habits, and practices that will undoubtedly help you grow richer. Hill has taken on a few intense topics to discuss about in this book and he explains and analyzes all of those very well. At times, his concepts and explanations do go beyond just finance management and become much more about life, the way we live, and the habits that could benefit us in general and gets a bit too preachy. If you are not a fan of self-help books, you most probably will not like this book but we recommend you give it a shot to get some important money related advice.

Rich Dad Poor Dad by Robert Kiyosaki and Sharon Lechter

Although the concepts discussed by Kiyosaki and Lechhter in Rich Dad Poor Dad aren’t that profound or even new, it’s the way they have approached these concepts that shapes the book. They talk about money as a tool for financial development and wealth instead of thinking of it as the thing you will have a lot of when you are finally wealthy and financially secure. They also emphasize the importance of financial education from the first chapter and later delve into describing the subjects and sub topics that come under financial education in detail.

You Are A Badass: At Making Money by Jen Sincero

Surprisingly enough, Sincero makes talking about money, finance, and investments funny and entertaining. Sincero has based this book on her own struggles and shortcomings with money and how she managed to earn a lot of it without resorting to illegal sources. By the time you finish this book, you will have full knowledge about your own bad spending and money management habits and understand some important concepts about finance and also how you can fix your bad financial habits.

How to Retire Happy, Wild, and Free: Retirement Wisdom That You Won’t Get from Your Financial Advisor by Ernie J Zelinski

Contrary to all the other books on this list, Zelinski does not really promote working hard to earn a lot of money and saving all of it for your future in his book How to Retire Happy, Wild, and Free. He just gives tips and tricks to make getting retired actually enjoyable and manage living interestingly – just with the money you have saved up in your account till date. The book stays true to its title and you will not stray from the

concepts of being happy, wild and free while reading it.

Why Didn’t They Teach Me This in School: 99 Personal Money Management Principles to Live By

by Cary Siegel

If you are in your late teens, 20s and early 30s and are still having a hard time trying to grasp the concept of personal financial management, this is the book for you. Siegel, who got the idea for this book by observing the fact that going to school taught nothing about handling money and investments to his kids, explains this very concept in a way that is very easy for beginners to understand. Like the title suggests, he has listed out 99 different principles related to personal finance management that he feels is very important to know and understand this topic properly.

Where and what to cut back

Sometimes even when we are being careful about the things we spend our money on and are tracking our expenditure, we don’t know the areas or places where we can actually save money. Here are some areas where you can reduce your spending and save a little over time.

Food

You might be a little confused here because we all know that food is a basic necessity that we depend on to live. So how could we possibly cut down on the money we spend for it? The obvious answer is by eating out less often and sticking to a meal plan. Prepare and cook all of your meals – including lunch and snacks – at home as much as possible. Also buy all of your raw kitchen ingredients in bulk as that will cost you a lot less money. Reserve going out to eat or ordering takeout only for special occasions. Also step away from all those small packaged snacks, it will neither fill you, nor help you save money.

Various forms of entertainment

You should probably start off here if you are a beginner to saving money. Cut off your cable tv (or smart tv), Netflix and any other similar kind of expenses. Stop going to every single concert that happens in your city, visiting clubs and dance bars every single night, and watching a newly released movie (at a theater) every week. These are some examples of expenses you could do without. Even when you want to watch that newly released movie, get the tickets for the earliest show as that will most likely be the cheapest deal. Find similar ways in which you can significantly decrease the amount of money you spend for entertainment purpose.

Other areas where you can save

Be creative and make things that you can gift other people on special occasions. One, it saves you a ton of money, and two, the gift itself also holds more meaning for the receiver.

DIY your beauty treatments. You can seriously find everything that you need for a lot of expensive beauty treatments like face masks, oil masks (on hair) and skin scrubs in your kitchen. Don’t buy the expensive and chemical infused ones found at the drugstore. Make them yourself using things that you already have.

Opt to take the public transportation whenever possible. Doing this will cost you way less than driving your own vehicle.

Beginner’s guide to money management

For someone who has just started to earn and save, the world and workings of personal finance management might be a little intimidating. But it needn’t be so, says FinLit Nepal’s Prakash Koirala who believes that the earlier you start managing your money, the better it is in the long run. Here he breaks down the basics of finance so that you get the idea of the different things you can incorporate into your lifestyle and work on to build your wealth.

Create a financial diary

Creating a financial diary is a crucial step to saving money effectively. In Nepal, the culture of tracking our earning and expenditure has not been established yet. But jotting down all money related matters in a single diary is very beneficial. It will help you recognize and understand your own spending and saving habits. You can also plan out your future saving or investing goals in detail and formulate strategies regarding these things according to your needs and preferences. Having a visual representation of all of these lists and spreads will help you organize your finance and give you an idea of the things you need to work on to get better at managing your money.

Be clear about your needs and wants

At first glance needs and wants might come across as the same thing but they really aren’t. Your needs are things that you have to have in order to survive – like your daily meals, your bed, your course books, etc. – and wants are things that you would like to have but don’t necessarily need – like that chic suit piece or that newly launched smartphone model. In order to spend less and save more, you need to learn this difference. Only buy the things that you absolutely need and don’t give into your wants. Chances are your craving for that thing will go away in a day or two. Before buying anything, contemplate whether it’s going to be useful for you and your family or is it just something you want to have because it’s the in thing to own.

Research before you pick a financial institution to deposit your money in

A lot of people pick banks based on how big scale or popular they are. Most of the times, both of those are insufficient indications for you to base your choices on. Instead look into the facilities that these banks provide, their interest rates, other fees like that of credit cards, debit card, and ATM card, minimum balance requirements, customer service and the security of your funds. You should also look into cooperatives and development banks too because generally, their rates and facilities are at times on par with or even better than some high profile banks. Also, choose to create a seperate savings account and make monthly deposits in it.

Sketch a retirement plan

Retirement is a difficult and heavy subject to think about. And if you don’t start planning for your retirement early on, your condition during your actual retirement can be worse than whatever it is that you are imagining right now. We, Nepalis, tend to not really plan anything about our post retirement life and think about how we will manage our finances after that early on. Little by little, if you start paying off all of your debts, save a significant amount of money from every single paycheck you receive, invest in retirement funds and taxable accounts, you will live much more comfortably when you finally do retire.

Understanding the share market

Nowadays, a lot of people are getting into buying and selling stocks and shares at different banks and cooperatives. It’s a very productive market where your investments could earn you quite a lot, provided you are smart about it. If you haven’t jumped on this bandwagon yet but plan on doing so sometime soon, Koirala shares some important things you should know before you get involved.

Opening accounts and researching the market

This is the first and the most basic step to buying and selling shares. It might seem very obvious but you would be surprised at how many people don’t know about it at all. You should also research the market and know about the exchange rates and the streak of different banks and cooperatives before picking one. You also need to know about and open both demat and trading account before you can buy or sell shares. And although both of these look like similar things, they aren’t. And yes you really need both to effectively navigate through the shares market. (If you want to place buying or selling orders in the share market then you use a trading account whereas you deposit the bought shares and store the sold shares through your demat account.) Also, you can do all of this electronically and don’t have to physically go to a counter for it.

Primary market versus secondary market

In the world of shares, there are two types of shares you can invest in: primary market and secondary market. The difference between these two is that in primary capital market, you buy the shares directly from the issuing company and in the secondary capital market, you buy, sell and trade shares from and to other investors like yourself without the company directly interfering in this matter.

Beginners should mostly trade only in the primary market in their initial days of getting involved in this industry as it is the more stable and safe market. Secondary market is mostly for experts and people who are very serious about their investments and are willing to work overtime to access the market and make smart decisions.

Keep yourself updated regularly

If you are getting into the shares business, you should always be on your toes. Keep yourself updated about the change in stock prices and immediately make your next move according to that change. Sometimes these stock prices change in seconds and unless you are active during those few seconds, you lose your chance of buying or selling stocks (to benefit you) then and there. There are lots of websites and apps – like ShareSansar, merolagani, Share Bazar, etc. – available that will make it easy for you to keep an eye on these fluctuating rates at all times.

You May Like This

UML leader Basnet to Balen: Don't be pampered just because you have a few hundred fans on Facebook

KATHMANDU, August 26: While the Mayor of Kathmandu Metropolitan City (KMC), Balendra Shah, is speeding up the work to demolish... Read More...

Complete education, full health could double Nepal's GDP per capita: WB

KATHMANDU, June 7: Nepal has the potential to double its Gross Domestic Product (GDP) per capita in the long run if... Read More...

3 Hundi operators arrested in Kathmandu

KATHMANDU, May 19: Acting on a tip-off, a team of police has raided in a flat in Chabahil Ganesthan and arrested... Read More...

Just In

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

- NC defers its plan to join Koshi govt

- NRB to review microfinance loan interest rate

- 134 dead in floods and landslides since onset of monsoon this year

- Mahakali Irrigation Project sees only 22 percent physical progress in 18 years

- Singapore now holds world's most powerful passport; Nepal stays at 98th

Leave A Comment