OR

NRB takes action against three development banks and three finance companies

Published On: February 15, 2024 02:45 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, Feb 15: Nepal Rastra Bank (NRB) has taken action against three development banks and as many finance companies. It has alerted the chairman and chief executive officer (CEO) of Muktinath Bikas Bank.

According to the NRB, it was found that the money accumulated in the customer protection fund, which was set up by the bank by collecting fees from the customers of poor class loans that flowed in personal and collective deposits was spent on other purposes and the said money was returned later.

Similarly, the central bank has warned the Board of Directors and CEO of Saptakoshi Development Bank. The NRB stated that even after the end of the first term of the independent director of the organization, he was continuously present in the board of directors meeting and participated in the decision-making process as an independent director.

According to the NRB, the CEO of Saptakoshi had changed the base rate by accessing the core banking system.

Similarly, Narayani Development Bank has been fined Rs 12,846 for not maintaining the mandatory balance as per the regulatory provisions. As the bank increased the CD ratio by 90 percent in the Nepali months of Shrawan and Bhadra, an additional fine of Rs 242,000 was imposed.

Likewise, the central bank has mentioned that appropriate instructions have been issued to warn the CEO and the board of directors of Progressive Finance as the latter was found to have given risky loans by adopting a non-current mortgage evaluation process.

It was found that Goodwill Finance provided loans to Maharjan Business Associates Pvt Ltd without adequately analyzing the project and ensuring the utilization of the loan amount while extending the loan, so appropriate instructions were given to the board of directors and the executive head.

Similarly, Guhyeshwari Merchant Banking and Finance was found to have violated the regulatory provisions of the NRB by selling the investment shares exceeding the prescribed limit in the last fiscal year 2022/23, according to the NRB.

You May Like This

NRB takes action against six commercial banks, imposing cash fines on two

KATHMANDU, Oct 20: The Nepal Rastra Bank (NRB) has taken action against six banks. During the first quarter of the... Read More...

Dev banks seek flexibility in prudential lending limit

KATHMANDU, June 19: Development Bankers Association Nepal (DBAN) has urged the Nepal Rastra Bank (NRB) to allow 'B' class development... Read More...

Hospitals too get permits to borrow in foreign currency

KATHMANDU, Sep 1: Nepal Rastra Bank (NRB) has paved the way for hospitals, which make earnings also in foreign currency, to... Read More...

Just In

- Nepal clinches thrilling victory over West Indies 'A' in T20 cricket match

- Capital Market Struggle Committee stages protest demanding protection of domestic investors (Photo Feature)

- Captain Paudel scores half-century in T20 match against West Indies 'A'

- Nine youths from Tanahu allegedly joining Russian army out of family contact for months

- West Indies 'A' sets Nepal a target of 205 runs

- Parliamentary committee directs govt to provide electricity tariff subsidies to cold storage facilities

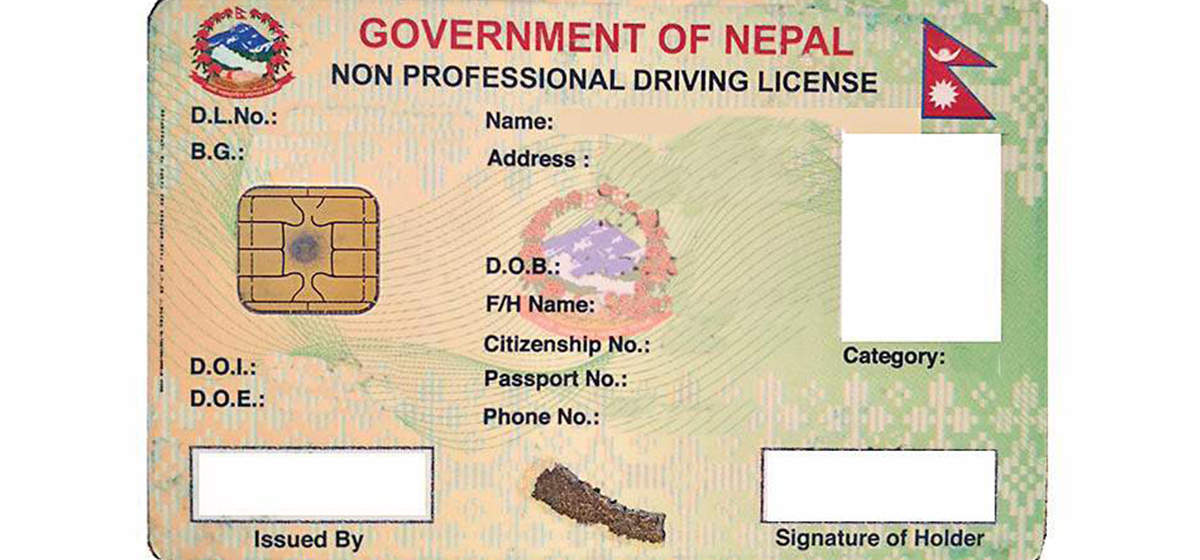

- Former DoTM employee Bhatta arrested in connection with illegal license issuance case

- One killed in a fire incident in Dadeldhura

Leave A Comment