OR

Daily market commentary

Nepse ends week in red as selling pressure prevails

Published On: February 7, 2020 09:30 AM NPT By: Republica | @RepublicaNepal

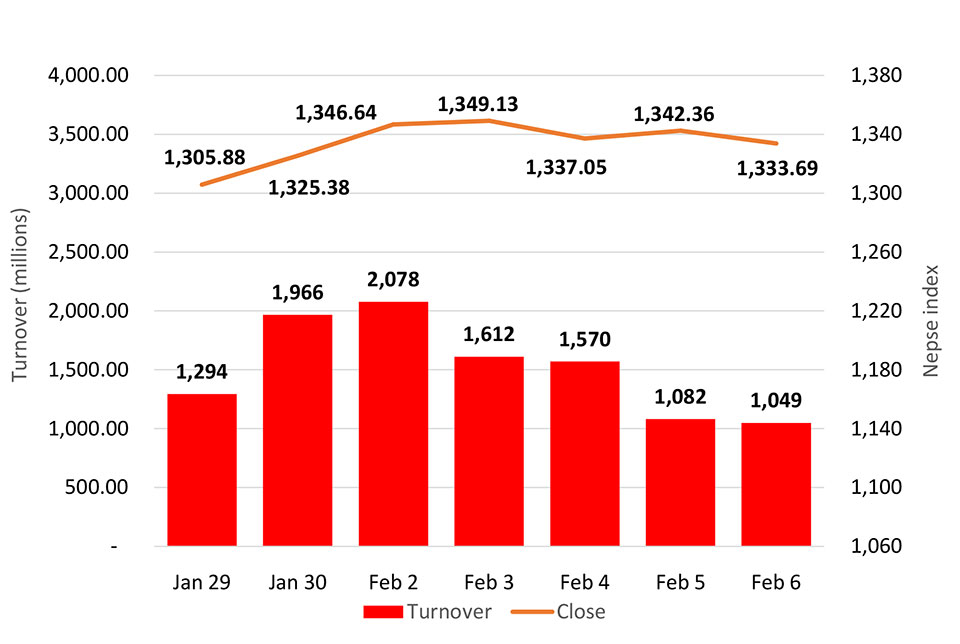

KATHMANDU: Stocks dipped sharply from the opening trading hour on Thursday. The stock market continued its journey to negative side of the spectrum toward the closing trading session as selling pressure prevailed in the market. At the end of trading, the benchmark Nepal Stock Exchange (Nepse) index was down 8.67 points to close the week at 1,333.69 points.

The stock market witnessed indecisive session as the index traded within a confined range. On a positive note, buyers have continued to absorb the selling pressure enabling the market to hold ground above 1,300-point mark. The local bourse recorded total turnover of Rs 1.04 billion.

Except Life Insurance and Manufacturing & Processing, which were marginally up, all major sectors closed the day in red. Non-Life Insurance and Hotels stocks came under pressure as their respective sub-indices were down by over 1% each. Sub-indices of Hydropower, Microfinance, Banking and Development Bank sectors also registered losses of 0.86%, 0.79%, 0.74%, and 0.65%, respectively. All other sectors closed marginally lower.

Among active stocks, Gurans life Insurance Company Ltd registered total transaction of Rs 45 million. Next, Nepal Life Insurance Company Ltd and Prabhu Bank Ltd posted turnovers of Rs 38 million and Rs 33 million, respectively. Similarly, Prime Life Insurance Company Ltd, NIC Asia Bank Ltd and Nepal Insurance Company Ltd saw over Rs 31 million worth of shares traded each. Citizen Investment Trust, Neco Insurance Co Ltd and Civil Bank Ltd were among active stocks of the day.

Among advances, share prices of Green Development Bank Ltd and Samriddhi Finance Company Ltd hit the upper circuit of 10%. Similarly, share price of Support Microfinance Bittiya Sanstha Ltd was up by 9.97%. Progressive Finance Ltd, Himalayan Power Partner Ltd and Best Finance Company Ltd also saw their share prices surge by over 4% each. Other gaining stocks include Gurans Laghubitta Bittiya Sanstha Ltd, Central Finance Co Ltd and Barun Hydropower Company Ltd.

On the other hand, Nepal Finance Ltd suffered the most as its share price fell 9.55%. Next on the list was Jyoti Bikas Bank with a 4.02% drop in its share price. Share prices of Mithila Laghubitta Bittiya Sanstha Ltd, Universal Power Company Ltd, Ridi Hydropower Development Company Ltd and Civil Bank Ltd were down by over 3% each. Ankhu Khola Jalabidhyut Company Ltd, National Hydropower Company Ltd and Laxmi Laghubitta Bittiya Sanstha Ltd were among other losing scrips.

In corporate space, Mahalaxmi Bikas Bank Ltd and Shine Resunga Development Bank Ltd have published their earnings report for the second quarter of FY2019/20. The net profit of the company stands at Rs 305.07 million and Rs 300.7 million with a growth of 54.36% and 51.13%, respectively.

On technical front, the index formed a bearish candlestick on the daily timeframe. The index is trading between the confined ranges and maintaining above the crucial psychological mark of 1300-point level. The movement around this level will be significant for investors to measure the possible short-term trend of the secondary market. Meanwhile, technical indicators suggest neutral sentiment prevailing in the local bourse.

This column is produced by ARKS Capital Advisors Ltd

www.arkscapitaladvisors.com

(Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

Stock market to remain closed for five days

KATHMANDU, March 23: The Securities Board of Nepal (Sebon) has instructed Nepal Stock Exchange (Nepse) to shut stocks transaction from... Read More...

Nepse surges as insurance, banking stocks post gains

KATHMANDU: The Nepal Stock Exchange (Nepse) index maintained positive bias for most of the session on Thursday. A steady advance... Read More...

Nepse gains 9 points

KATHMANDU: The stock market traded in green throughout Wednesday's trading session. The Nepal Stock Exchange (Nepse) index saw a stable... Read More...

Just In

- NRB introduces cautiously flexible measures to address ongoing slowdown in various economic sectors

- Forced Covid-19 cremations: is it too late for redemption?

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

- Body handover begins; Relatives remain dissatisfied with insurance, compensation amount

- NC defers its plan to join Koshi govt

- NRB to review microfinance loan interest rate

- 134 dead in floods and landslides since onset of monsoon this year

Leave A Comment