OR

Weekly Market Commentary

Nepse unchanged after volatile week

Published On: September 24, 2021 07:19 PM NPT By: Republica | @RepublicaNepal

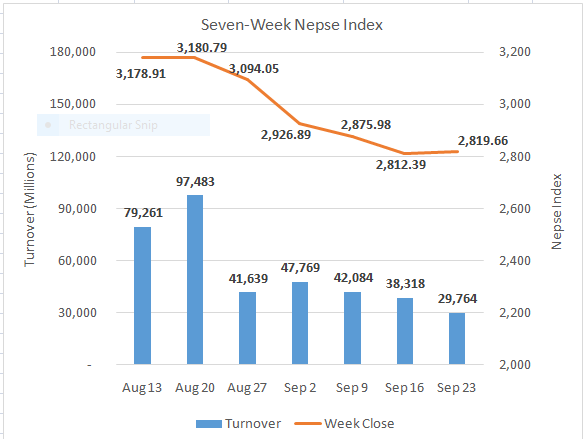

KATHMANDU, Sept 24: Stocks saw significant selling pressure to begin week’s trading on Monday. The benchmark tanked 113.14 points – Nepse’s biggest point-drop in history in Monday’s session. The equity market found footing on Tuesday, however, registering a modest gain of 13.82 points. A sharp recovery ensued on Wednesday as the benchmark recovered all of its early losses with another advance of 104.88 points. A subdued end to the week with 2.71 points rise on Thursday saw the index close week almost at the opening level. Nepse ended the review period at 2,819.66 – up 7.28 points against the prior weekly close.

Investors saw notable whipsaw amidst week’s trading with the equities abruptly changing directions driven by financial news relating to illiquidity and interest rates. Nonetheless, the broad sell-off seen in the equity market in the last month, which pushed the index towards its 6-month low, saw buyers take heavy buying positions at mid-week. Consequently, the equity market eked out a modest gain in the week. Rs. 29 billion worth of the equities changed hands.

In the meantime, commercial bank stocks made a notable recovery towards the end of the week driven by dividend announcements from Machhapuchhre Bank Ltd and Sanima Bank Ltd. With relatively high dividend yield among other sectors, dividends of the respective banks helped lift the entire sector.

Sensitive Index also ended higher reflecting strength in Class ‘A’ stocks. Among sectors, only Banking and Manufacturing & Processing stocks managed to end in green. Heavyweight banks rose 3.18%, helping the market to stay afloat. Manufacturing & Processing sub-index edged 0.15% higher. On the other hand, Trading and Hydropower sectors suffered the most with declines of over 3% apiece. Investment and Mutual Fund sub-indices also came under pressure and dropped over 2%. All other segments ended in negative territory.

In the news, Kamana Sewa Bikas Bank Ltd declared its dividend for the year 20/21. The development bank has announced 18.5% bonus shares and 0.97% cash dividend to its shareholders.

In terms of ARKS technical analysis, the index formed a long legged doji reflecting volatile trading and lack of conviction. The market also has found support at 2,800 mark on the closing basis, which should act as a crucial level for the market. A breach of 2,800 can see the index test 2,700 psychological level. On the other hand, a consolidation in the current zone and a rebound can see the index resume its upward move.

This column is produced by ARKS Capital Advisors Ltd.

www.arkscapitaladvisors.com

(Views expressed in the article are those of the producer and do not necessarily reflect those of thispublication)

You May Like This

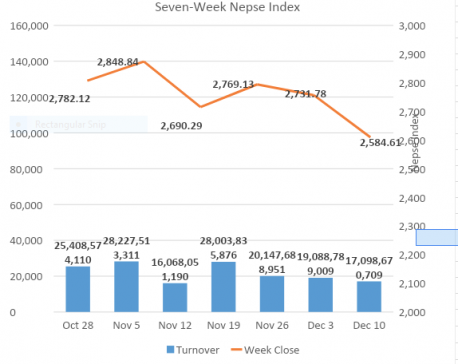

Stocks close in red for a third straight week

KATHMANDU, Dec 10: Stocks began week with firm losses as Nepse plunged over 70 points on Sunday. A temporary recovery... Read More...

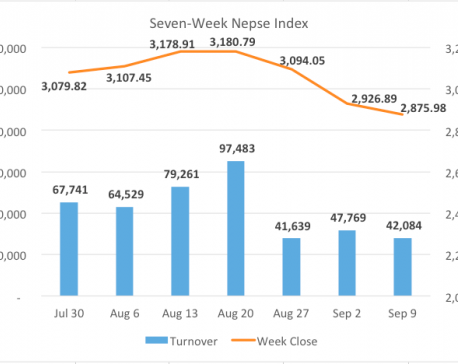

Nepse in weekly correction but selling pressure eases off

KATHMANDU, Sept 10: The Nepal Stock Exchange (Nepse) index opened week with serious weakness with the benchmark dipping more than 100... Read More...

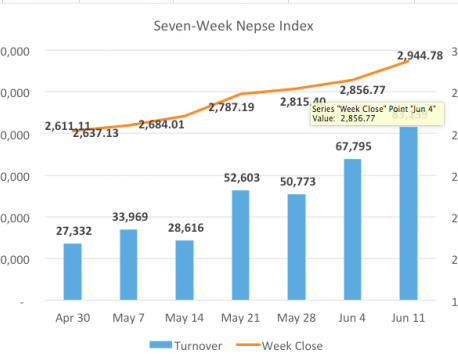

Nepse stretches winning run with record weekly turnover

KATHMANDU, June 12: Following a gain of 41.37 points in the week earlier, the bourse continued to see upbeat movement since... Read More...

Just In

- Heavy rainfall likely in Bagmati and Sudurpaschim provinces

- Bangladesh protest leaders taken from hospital by police

- Challenges Confronting the New Coalition

- NRB introduces cautiously flexible measures to address ongoing slowdown in various economic sectors

- Forced Covid-19 cremations: is it too late for redemption?

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

Leave A Comment