OR

#Nepal Investment Summit 2024

Nepal Investment Summit 2024 and Victor Hugo Moments for Reforms

Published On: April 28, 2024 12:02 PM NPT By: Atul K Thakur

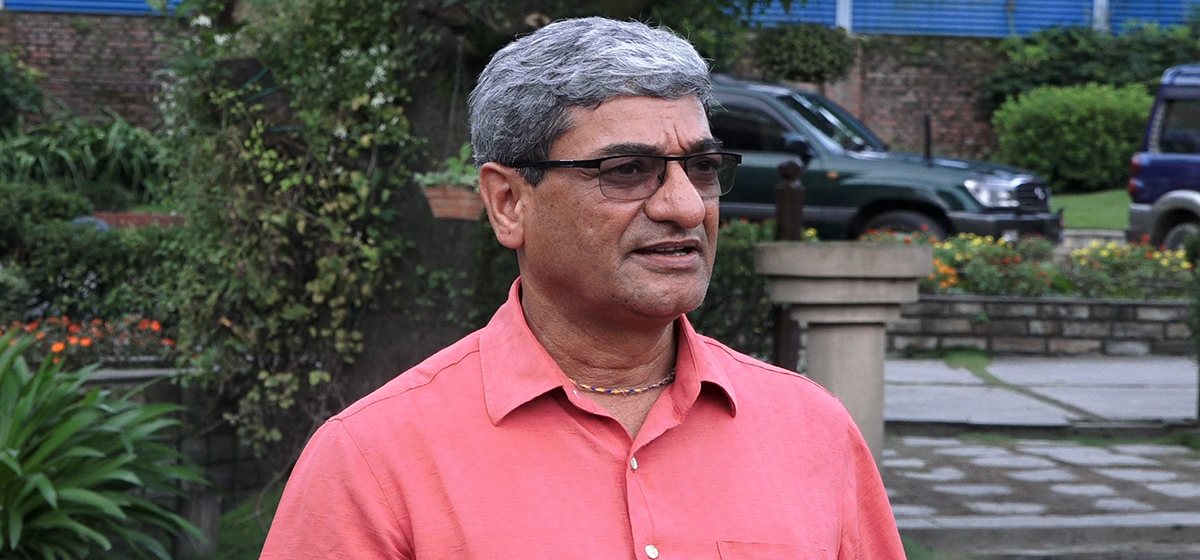

As Nepal Investment Summit is taking place in Kathmandu after a five-year gap on 28-29 April, the CEO of Investment Board Nepal Sushil Bhatta deserves special compliments for unleashing Nepal’s investment drawing potential at a crucial juncture when Nepal desperately needed its political economy in the right order.

The unimaginable losses which Nepal suffered with Covid-19, besides the structural macroeconomic challenges, can also be attributed to the recessionary tendency in Nepal’s economy that made the decision-makers in both the government and industry jittery. As Nepal Investment Summit is taking place in Kathmandu after a five-year gap on 28-29 April, the CEO of Investment Board Nepal (IBN) Sushil Bhatta deserves special compliments for unleashing Nepal’s investment drawing potential at a crucial juncture when Nepal desperately needed its political economy in the right order. Notwithstanding the systemic limits, the IBN has remarkably put Nepal as a competent investment destination and the positive momentum created with the “Nepal Investment Summit 2024” will necessitate reorienting the domestic economy to get better equipped for global convergence.

Recognising the virtue of reforms

“Nothing else in the world…not all the armies…is so powerful as an idea whose time has come,” are the often cited words of wisdom from French writer Victor Hugo that are particularly relevant for Nepal, today, when it surely needs to accept an idea whose time has come and that is the spirit of economic reforms. Not as a corollary, but it would be worthwhile for the policymakers at the helm in Kathmandu to look back at India of 1991 and the then finance minister Dr Manmohan Singh’s much-celebrated reference of Victor Hugo’s quote before changing the course of majorly state-controlled Indian economy with ushering economic liberalization plan. Going beyond the words of wisdom, what sacrosanct is to identify the common reasons back then in India or now in Nepal, are the ‘structural flaws’ and ‘cyclical decline’.

Nepal’s real developmental dilemma lies in its low propensity to reform while keeping the monopolistic structure in key productive sectors. Notwithstanding the promises made by the transition from a monarchy to a functional democracy, its economy is neither handled well by the state nor private enterprises. A sad truth remains that Nepal has the pursuit for getting foreign investments but without opening its economy for fair competition (even if not the perfect one) and ushering market reforms. Another fault line is having its front-running industries showing no signs of recognising the export potential and recalibrating their capacity to make Nepal a hub of hope rather than despair. The policymakers here should realize that Nepal has no backup of a command economy to support a few major enterprises, and next, the aspirations of people can’t wait for things to get in order with nature’s command and control.

To get the system in order, it would be imperative to have a consensus on making a long-term economic vision for Nepal. This will be made possible by giving an alternative development paradigm to Nepal and recognising the need for a fine balance in having the government and industry work in tandem despite the frequency of changes in political order. To know the evolution and working of a political order, it would be helpful to quote the political scientist Francis Fukuyama who recognised the centrality of three institutions for explaining it: the state, the rule of law and mechanisms of accountability. Kathmandu and provincial elites helming the political might should recognise the merit of ‘accountability’, ‘home works’ and ‘rule of law’. They should work for a political economy where the state acts like a facilitator for inclusive economic development. This too is an idea whose time has come.

Making a progressive turf

Going beyond the jargon, there is glaring urgency to identify the bottlenecks in Nepal’s economy and act promptly to position Nepal as an ideal investment destination:

-Weak infrastructure base with shortcomings in planning and implementation: A few examples are the road projects that have been planned in fancy rather in response to the requirements. Nepal certainly doesn’t need 8-lane roads and with a completion phase as long as over a decade. The infrastructure projects have to be sustainable and thus ensuring transparency and efficiency is the need of hour.

-Wasted energy potential: While it was supposed to illuminate the home and the world, with just a production capacity of 2500 megawatt of hydroelectricity and no avenues to sustain its export to India, mainly for offering low cost-advantage and cyclical inability to meet the demand at home turf, Nepal is missing to explore the actual benefits. Nepal should brand its hydroelectricity more aggressively as “green energy”, augment its production, and increase the consumption at home (with more uses of electric vehicles and other appliances) and keep the export to India unwaveringly. This will be a game changer if the course-correction is made at this front.

-Sectoral reforms: The key sectors (including telecom, banking and financial services with focus on making a rational payment arrangement, agriculture & food processing, IT & ITeS; FMCG, Aviation) should be opened for competition where the existing players should compete with new entrants and let the end consumers benefit out of it.

-Abolishing monopolistic tendency and promoting fair competition: This will be possible with the state’s participation in the transformative process of reforms as a facilitator and with a welfaristic touch.

-Safe and improved connectivity: On its own and through the developmental partnerships, Nepal should particularly make the road and air connectivity safe and improved. Its infrastructure should have a welcoming preparedness.

-Enhancing tourism potential: Nepal’s main source of revenue should be boosted with improved connectivity. Needless to say, the whole world is looking at Nepal as a major tourism destination; it is endowed with natural and civilisational richness and there is no reason tourism should not be treated as a major industrial sector.

-Climate change and mitigation: As a country uniquely positioned with the top peaks of Himalayas, huge water reservoirs and an open border with India, Nepal has all the reasons to come forward and play a major role to mitigate climate change. In doing so, it will create a strong basis of sustainability and finally help its economy in many ways possible.

-Checking outbound migration and decreasing reliance on remittance: While remittance contributes to about 22 percent of Nepal’s GDP, it comes at the cost of immense human suffering and long-term socio-economic losses. The upward mobility can’t be stopped but large masses going to far flung destinations for the sake of survival can be absorbed with gainful employment in the country if Nepal comes out of self-imposed economic woes.

-Improving transparency and removing corruption: Doing so will help in restoring the confidence of the private sector in the country and also help in getting foreign investments.

-Recognising the virtue of ‘home work’ rather than ‘external influence’: As a sovereign country and with a firmly established democracy, Nepal should act at home turf for putting things in order. Beyond a point, there is no reason to cite ‘external influence’ as a factor that really harms Nepal’s prospects. It should be dealt with much more effectively.

If Nepal acts to make the state much more responsible for inclusive growth and usher in a wave of progressive economic reforms, it has a chance to come out stronger after transition. Some of the long-pending actions will transpire the wishful changes ahead for Nepal, and India as a friendly neighbor, can certainly be a partner of such a metamorphosis.

Emerging Nepal as an investment hub

With credible aspirations and credentials in the global economic order, India is a natural ally of Nepal as the latter is clearly aspiring to host the major businesses on its land and with utmost professional efficiency. The Indian perspectives are clearly very positive as Nepal is heading towards attaining greater scale, efficiency and engagements for making its economy robust and forward looking. While the new wave of economic aspirations may make Nepal rebuilt professionally, its traditional goodwill with India will continue to drive the existing business collaborations. In all probability, an important forum like “Nepal Investment Summit 2024” shall offer a much-needed platform for meeting the aspirations and potential with the resources—and in that process, awaits some of the transformational economic possibilities for Nepal.

It would be worthwhile to take note of the concrete outcomes of the Summit, something of greater interest would be Nepal at the helm of a grand investment affair with making strong global interfaces. The Indian businesses will be well-represented in Nepal Investment Summit 2024; it is very much likely that Nepal will get some truly promising investment and reinvestment commitments from them. As someone who closely worked for Nepal Investment Summit 2024, these are the thoughts which I was supposed to present as a speaker at the Summit. In my absentia (with pressing compulsions), it is wishful that the words appearing here on the page of Republica are read by friends and colleagues from India and Nepal—besides the esteemed guests’ from across the world who are in Kathmandu for a significant business congregation, Nepal Investment Summit 2024.

You May Like This

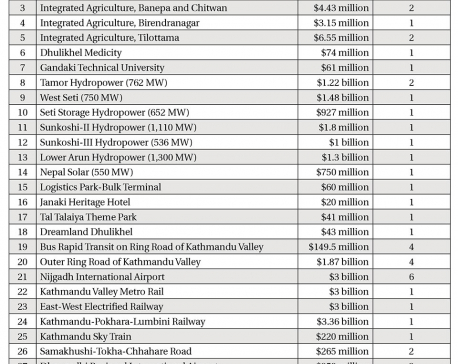

48 proposals received for 31 projects showcased at investment summit

KATHMANDU, April 22: Investment Board Nepal (IBN) has said that it has received as many 48 applications for 31 out... Read More...

Political changes must not affect Nepal Investment Summit

Amidst the backdrop of recent political developments in the country, Finance Minister Barshaman Pun's assurance on Thursday that the planned... Read More...

FinMin directs IBN to build large projects by raising capital on its own

KATHMANDU, March 10: Finance Minister Janardan Sharma has instructed the Investment Board Nepal (IBN) to move ahead with big projects... Read More...

Just In

- Kathmandu Valley's air pollution decreases

- KMC to take action against cooperatives within its jurisdiction that fail to regularly update activity details

- Nepal’s forex reserves surge to Rs 1.911 trillion

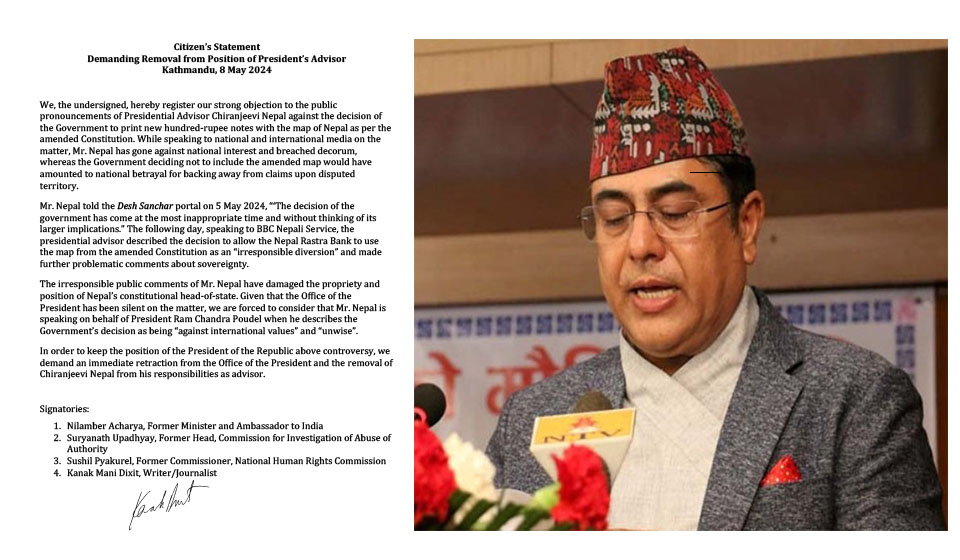

- Balen: ‘Giri Bandhu Tea Estate case is an example of a person’s honesty’

- Police arrest singer Ravi Oad on charge of marital rape

- CIAA to prosecute Security Printing Center's Director Bikal Paudel among others for corruption

- Nepal Mobility Solutions introduces ‘JumJum’, a new ride-sharing platform for Kathmandu

- PM Dahal positive about forming parliamentary probe committee: NC Chief Whip Lekhak

Leave A Comment