OR

Daily Market Commentary

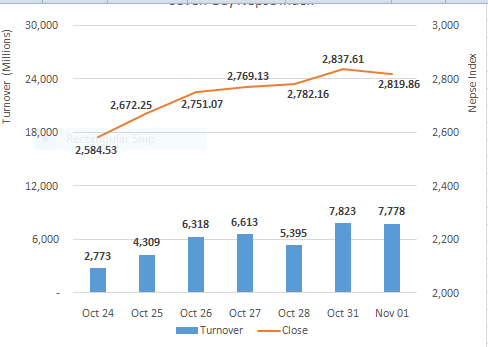

Nepse snaps 6-day winning streak

Published On: November 1, 2021 06:49 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, Nov 1: Stocks opened Monday’s trading on a strong note with Nepse trading around 30 points higher in the morning. The index gyrated in green thereafter but selling pressure in the afternoon dragged the market in negative territory dipping as much as 30 points. A small recovery at the end saw the benchmark close with a loss of 17.75 points at 2,819.86.

The index had continued to make a steady recovery after hitting its recent low of 2,500 mark where the index gathered more than 300 points. However, some correction on short term profit booking was evident on Monday. Turnover remained upbeat with almost Rs. 8 billion worth of equities changing hands.

Mahalaxmi Bikas Bank Ltd and RMDC Laghubitta Bittiya Sanstha Ltd were traded the most with turnovers of over Rs. 365 million each. Nabil Bank Ltd, next, posted a turnover of Rs. 340 million. Kamana Sewa Bikas Bank Ltd, Arun Valley Hydropower Development Company Ltd and Ridi Hydropower Development Company Ltd were among other actively traded stocks.

Manushi Laghubitta Bittiya Sanstha Ltd, Sahas Urja Ltd and Panchthar Power Company Ltd hit the upper circuit of 10% leading the gainer’s list. Himalayan General Insurance Ltd, Civil Bank Ltd, Lumbini Bikas Bank Ltd and Neal Credit and Commerce Bank Ltd and Mahalaxmi Bikas Bank Ltd were among other major gaining scrips.

Kamana Sewa Bikas Bank Ltd, on the other hand, tanked sharply losing more than 6% on its price. Himal Power Partner Ltd, Green Life Hydropower Ltd, Ridi Hydropower Development Company Ltd and Ghalemdi Hydro Ltd followed suit with losses of more than 5%. Samata Laghubitta Bittiya Sanstha Ltd, Civil Laghubitta Bittiya Sanstha Ltd, CEDB Hydropower Development Company Ltd and Guheshwori Merchant Banking & Finance Co. Ltd fell over 5% apiece.

On the technical front, the index witnessed a correction after a 300 point rally driven mainly by profit taking. 2,800 mark can be taken as a pivotal point where the index’s reaction will help gauge the possible direction of the equity market. Moving Average Convergence Divergence line stays just below the 0 line, which still indicates short term downward trend. Hence, a further surge with volume can see the index make a substantial recovery towards 3,000 mark.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

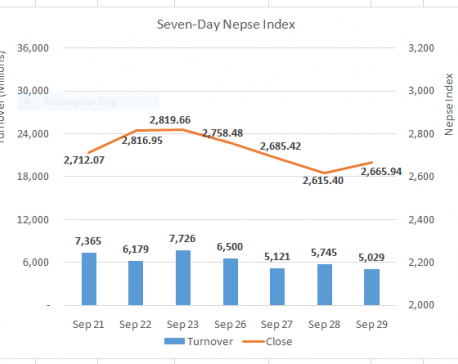

Stocks recoup losses as 2,600 mark holds ground

KATHMANDU, Sept 29: The Nepal Stock Exchange (Nepse) saw strength in the morning on Wednesday with the index climbing around 30... Read More...

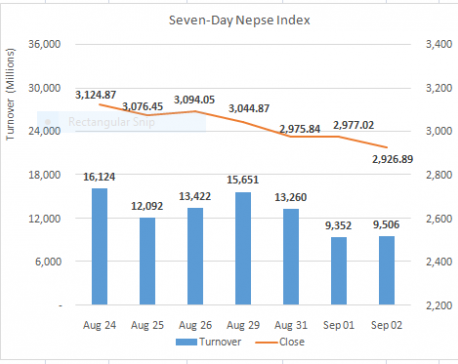

Nepse resumes correction to chase 2,900 mark

KATHMANDU, September 2: The equity market opened in positive territory but traded in red within the first trading hour on... Read More...

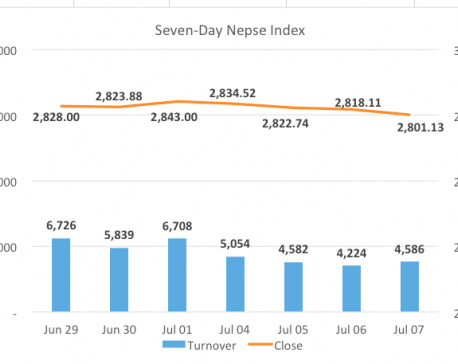

Nepse sees modest losses as quarter end approaches

KATHMANDU, July 7: Stocks traded briefly in green before pulling back towards the opening level in the morning. Subsequently, the benchmark... Read More...

Just In

- CM Kandel requests Finance Minister Pun to put Karnali province in priority in upcoming budget

- Australia reduces TR visa age limit and duration as it implements stricter regulations for foreign students

- Govt aims to surpass Rs 10 trillion GDP mark in next five years

- Govt appoints 77 Liaison Officers for mountain climbing management for spring season

- EC decides to permit public vehicles to operate freely on day of by-election

- Fugitive arrested after 26 years

- Indian Potash Ltd secures contract to bring 30,000 tons of urea within 107 days

- CAN adds four players to squad for T20 series against West Indies 'A'

Leave A Comment