OR

Daily Market Commentary

Nepse down 60 points as all sectors tumble

Published On: November 11, 2021 07:00 PM NPT By: Republica | @RepublicaNepal

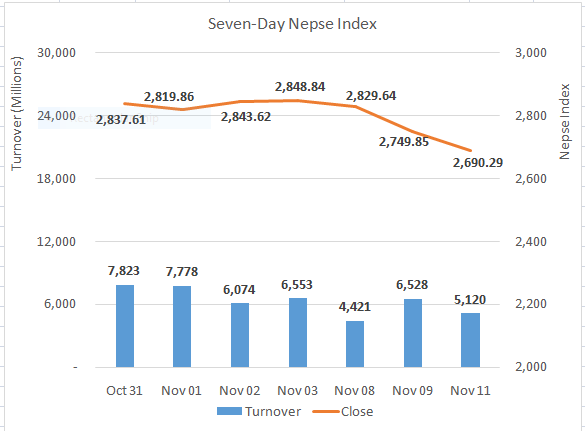

KATHMANDU, Nov 11: The Nepal Stock Exchange (Nepse) index opened Thursday’s trading on a weak note. A sharp dip and recovery in the early hours was followed by a steady downfall in the afternoon. At the close, Nepse stood at 2,690.29 – down 59.57 points against the session earlier.

The index has continued to make strides to the downside since the resumption of trading after Tihar holidays. With liquidity yet to ease in the financial system, shareholders are wary of the high deposit and loan rates which might draw investments away from the equity market. Turnover also remained subdued with only Rs. 5 billion worth of equities changing hands on the day.

All sectors saw red with Finance, Development Bank and Investment sectors dragging the broader index the most. The respective indices lost 4.22%, 3.61% and 3.05%. All other segments saw notable dips.

Mahalaxmi Bikas Bank Ltd, Nabil Bank Ltd and ICFC Finance Ltd were the active scrips of the day with respective turnovers of Rs. 475 million, Rs. 311 million and Rs. 292 million. Api Power Company Ltd, Jyoti Bikas Bank Ltd and Arun Kabeli Power Ltd were the other actively traded stocks.

Manushi Laghubitta Bittiya Sanstha Ltd and Terathum Power Company Ltd hit the upper circuit level of 10%. Sahas Urja Ltd, Goodwill Finance Company Ltd, Samudayik Laghubitta Bittiya Sanstha Ltd jumped 7.64%, 3.93% and 3.44%.

Mahalaxmi Bikas Bank Ltd and ICFC Finance Ltd suffered back to back losses. Both scrip tumbled 10%. Shiva Shree Hydropower Ltd tanked 7.39% after reporting negative earnings per share. Barun Hydropower Company Ltd, Union Hydropower Ltd and Synergy Power Development Ltd dipped 6% apiece.

On the technical front, the equity index formed a bearish candlestick suggesting sellers dominance in the current context. A dip below 2,700 mark also suggest weakness. Both RSI and MACD reflect possibility of further corrective move. A minor support lies at 2,680, a break of which will indicate probable dip to 2,600. On the other hand, a rebound with volume might see the index make further recovery.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

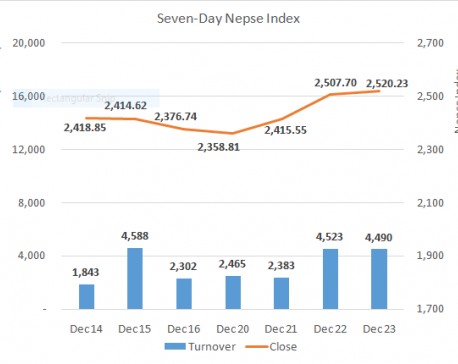

Nepse ekes out modest gain to end week in upbeat note

KATHMANDU, Dec 23: Stocks traded briefly in negative territory amidst active profit booking in the morning. Nonetheless, the bourse held... Read More...

Nepse plunges 70 points as rout intensifies

KATHMANDU, June 21: The local stock market opened in green but moved sharply lower within first few minutes of trading. A... Read More...

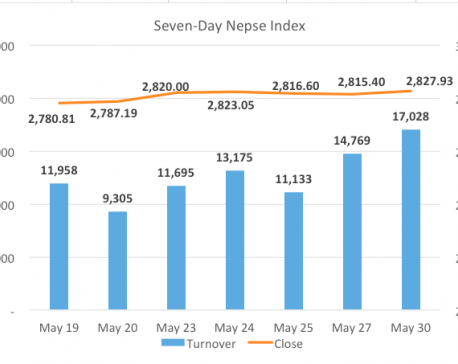

Nepse end slightly higher, volumes make another record

KATHMANDU, May 30: Following modest corrections in the latter half of the prior week, stocks saw massive gains in Sunday... Read More...

Just In

- Fire destroys wheat crop in Kanchanpur, Kailali

- Bipin Joshi's family meets PM Dahal

- State Affairs and Good Governance Committee meeting today

- Gold items weighing over 1 kg found in Air India aircraft at TIA

- ACC Premier Cup semi-final: Nepal vs UAE

- Sindhupalchowk bus accident update: The dead identified, injured undergoing treatment

- Construction of bailey bridge over Bheri river along Bheri corridor reaches final stage

- Taylor Swift releases ‘The Tortured Poets Department’

Leave A Comment