OR

KATHMANDU, July 28: The government has made Personal Account Number (PAN) mandatory for all salaried workers from the current Fiscal Year 2019/20. Starting mid-July, all employers are required to record tax deducted at source (TDS) in the respective accounts of their staffers. For that, all their employees must have PAN.

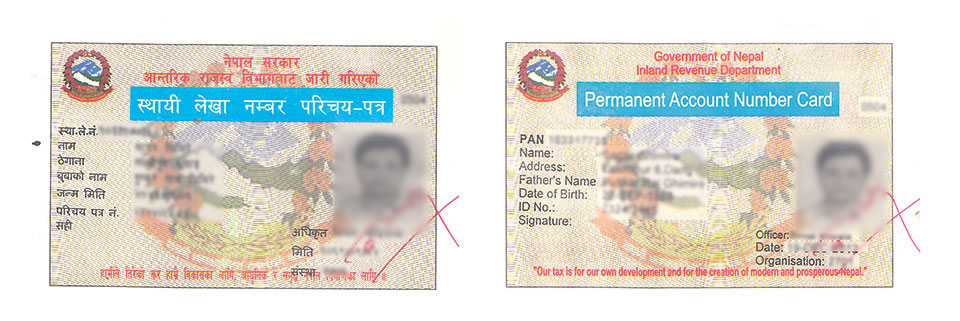

Taxpayer service offices across the country have witnessed a rise in the number of applications for PAN in recent days. The following are the pointers that the applicants can go through to know about the different aspects of PAN.

ABOUT PAN

PAN is a unique and permanent numeric identifier for a taxpayer. The PAN code is a nine digit number valid for the lifetime of the holder. It is used for tax payment and recording tax payment details of an individual. It also identifies any business, employment, and investment of the holder. It is issued to all taxpayers and companies that are supposed to pay tax deducted at source (TDS) to the government. The government does not validate any company's payment of salaries or wages to its employees or workers not having PAN.

All businesses in Nepal are required to obtain a PAN registration certificate from the Inland Revenue Office (IRO) before coming into operation. The law of Nepal mandates PAN registration, therefore, it is crucial to understand PAN and the process of obtaining PAN.

TYPES OF PAN

PAN should be obtained by individual, business, and proprietary business taxpayers. Accordingly, the Inland Revenue Department (IRD) issues PAN for individuals (Personal PAN, or PPAN), businesses and proprietary businesses.

WHO IS REQUIRED TO HAVE PAN?

Any individual, company or organization involved in a business or non-business activity that does financial transaction and that files income tax to the government, is required to have PAN. The companies, firms or organizations deducting TDS should have PAN. Starting the current fiscal year, PAN is mandatory for employees or workers earning any amount in the form of salary, wage, leave pay, commission, prizes, bonuses, or other facilities from any organization.

The government does not validate any company's payment of salaries and wages to its employees or workers who do not have PAN. Because of the new provision, employers have started directing their staffers to get PAN. With the decision implemented from July 17, all salaried employees should have PPAN for their tax deducted at source (TDS) to be recorded in their respective accounts. Similarly, if a company makes payment amounting to Rs 1,000 or more, they will have to issue a PAN bill for which they need to have PAN card for their businesses.

WHO ISSUES PAN?

The IRD issues PAN through its 59 field offices including 38 Inland Revenue Offices (IROs), 19 Tax Service Offices (TSOs), one Medium Level Tax Office (MLTO) and one Large Taxpayer Office (LTO) located in different parts of the country.

PAN REGISTRATION

Applicants can apply for the registration of PAN by submitting an application form that can be acquired at the IRO or TSO. The form can also be downloaded from the website of IRD. The form must be filled and submitted to the concerned IRO or TSO.

The application for PPAN can also be lodged online. For that, applicants should visit the website of IRD and select Taxpayer Portal. After clicking 'Application for Registration', one needs to fill up the details as required in the form. After entering all the information, and selecting the tax office near them, the applicant has to press 'submit' button following which they will get a submission number, which serves as the identification number of applicants. The applicant will get PPAN card after producing the submission number at the tax office a day after submitting their application.

The IRD issues PPAN collectively if online forms of the employees of government offices, public entities, schools, universities, hospitals, non-governmental organizations, and industrial and business firms are collectively submitted. Companies and organizations can also request the department for PPAN of their staff on-site, for which the department will dispatch a team to provide the service.

DOCUMENTS FOR PPAN REGISTRATION

Application form, copy of the applicant's citizenship certificate, and two passport size photos are required for the PPAN registration. If the applicant is a foreigner, s/he needs to present citizenship or any other authentic identification document.

IMPORTANCE OF PAN

PAN makes financial transaction through banks, payment of bills, or any other documentation work for any industry, trade, profession, business or employee easier. It makes the tax paid to the government transparent and easier. It is a citizen's responsibility to pay tax to the government.

TIME

Stating that it has eased the process of PAN card distribution, the government has maintained that it does not take long to obtain PAN. Applicants having necessary documents are provided with the PPAN shortly after submitting all the documents. It takes an average of one day to obtain the card from any TSO or IRO.

BENEFITS OF PAN

PAN makes financial transactions, imports and exports, applying for loan from banks, and tax-related works easier. It is a strong tool to maintain transparency in the business. Companies used to deposit tax of their employees collectively but with the implementation of mandatory PAN card, their taxes will be deposited under the respective names of the employees.

PAN FOR FOREIGNERS

Foreigners having legal business, investment, involvement in trade, profession, enterprise, or employment in Nepal should have PAN. The applicant should enclose his or her citizenship or document(s) that identifies them, along with the application.

GOVERNMENT'S 'ONE PERSON ONE PAN' POLICY

The government had introduced 'One Person One PAN' policy for the FY 2019/20. It has allotted a total of 1.371 million PAN - 191,000 PPAN and 1,180,000 business PAN as of July 21. All income earners are required to have their PPAN and should pay a minimum 1 percent income tax. For earnings higher than Rs 400,000 a year, individuals should pay an additional 10 percent for each additional Rs 100,000. Married couple earning Rs 450,000 or less a year can jointly pay 1 percent, while they should pay additional 10 percent for every additional Rs 100,000.

INDIVIDUAL ASSOCIATED WITH TWO COMPANIES

Any individual associated with and earning through two companies is not required to have two different PAN. However, s/he should report to concerned IRO or TSC about the earning if it exceeds Rs 400,000 and should pay the tax accordingly.

PAN FOR LOAN

Nepal Rastra Bank (NRB), the central bank of Nepal, has made PAN mandatory for those seeking loans above Rs 5 million. According to the monetary policy for the FY 2019/20, bank and financial institutions (BFIs) are obliged to ask for PAN number before issuing loans. Previously, an individual getting a bank loan was required to have PAN number only if s/he was borrowing more than Rs 10 million.

You May Like This

Think beyond short-term measures

Women in Karnali are dying due to delivery-related complications and the state response to this serious problem has not gone... Read More...

Rules are meant to be followed

One of the first announcements the government of KP Sharma Oli made in its first months was about restricting ‘unnecessary’... Read More...

Minister Pun refutes rumor of handing over Budhi Gandaki hydro project to Gezhouba

KATHMANDU, June 24: Minister for Energy, Water Resources and Irrigation Barsha Man Pun has clarified that the government has not... Read More...

Just In

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

- NC defers its plan to join Koshi govt

- NRB to review microfinance loan interest rate

- 134 dead in floods and landslides since onset of monsoon this year

- Mahakali Irrigation Project sees only 22 percent physical progress in 18 years

- Singapore now holds world's most powerful passport; Nepal stays at 98th

Leave A Comment