OR

National Payment Gateway delayed by over a year; some see collusion

Published On: February 26, 2021 12:13 PM NPT By: RAJESH KHANAL

Stakeholders suspect of authority coming under influence of private digital payment companies

KATHMANDU, Feb 26: The government had announced to launch a national payment gateway (NPG) by September 2020. It has been more than five months past the deadline and the government authorities are yet to expedite the much awaited integrated payment system.

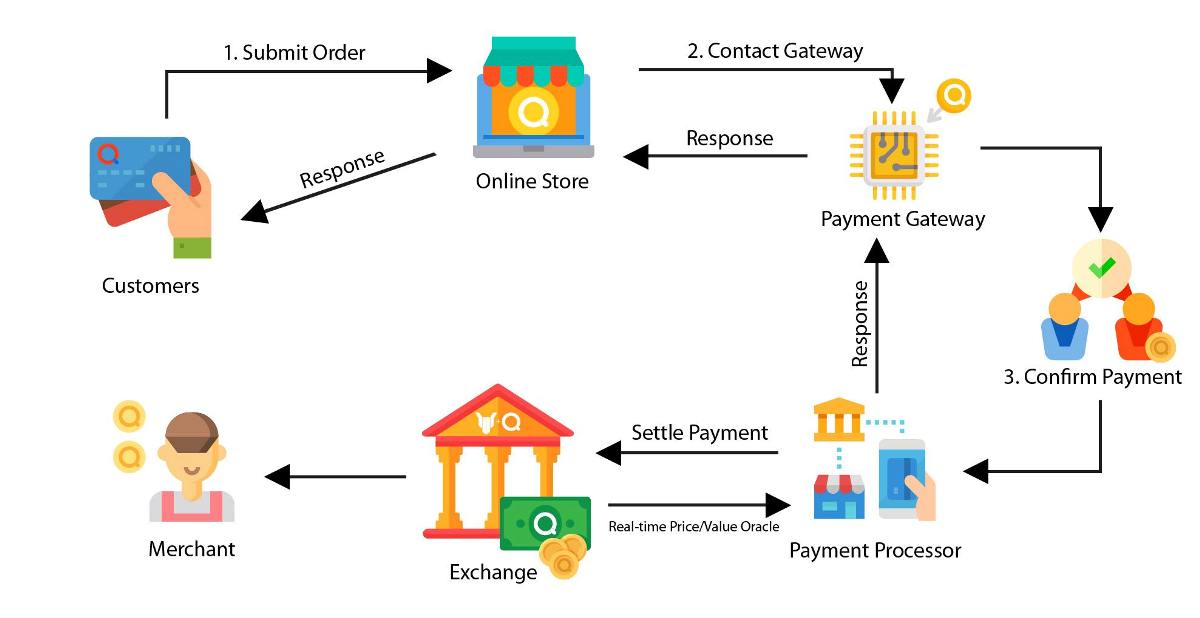

NPG is a common platform that integrates various systems of online payments, including private mobile wallets and card payment services along with financial transactions of the government. It incorporates the entire payments ecosystem that helps reduce cost and reduce risk factors that could arise in the existing online payment systems.

Currently, banks and financial institutions (BFIs) have been paying hefty prices for digital transactions through international payment gateway like Visa and MasterCard due to lack of Nepal’s own payment gateway. The switch is crucial for connecting all the institutions involved in electronic transactions.

In the absence of NPG, the BFIs have been relying on international switches for the payment through debit and credit cards as well as for the use of ATMs. While banks have made their own switch for this purpose, Nepal Rastra Bank (NRB) has been paying around 12 rupees per transaction to the operators of foreign switches.

However, the enforcement of the NPG is still at a snail pace. Gunakar Bhatta, spokesperson of NRB, said the discussion is underway to complete necessary works. “The central bank, in coordination with National Information Technology Center and Nepal Clearing House Limited (NCHL), has been working on completing the ground work soon,” Bhatta said.

According to NRB officials, the central bank has already handed over authority to the NCHL to work as the main implementing agency of the NPG. Bhuban Kadel, executive director at Payment Systems Department of NRB, said the NCHL is currently working to manage necessary compliance for settling up the transactions to be carried out by card and non card users.

Kadel said the NPG will enable switching the server to the domestic domain. “It will help maintain national sovereignty, apart from minimizing the risk and operational costs,” he added.

With an aim to incorporate the entire payment ecosystem under the NPG, the central bank last year launched real-time gross settlement (RTGS), which helps settle large amounts of personal transactions via electronic mode. Once the NPG is online, all types of transactions can be settled through a single stream, thereby controlling the malpractices seen in online transactions.

Nara Bahadur Thapa, former executive director of NRB, also stressed on the need for implementing the NPG at the earliest. According to him, it should take an average of 18-22 months to prepare the necessary platforms to ensure the complete functionality of the system.

But the NPG is on hold for over a year. However, the NRB officials are also left without a clue on when the system will be launched. “There is no such timeframe that we can ascertain when the system will come online,” Kadel said.

Bankers smell a rat on the NRB’s delay in launching the NPG. “There is a possibility that the individual payment settlement companies have been pressurizing the authority to deliberately postpone the date, just to fulfill their vested interest,” said a senior bank official.

Last April, such malpractice had come to a limelight after Prime Minister's Information Technology Consultant Asgar Ali was found promoting his private company -- eSewa -- by stopping the operation of a payment gateway system purchased earlier by the government for 250 million rupees.

You May Like This

Corruption in National Payment Gateway: CIAA decides not to prosecute nine officials

KATHMANDU, Oct 3: The Commission for the Investigation of Abuse of Authority (CIAA) has decided not to proceed with the... Read More...

CIAA files cases against high-ranking govt officials on corruption charge

KATHMANDU, Oct 3: The Commission for the Investigation of Abuse of Authority (CIAA) has filed cases against nine individuals including... Read More...

Corruption in National Payment Gateway: CIAA files case against seven people including Secretary Marasini

KATHMANDU, Oct 2: A corruption case has been filed against seven people, including an incumbent secretary, in connection with corruption... Read More...

Just In

- NEA Provincial Office initiates contract termination process with six companies

- Nepal's ready-made garment exports soar to over 9 billion rupees

- Vote count update: UML candidate continues to maintain lead in Bajhang

- Govt to provide up to Rs 500,000 for building houses affected by natural calamities

- China announces implementation of free visa for Nepali citizens

- NEPSE gains 14.33 points, while daily turnover inclines to Rs 2.68 billion

- Tourists suffer after flight disruption due to adverse weather in Solukhumbu district

- Vote count update: NC maintains lead in Ilam-2

Leave A Comment