OR

Daily Market Commentary

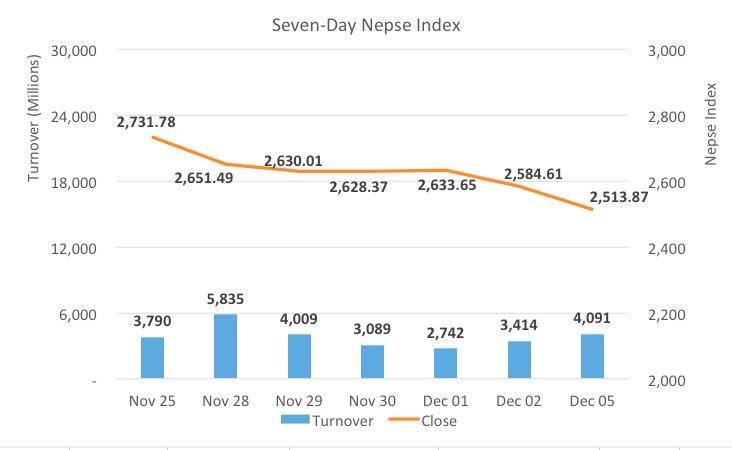

Nepse begin week with a sharp dip

Published On: December 5, 2021 09:57 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, Dec 6: Stocks continued to tumble since the beginning of Sunday’s session. After dropping towards 2,550, the market found some footing. Nonetheless, the benchmark index continued to dip sharply in the latter trading hours. At the close, Nepse registered a loss of 72.32 points to end trading at 2,513.87.

The day’s dip saw extension of Thursday’s losses with the market shedding almost 120 points in 2 days. Liquidity crisis in the financial system is mainly keeping the buyers from taking any heavy buying positions. Higher interest rates and restricted credit limits have had a notable negative impact in the equity market of late. However, given budget expenditures increase in the coming months, liquidity situation might see some improvement. Turnover remained low as only Rs. 4 billion worth of shares changed hands.

Finance, Trading and Development Bank sectors suffered the most with losses of over 4% each. ‘Others’, Investment and Hydropower sub-indices fell over 3%. All other sectors saw firm declines. Heavyweight banks also dipped 2.33%.

Shares of National Hydropower Company Ltd were traded the most with a turnover of Rs. 286 million. Himalayan Distillery Ltd, Nepal Telecom Ltd and Nabil Bank Ltd logged in turnovers of Rs. 173 million, Rs. 167 million and Rs. 161 million. Mahalaxmi Bank Ltd, Api Power Company Ltd and Arun Kabeli Power Ltd were among other active stocks.

Nyadi Hydropower Ltd continued to surge with another 10% rally. Naya Sarathi Laghubitta Bittiya Sanstha Ltd and Mailung Khola Jalbidhyut Company Ltd also added around 4%. Unilever Nepal Ltd, Narayani Development Bank Ltd, Ajod Insurance Ltd and Siddhartha Insurance Ltd also climbed slightly higher.

ICFC Finance Ltd and Sabaiko Laghubitta Bittiya Sanstha Ltd were the major decliners with losses of over 8% each. Karnali Bikas Bank Ltd, Green Development Bank Ltd, Panchakanya Mai Hydropower Ltd. Muktinath Bikas Bank Ltd, United Modi Hydropower Ltd and Pokhara Finance Ltd closed over 6% lower.

As per the ARKS technical analysis, the index formed a strong bearish candlestick to close at the support level of 2,500. Momentum indicators also reflect weak sentiment making any notable recovery unlikely in the present context. Nonetheless, traders can go long on a volume backed rebound from the current zone for short term trading.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

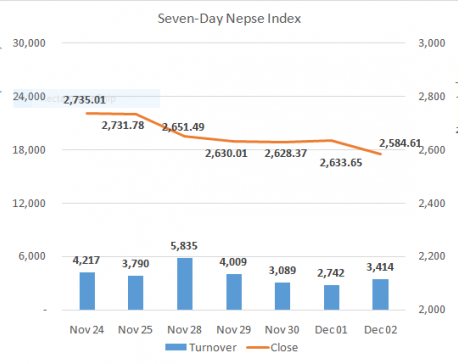

Nepse ends the week on lower note

KATHMANDU, Dec 2: The local bourse started on a positive note but failed to sustain in the positive territory and... Read More...

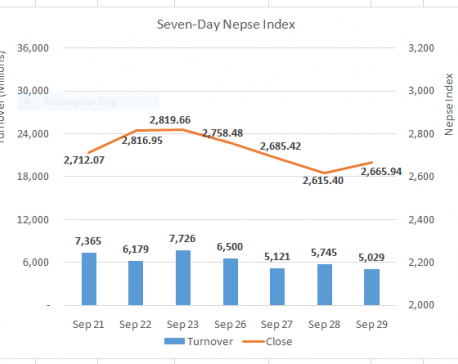

Stocks recoup losses as 2,600 mark holds ground

KATHMANDU, Sept 29: The Nepal Stock Exchange (Nepse) saw strength in the morning on Wednesday with the index climbing around 30... Read More...

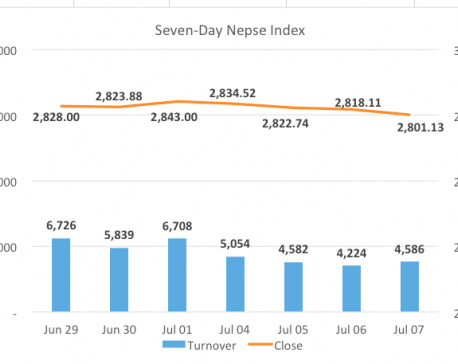

Nepse sees modest losses as quarter end approaches

KATHMANDU, July 7: Stocks traded briefly in green before pulling back towards the opening level in the morning. Subsequently, the benchmark... Read More...

Just In

- Nepal Investment Summit (live)

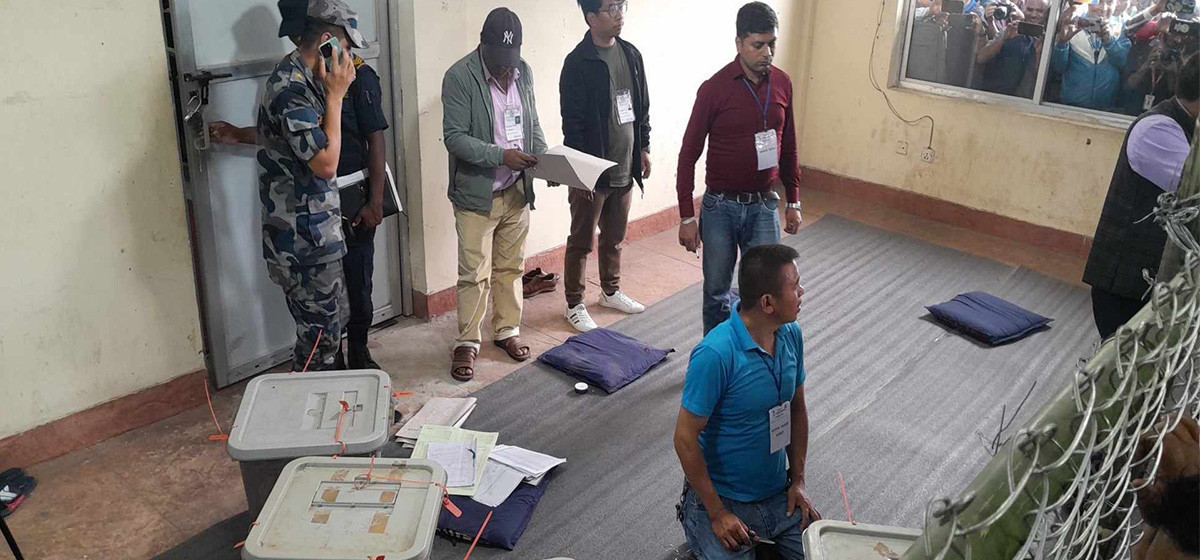

- Ilam-2 and Bajhang 1(a) by-elections: Vote counting begins

- Nepal is a prime destination for international investment: FinMin Pun

- President Paudel issues ordinance related to facilitation of investment

- Hearing on Cricketer Lamichhane’s appeal today

- Clear Policies Set to Boost American Investment in Nepal: US Ambassador Thompson

- Second T-20 series: Nepal loses toss, set to go for fielding first

- Nepal Investment Summit 2024 and Victor Hugo Moments for Reforms

-1200x560-wm_20240427144118.jpg)

Leave A Comment