OR

Social media storms over Tootle's tax evasion

Published On: January 23, 2019 02:36 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, Jan 23: Tootle, a ride-sharing service provider, has faced strong criticism on social media after Wednesday's Republica revealed that the company was collecting 13 percent Value Added Tax (VAT) from riders for 19 months but without paying the tax to the government.

#Tootle could have been a success story in Nepal, breaking the transport syndicate. But we forgot that even entrepreneurs like @bhattasixit are produce of same system and are no different when it comes to acting illegally and evading tax. This is our #Nepal brothers. pic.twitter.com/WWLqb1lmtG

— तातो जेरी (@TatoJeri) January 23, 2019

People from various walks of life of the society, mostly youths, took to Twitter and Facebook to vent their ire against tax evasion by Tootle.

Few days back @PM_Nepal had instructed the authorities "not to obstruct the operation of the ride service #Tootle." Did he say so just for popularity—without even a case study? If there was a study, the VAT evasion would not be missed. Good report @BikenDawadi ! https://t.co/0s4aArtPF0

— Kushal Basnet (@KushalTweets) January 23, 2019

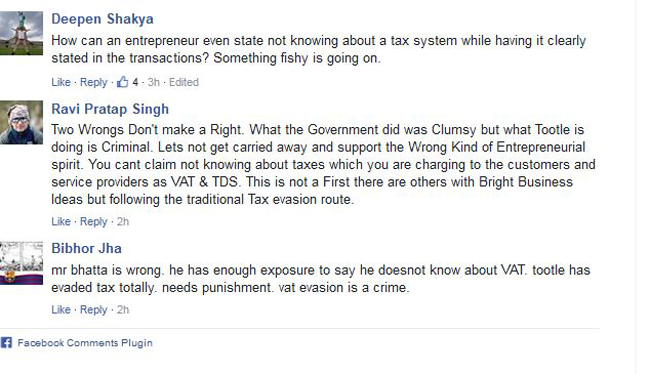

Lashing out at the Tootle Company and its co-founder Sixit Bhatta, Twitteraties have questioned over the transparency of the financial transactions of company.

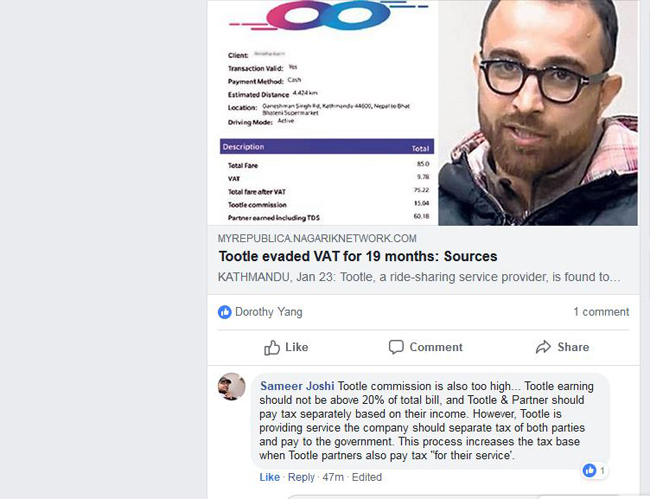

A Facebook user Sameer Joshi wrote "Tootle's commission is also too high... Tootle earning should not be above 20% of total bill, and Tootle & Partner should pay tax separately based on their income. However, Tootle is providing service the company should separate tax of both parties and pay to the government. This process increases the tax base when Tootle partners also pay tax "for their service'."

A Twitter user with handle KASHBAG @KASHBAG writes: @bhattasixit I was not expecting #Tootle evading taxes (VAT & TDS). I withdraw my support to #Tootle until it settles the tax issues. 'Ignorance of law is not an excuse'!

@bhattasixit I was not expecting #Tootle evading taxes (VAT & TDS). I withdraw my support to #Tootle until it settles the tax issues. 'Ignorance of law is not an excuse' !https://t.co/eppfDoo9Qq

— KASHBAG (@KASHBAG) January 23, 2019

@bhattasixit you are not even registered with VAT !? and what happens to all the VAT we(riders) paid so far? #Tootle https://t.co/b8h5qpsnrc

— Sanjeev (@Tethys_San) January 23, 2019

According to sources, Tootle collected VAT from riders since its inception in January 2017 to July 2018. However, the company is found not even registered at the department concerned as a VAT paying company.

Sixit Bhatta, chief executive officer of Tootle, told Republica that the company is currently in the process of registering for VAT.

The booking history from the Tootle mobile app shows the company charging Rs 9.78 as VAT for a total fare of Rs 85 for a shared ride of 4.4 kilometers. Of the total, the Tootle commission is Rs 15.04 while the partner earns Rs 54.16 after Tax Deducted at Source (TDS) of Rs 6.02. Bhatta claimed that the company has been paying the TDS.

Bhatta further claimed that the company collected VAT in the initial stages due to lack of knowledge about the tax system.

“Since we were a start-up, we did not know about the tax system,” he said, “We realized our mistake after consultations with chartered accountants and then stopped collecting VAT.”

The booking history in the company’s app from July 2018 onward does not show VAT being deducted from earnings.

While startups are hard and profitability or break-even for #Tootle may not happen in near future, saying we didn't know we are required to pay VAT amount to govt is just feigning ignorance. After July, if they stopped collecting VAT, how does the deducted amount remain same?

— Jitendra Harlalka (@jitendra_) January 23, 2019

However, a source claimed that the company is still extracting VAT from riders. “Tootle is still collecting VAT,” the source said.

Tootle has been found using the same payment model as the one for deducting charges from riders but it has now stopped showing the details of transactions.

“We used the VAT head before, but we do not have it now,” Bhatta said. “However, the total charges we deduct have remained constant.” That means the partner still receives Rs 54.16 if Tootle charges Rs 85 for the 4.4 kilometer ride.

Asked what happened to the amount collected as VAT during the 19 months, Bhatta said he had to check with the company’s accounts.

I don’t think you should worry about being seen as a “big ugly” profiteer- yet @bhattasixit. People may be willing to give #tootle beneift of doubt.

— Kashish Das Shrestha (@kashishds) January 23, 2019

But @arpanshr is right. Your company should immediately figure out what VAT was collected + what happened to it + how to refund.

Bureaucrats have condemned the conduct of the ride-sharing company as illegal. Secretary at the Prime Minister’s Office and former revenue secretary Shishir Kumar Dhungana said, “It is a crime if a company collects VAT from users without registering for VAT.”

Similarly, former finance secretary Shanta Raj Subedi said that such tax evasion can result in a jail term and up to 100 percent refund of the evaded amount. “The department concerned will access the VAT amount and make the company pay up to 100 percent of it as compensation,” he said, “The company operators may also have to serve a jail sentence.”

जाडो याम सकिएपछि टूटल प्रयोग गरौला भनेको सरकारलाई भ्याटनै तिरेका रैनछन् । उठाउनु पर्छ भन्ने थाहा रैछ, बुझाउनुपर्छ भन्ने था रैनछ । देश अनुसारको मति । @tootletoday का संचालक @bhattasixit ठूलै धनी बन्ने छाँट देखाउँदैछन् ।

— Prateek Pradhan (@prateekpradhan) January 23, 2019

You May Like This

What Nepal needs is India's friendship and support for growth: Nepal PM Oli

In an exclusive interview to The Hindu, Mr. Oli says the bitterness of past relations have been put behind them,... Read More...

UNCDF, Tootle to pilot roving agents in Nepal

KATHMANDU, Feb 20: The United Nations Capital Development Fund’s (UNCDF) MM4P programme and Tootle signed a grant and technical assistance agreement... Read More...

Party's name will be Nepal Communist Party after merger: Leader Nepal

KAILALI, Feb 9: CPN-UML leader Madhav Kumar Nepal said that the name of the new party after merger between CPN-UMLand... Read More...

Just In

- NRB introduces cautiously flexible measures to address ongoing slowdown in various economic sectors

- Forced Covid-19 cremations: is it too late for redemption?

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

- NC defers its plan to join Koshi govt

- NRB to review microfinance loan interest rate

- 134 dead in floods and landslides since onset of monsoon this year

Leave A Comment