OR

Weekly Market Commentary

Nepse ends week lower despite positive earnings outlook

Published On: November 17, 2018 01:20 AM NPT By: Republica | @RepublicaNepal

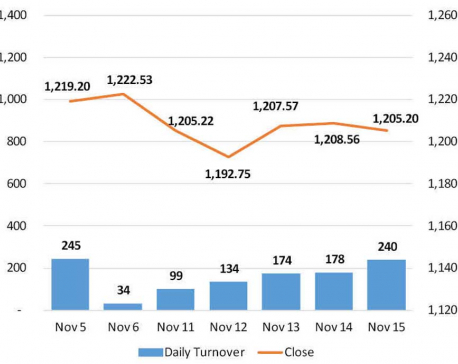

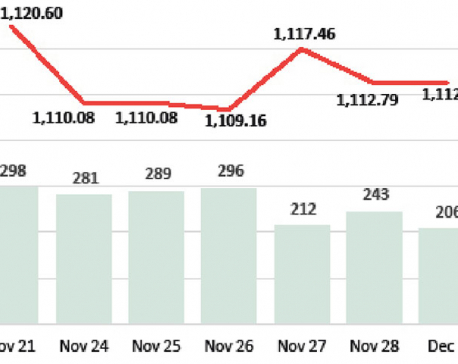

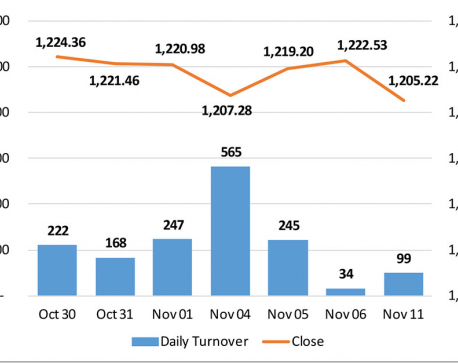

KATHMANDU, Nov 17: Stocks resumed post holidays trading on Sunday. However, trading remained largely affected by glitches in the Nepal Stock Exchange (Nepse)'s official website in the first few sessions of the week. The benchmark Nepse index shed almost 30 points in the first two trading days. A rebound on Tuesday saw the index recoup some of its earlier losses while the remaining two sessions witnessed modest moves in the broader market. Eventually, the index closed the week at 1,205.02 points registering a loss of 17.51 points or 1.43 percent in the review period.

The index, which consolidated in the previous week, failed to stage a rebound as the index fell further towards the 1,200 points mark. Most Nepalese equities fell despite most of the heavyweight banks and other sector companies reporting notably upbeat earnings in the week. Majority of the investors still seemed to refrain from going long in the absence of a stimulus in the financial space. Higher interest rates also continue to remain as one of the major concerns among investors. Market participation remained comparatively low as the bourse posted a weekly turnover of Rs 825 million.

Amid the broad sell-off, the biggest losses came from energy stocks. Hydropower sub-index tumbled more than 4 percent in the week. Meanwhile, decline seen on few major banking names weighed on Banking sub-index dragging it down by almost 2 percent. Microfinance sub-index also suffered and dropped 1.80 percent. Sub-index of Hotels segment also sank more than 1 percent. Besides, most of the other sectoral indices ended the week lower.

Amid a spate of earnings reports, a few listed companies announced dividends in the review period. Standard Chartered Bank Ltd announced 17.50 percent cash dividend to its shareholders from its fiscal year 17/18's earnings. Similarly, Soaltee Hotel Ltd declared 26.31 percent dividend including 10 percent bonus shares and 16.31 percent cash payout. Meanwhile, micro sector lenders including Unnati Microfinance Bittiya Sanstha Ltd and Nagbeli Laghubitta Bikas Bank Ltd proposed 40.50 percent and 16.11 percent bonus shares, respectively.

Among major listings, more than 17 million unit Further Public Offering (FPO) shares of Nepal Bank Ltd got listed in the exchange. Other listings for the week include bonus shares of NMB Bank Ltd, Century Commercial Bank Ltd and Shree Investment Finance Company Ltd, and right shares of Central Finance Company Ltd.

As per the ARKS weekly technical analysis, the Nepse index formed a bearish candlestick despite the sell-off easing in the previous week.

Technical indicators also suggest the market favoring bears in the present context. Further, indecision prevails in the equity market on the back of low volume trading sessions of late. Hence, the equity market is yet to show signs of a notable shift from the recent downfall.

This column is produced by ARKS Capital Advisors Ltd

www.arkscapitaladvisors.com

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

Stocks end week with a modest drop

KATHMANDU: Nepal Stock Exchange (Nepse) posted a loss of 3.36 points to settle at 1,205.20 points on Thursday. Though the... Read More...

Nepse begins week on a flat note

KATHMANDU: Stocks remained mostly unchanged in the beginning trading hour of Sunday’s session. After a small dip in the Nepal... Read More...

Nepse down 17 points

KATHMANDU: The benchmark Nepal Stock Exchange (Nepse) index struggled throughout Sunday’s trading session. The index fell sharply in the initial... Read More...

Just In

- NRB introduces cautiously flexible measures to address ongoing slowdown in various economic sectors

- Forced Covid-19 cremations: is it too late for redemption?

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

- NC defers its plan to join Koshi govt

- NRB to review microfinance loan interest rate

- 134 dead in floods and landslides since onset of monsoon this year

Leave A Comment