OR

Nepse at record high of 1,800 points

Published On: July 19, 2016 10:00 PM NPT By: Republica | @RepublicaNepal

Monetary policy drives investors toward banking stocks

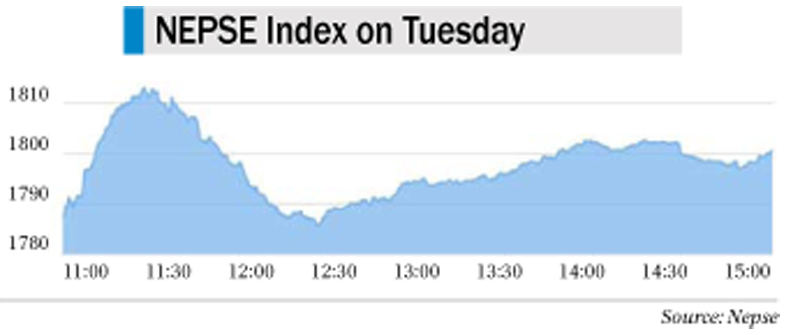

KATHMANDU, July 19:Nepal Stock Exchange (Nepse) index climbed up 13.9 points on Tuesday to close at a record 1,800.47 points.

The stock market is been rallying for the past year despite the economy suffering from last year's devastating earthquakes, Tarai turmoil and subsequent unofficial economic blockade imposed by India.

While investors are on a buying frenzy, many analysts doubt that the bull run fuelled by speculation spells huge risk for many, particularly novice and small investors.

Though the economic growth plunged to one of the lowest levels in the history in 2015/16, the stock market's climb to record highs in recent months have worried the stock market regulator (Securities Board of Nepal), Nepse and Nepal Rastra Bank - the central monetary authority.

While Sebon and Nepse have already issued three statements, urging investors to become cautious, their warnings have not worked to calm down the market.

Stock brokers and analysts attribute the bullish market to investors' expectation of stock dividends as bank and financial institutions (BFIs) as well as insurance companies are planning to raise paid-up capital, cheaper financing facility at low interest rates, and market reforms initiated by Sebon.

Releasing the monetary policy for 2016/17, the central bank tightened the flow of finance toward the stock market by bringing down ceiling of the loans to 50 percent on valuation of share pledges. However, the central bank's move has not discouraged investors from pouring their money into the stock market.

"There were fears that the central bank would reduce the level of BFIs' exposure to the stock market. However, the reduction of the ceiling of the loans on the valuation did not affect investors. Instead, the seven percent cap on the cost of fund for microfinance companies have driven the microfinance investors toward shares of commercial banks," Anjan Raj Poudyal, former president of Stock Brokers Association of Nepal, told Republica. "There are also expectations at the fiscal year end that commercial banks would perform better, which means they will be in a better position to distribute more dividends in the current fiscal year," he added.

However, investors holding shares of microfinance institutions are suffering huge losses in recent days after the central bank introduced seven percent interest spread on their cost of fund. "Share prices of most of the microfinance institutions are going down as investors fear that profit and returns of these companies will go down after the imposition of seven percent interest spread cap,” Poudyal said. “It came as a shock for investors who were expecting the central bank to raise paid-up capital requirement for microfinance institutions," added Poudyal.

While Banking, Hotels, Development Bank, Finance, and Manufacturing and Processing groups registered gain on Tuesday, Hydropower, Insurance and Others suffered loss.

A total of 2.9 million units of shares of 139 companies worth Rs 2.1 billion were traded in the market on Tuesday. Total market capitalization reached Rs 1,981 billion.

Preparation on to add one more clearing bank

Securities Board of Nepal (Sebon), Nepal Stock Exchange (Nepse) and CDS and Clearing Ltd (CDSCL) have decided to intensify work for add another clearing bank.

Issuing a statement, Sebon, the capital market regulator, said that the meeting of these institutions held on Monday decided to complete technical works for adding another clearing bank for trading of the securities in the secondary market by August 16.

At present, only Global IME Bank Ltd has been allowed to work as a clearing bank.

Investors and stock brokers have been demanding that there should be at least one more clearing bank in the wake of rising transactions in the stock market.

Clearing bank pays the seller after receiving payment from the buyer through CDSCL.

The Clearing and Settlement Bylaw 2013 allows Nepse to issue permit to banks to work as a clearing bank.

Similarly, the meeting also decided to give a final touch to the process of issuing unique identification number to investors by the end of August.

Strict enforcement of completing trading process within T+3 days, arrangement of settlement guarantee fund and auction market, and amendment and update of various rules and bylaws related to the stock market are some of the decisions taken by the joint meeting, according to the statement.

You May Like This

Nepse closes at record high of 1,666 points

KATHMANDU, June 25:Nepal Stock Exchange (Nepse) index jumped 44.02 points this week to close at yet another high of 1,666.29... Read More...

Nepse closes at record high of 1,567 points

KATHMANDU, June 10: Nepal Stock Exchange (Nepse) index climbed up 83.56 points this week to close at record high of 1,566.7... Read More...

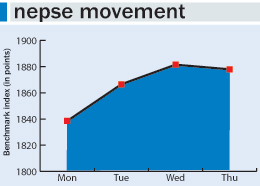

Nepse up 79 points as investors turn to banking stocks

KATHMANDU, July 30: Nepal Stock Exchange (Nepse) index gained 79.1 points this week to close at 1,881.45 points on Thursday--the... Read More...

Just In

- Rato Machhindranath Jatra begins (With Photos)

- Bhatbhateni Supermarket Chairman Gurung pledges to contribute Rs 410 million to build a children's hospital

- Gold price surged Rs 2,500 per tola last week

- Sarlahi section of east-west electric railway project witnesses 90 percent progress

- 2.2 km road waiting blacktopping for over 22 months in Kaski

- NEPSE lost 33.73 points, while investors lost Rs 52 billion from shares trading last week

- KMC starts homework to draft policy and program and annual budget for FY 2024/25

- Joint meeting of Federal Parliament to be held on May 14, President to address the meeting

Leave A Comment