OR

Weekly Market Commentary

Nepse ends week higher as mutual funds and commercial bank stocks see strength

Published On: July 23, 2021 07:30 PM NPT By: Republica | @RepublicaNepal

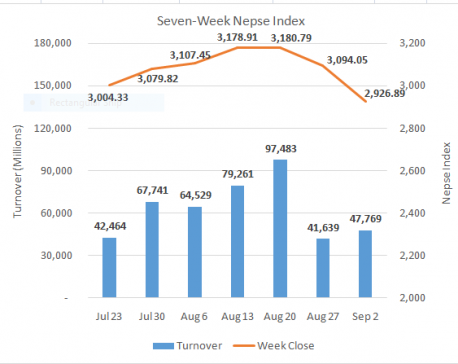

KATHMANDU, July 23: After a strong opening to the week, the index consolidated around 3,000 mark for most of the trading days. The stock market rallied more than 97 points on Sunday after congress leader Sher Bahadur Deuba convincingly won the vote of confidence from the parliament ensuring continuity of his term as the Prime Minister. Buying pressure lost steam thereafter, but the market didn’t see any major corrections in the latter trading days. On Monday, Nepse rose 13.81 points followed by a 8.85 point’s drop in Tuesday. After a holiday on Wednesday, stocks gained further ground and added 18.76 points. Consequently, Nepse ended week up by more than 120 points or 4% at 3,004.33.

After a recovery in the last week of the fiscal year, the equity market saw further optimistic movement in the first week of fiscal year 21/22. With a boost seen in mutual fund sector driven by upbeat dividend announcements by two mutual fund schemes run by Laxmi Capital Ltd and strength seen in commercial banks, the broader market reflected confidence among investors. Turnover also improved as the bourse recorded a daily average turnover of over Rs. 10 billion.

Class ‘A’ stocks also mirrored the broader market with the Sensitive Index climbing 3.86%. All sectors ended the week firmly higher. Mutual Fund segment moved sharply higher as the gauge jumped 16.24%. Banking and Trading sectors also shot up by over 7%. Hydropower, Development Bank, Life Insurance and Manufacturing & Processing sub-indices rose more than 3%. All other sectors saw moderate gains in the week.

On the corporate front, Asian Life Insurance Company Ltd called for its Annual General Meeting (AGM) for the fiscal year 18/19 on August 15. The life insurer has not announced any dividend for the respective year. Endorsement of the financial reports, election of board members and promoter-public shareholding ratio conversion to 60-40 are the main agendas of the meeting.

As per the ARKS technical analysis, the equity market formed a strong bullish candlestick on the weekly timeframe. Bulls remained in control of the market with the index closing the week firmly higher. Weekly Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest sentiment tilting towards bulls, but a lack of notable momentum is observed. A bounce from 3,000 mark with substantial volumes can see the index make a fresh high. On the other hand, immediate strong support lies at 2,800 level.

This column is produced by ARKS Capital Advisors Ltd.

www.arkscapitaladvisors.com

(Views expressed in the article are those of the producer and do not necessarily reflect those of thispublication)

You May Like This

Nepse ends in green for four consecutive weeks

KATHMANDU, Jan 14: The Nepal Stock Exchange (Nepse) index saw a firmly upbeat week after the country saw a spike... Read More...

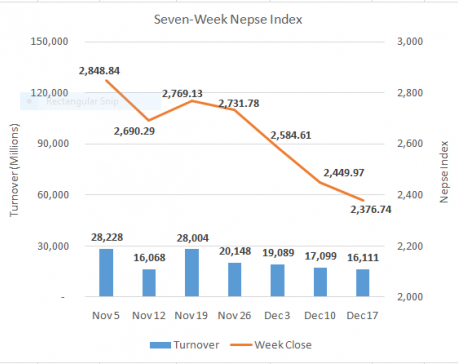

Nepse posts weekly loss of 73 points despite mid-week recovery

KATHMANDU, Dec 18: The equity market continued to suffer with the Nepse index ending in red for a fourth consecutive week.... Read More...

Nepse extends correction to trade close to 2,900 support mark

KATHMANDU, September 3: The stock market opened the week’s trading on a feeble note with the benchmark Nepse index tanking more... Read More...

Just In

- NEA Provincial Office initiates contract termination process with six companies

- Nepal's ready-made garment exports soar to over 9 billion rupees

- Vote count update: UML candidate continues to maintain lead in Bajhang

- Govt to provide up to Rs 500,000 for building houses affected by natural calamities

- China announces implementation of free visa for Nepali citizens

- NEPSE gains 14.33 points, while daily turnover inclines to Rs 2.68 billion

- Tourists suffer after flight disruption due to adverse weather in Solukhumbu district

- Vote count update: NC maintains lead in Ilam-2

Leave A Comment