OR

Daily Market Commentary

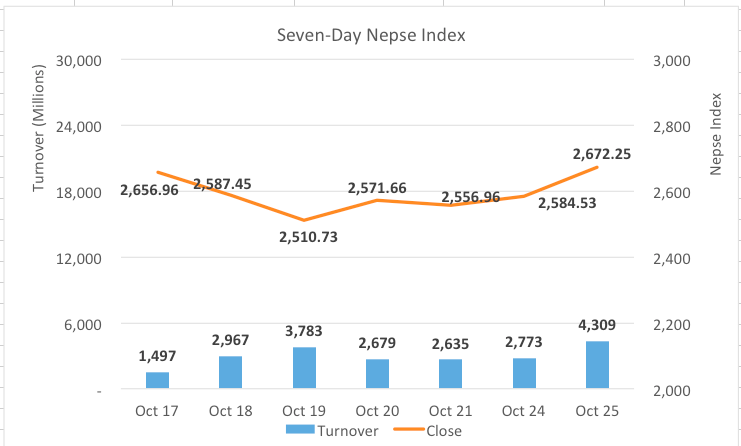

KATHMANDU, Oct 25: The local equity market saw strength since the beginning of Monday’s trading hour. The Nepal Stock Exchange (Nepse) index rallied more than 65 points in the one and half hour of trading before pulling back slightly lower. Stocks continued to surge in the latter trading hours with all sectors ending firmly in green. At the close, Nepse registered a gain of 87.63 to settle at 2,672.25.

Market continued to remain positive for the second straight session. Investors showed enthusiasm helping the market stage an 87-point rebound. However, the index is yet to see a major recovery, while still trading around 520 points lower than its all-time high. Although the turnover has managed to increase and Rs. 4.308 billion worth of equities traded on Monday.

Finance, Hydropower and Development bank segments were the leaders with the respective indices jumping 7.81%, 7.57% and 6.51%. Investment, Non-life Insurance and Life Insurance sector climbed 4.4%, 4.06% and 3.73% correspondingly. Banking, Hotels and Tourism, Manufacturing & Processing, Others, Microfinance sub index witnessed notable strength and surge above 2% each. Mutual funds and trading also closed firmly in green.

Among active companies, Mahalaxmi Bikas Bank Ltd, API Power Company Ltd and Siddhartha Bank Ltd posted a turnover of Rs. 162 million, Rs. 134 million and Rs. 131 million respectively. Similarly, National hydropower Company Ltd, Nabil Bank Ltd, Mero Microfinance Bittiya Sanstha Ltd recorded the volume of Rs.122 million, Rs.116 million and Rs.109 million correspondingly. Nepal Bank Ltd, Arun Valley Hydropower Company td, United Modi Hydropower Ltd and Kamana Sewa Bikas Bank Ltd were the other heavily traded shares of the session.

Gurkhas Finance Ltd, Best Finance Company Ltd, Shree Investment Finance Company Ltd and Central Finance Co. Ltd were among the major gainers with each scrip hitting the upper circuit level of 10%. Besides, several other hydropower, finance and development stocks rose 10% on the day.

Shangrila Development Bank Debenture 2087, Mero Microfinance Bittiya Sanstha Ltd, Unilever Nepal Ltd and 10% Laxmi Bank debenture 2086 and 8.5% Laxmi Bank Debenture 2088 shares suffered and decline by 4%, 3.97%, 2%, 1.91% and 1.05% respectively. Support Microfinance Bittiya Sanstha Ltd, NIC Asia Growth Fund, Kumari Equity Fund , 8.5% Sanima Debenture 2087 and 11% NIC Asia Debenture 082/83 ended in negative territory with a slight decrease.

As per the ARKS technical analysis, the market succeeded to break the two months downtrend making a bullish marubozu candlestick pattern which usually suggests a reversal. Technical indicators also suggest positive momentum in the coming session. However, the key 2,800 mark must be watched before taking any significant position on the buying side. A breakout above 2,800 with volume in the coming sessions can see the index make a decent recovery towards 3,000. On the other hand, immediate support can be taken as 2,600 psychological line.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

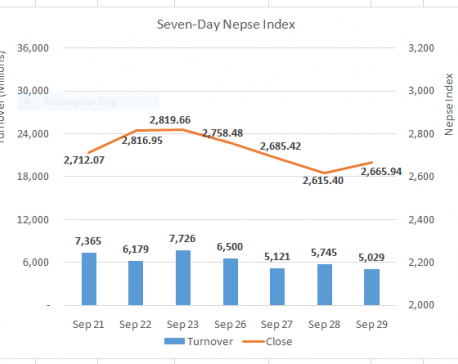

Stocks recoup losses as 2,600 mark holds ground

KATHMANDU, Sept 29: The Nepal Stock Exchange (Nepse) saw strength in the morning on Wednesday with the index climbing around 30... Read More...

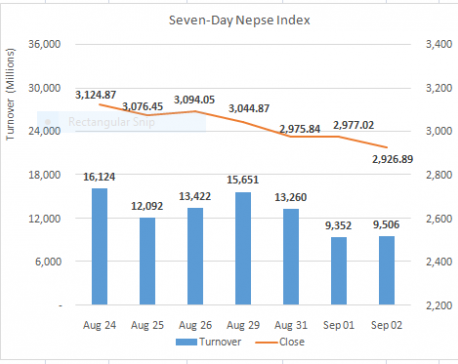

Nepse resumes correction to chase 2,900 mark

KATHMANDU, September 2: The equity market opened in positive territory but traded in red within the first trading hour on... Read More...

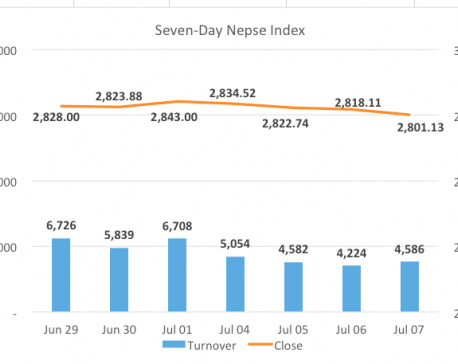

Nepse sees modest losses as quarter end approaches

KATHMANDU, July 7: Stocks traded briefly in green before pulling back towards the opening level in the morning. Subsequently, the benchmark... Read More...

Just In

- Hearing on Cricketer Lamichhane’s appeal today

- Nepal Investment Summit (live)

- Clear Policies Set to Boost American Investment in Nepal: US Ambassador Thompson

- Second T-20 series: Nepal loses toss, set to go for fielding first

- Nepal Investment Summit 2024 and Victor Hugo Moments for Reforms

- Kathmandu continues to top the chart of world’s most polluted cities

- 3rd Investment Summit: Govt seeking letters of intent for 20 projects

- Gold price increases by Rs 400 per tola

-1200x560-wm_20240427144118.jpg)

Leave A Comment