OR

Daily market commentary

Nepse ends 18 points lower

Published On: March 23, 2020 09:45 AM NPT By: Republica | @RepublicaNepal

KATHMANDU: The local bourse witnessed one of its most bland trading sessions as associations of merchant banks and stock brokers issued a press release on the day stating that all merchant bank and broker offices will remain closed between March 22 and April 2.

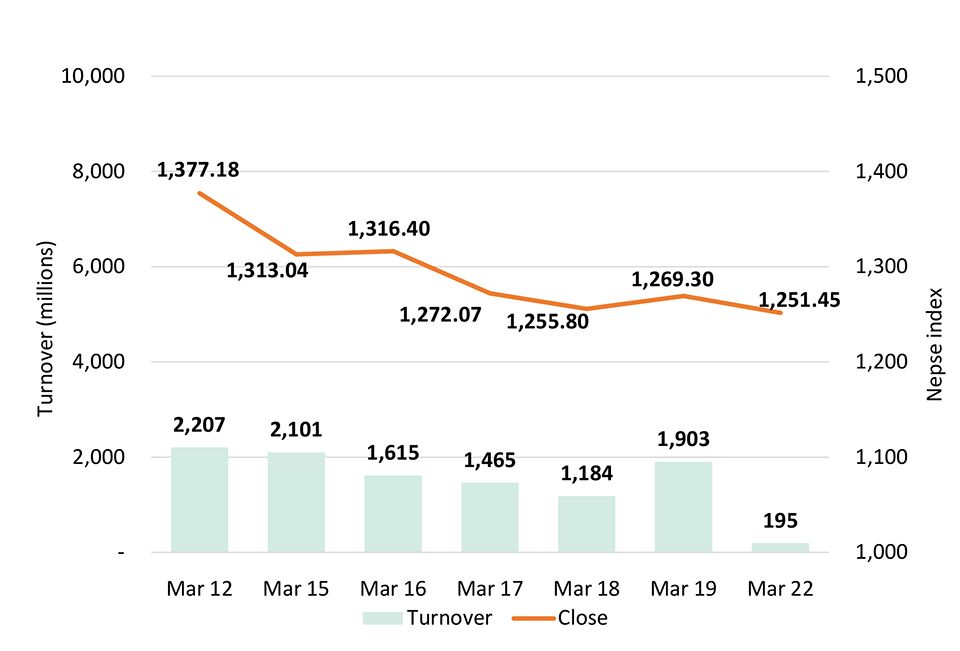

On Friday, Prime Minister Khadga Prasad Oli announced measures to curb the possibility of COVID-19 outbreak in the country. In the announcement, he ordered all non-essential services to be closed for 2 weeks. However, with no official words from the Nepal Stock Exchange (Nepse) or Securities Board of Nepal (Sebon), Nepse's trading system remained open allowing traders to engage in online transaction. The market, however, saw lackluster trading for most of trading session with the benchmark Nepse index wavering marginally toward either side. Nonetheless, a sharp decline late in the afternoon saw the benchmark index close trading 18.20 points lower at 1,251.45 points.

With notably subdued turnover of below Rs 200 million, investors fail to judge the actual tone of the secondary market. The overall price levels were already affected by panic-selling since the beginning of March. Investors stayed cynical over the outlook of the Nepali equity market as COVID-19 continues to affect the global market. Nonetheless, the market has already dropped roughly 25% over past three weeks. Hence, indecisiveness has prevailed in the last couple of sessions.

Most sectors ended in red as low volume trading accentuated the selling effect. Banking sub-index was down by 2.42%. Life Insurance and Trading segments also came under pressure and lost 1.51% and 1.36%, respectively. Manufacturing & Processing and Development Bank sub-indices closed roughly 1% lower each. Microfinance, Hydropower and Finance sub-indices also fell marginally. On the other hand, Hotels sub-index jumped 3.51%. 'Others' sector rose 1.08%, while Non-life Insurance sub-group edged 0.02% higher.

Nepal Life Insurance Company Ltd was the most traded scrip on the day. Over Rs 28 million worth of shares of the life insurer changed hands on the day. NMB Bank Ltd followed suit with a transaction of almost Rs 20 million. Further, NMB Bank Ltd, Himalayan Distillery Ltd and NIC Asia Bank Ltd registered turnovers of Rs 14 million, Rs 11 million and Rs 10 million, respectively.

Leading the gainers, Janautthan Samudayik Laghubitta Bittiya Sanstha extended its rally. Share price of the micro sector lender hit the upper circuit of 10% for a third straight day. Api Power Company Ltd and Central Finance Co Ltd also saw strength and saw their share prices surge by over 7% each. Share prices of Civil Laghubitta Bittiya Sanstha Ltd and Soaltee Hotel Ltd also advanced by over 5% each.

Conversely, Guheshwori Merchant Banking & Finance Co Ltd took the biggest knock as its share price tumbled by over 9%. Subsequently, Nepal Investment Bank Ltd Promoter Share and Nepal Credit and Commerce Bank Ltd registered declines of more than 6%. First Microfinance Laghubitta Bittiya Sanstha Ltd, National Life Insurance Company Ltd, Prime Commercial Bank Ltd and Kumari Bank Ltd were among other major losing scrips of the day.

On the technical front, the market has formed a bearish candlestick on the daily timeframe erasing Thursday's gains. Nonetheless, the market is showing signs of consolidation at the current juncture with range-bound trading seen in the past few sessions. Further, the volatility level has dropped significantly with technical indicators also pointing toward a decline in bearish momentum. Hence, investors must now wait for a volume-backed rebound before taking major long position in the market. The major support lies in 1,200-1,220 points range.

This column is produced by ARKS Capital Advisors Ltd

www.arkscapitaladvisors.com

(Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

Stock market to remain closed for five days

KATHMANDU, March 23: The Securities Board of Nepal (Sebon) has instructed Nepal Stock Exchange (Nepse) to shut stocks transaction from... Read More...

Sebon paves way for stock brokers to provide margin lending services

KATHMANDU, Feb 2: The Securities Board of Nepal (Sebon) has allowed stock brokerage firms to provide margin lending to investors. Read More...

Nepse begins week on a flat note

KATHMANDU: Stocks remained mostly unchanged in the beginning trading hour of Sunday’s session. After a small dip in the Nepal... Read More...

Just In

- Japanese envoy calls on Minister Bhattarai, discusses further enhancing exchange through education between Japan and Nepal

- Heavy rainfall likely in Bagmati and Sudurpaschim provinces

- Bangladesh protest leaders taken from hospital by police

- Challenges Confronting the New Coalition

- NRB introduces cautiously flexible measures to address ongoing slowdown in various economic sectors

- Forced Covid-19 cremations: is it too late for redemption?

- NRB to provide collateral-free loans to foreign employment seekers

- NEB to publish Grade 12 results next week

Leave A Comment