OR

IB opens licenses for micro insurers while exerting pressure on existing insurance companies for merger

Published On: August 27, 2022 06:35 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, August 27: The Insurance Board (IB) has opened licenses for micro insurance companies, contradicting its own policy to reduce the number of insurers operating in the country.

IB, the regulatory body of the country’s insurance business, has been pressurizing the existing insurance companies into merger, arguing that there is not enough business for a large number of insurers. But on the other hand, it has opened the license to new firms.

Issuing a 35-day public notice on Friday, the IB called firms willing to start micro insurance businesses. According to the IB, it is issuing insurer licenses to seven firms. Of them, three will work in life insurance while remaining four will be non-life insurers.

The regulator has fixed a requirement of Rs 750 million as paid up capital for the new insurers. Likewise, the interested companies should not have cross holdings to get new licenses.

The government is said to have opened the new insurer licenses bowing to the pressure of the country’s big business groups that include Vishal Group, IME Group and Chaudhary Group. Many of them have already submitted their proposals to obtain insurance licenses before the IB made the public call for the micro insurance companies.

Muktinath Insurance, Mahalaxmi General Insurance, Annapurna General Insurance, Manakamana Insurance, Abhiyaan General Insurance and Upakar General Insurance have filed their applications for non-life insurance. Similarly, Uni Life Insurance, Standard Life Insurance and Upakar Life Insurance have sought to take new licenses of life insurers.

Giving a deadline of mid-April 2023, the IB has been pushing the insurers to either increase their capital base or go into a merger if they fail to do so. According to the regulator, the life insurance companies will have to increase their paid-up capital to Rs 5 billion from the existing Rs 2 billion. Similarly, non-life insurers will have to raise their capital to Rs 2.50 billion from Rs 1 billion.

As of now, Himalayan Everest Insurance, the organization formed after merging Himalayan General Insurance and Everest Insurance, has already started its integrated transaction. Prabhu Life Insurance and Mahalaxmi Life Insurance also signed an agreement to merge.

Prabhu Insurance Limited and Ajod Insurance Limited have also agreed to go into unification. Similarly, Prime Life, Union Life and Gurans Life have already signed agreements for merger. Sagarmatha Insurance Company and Lumbini General Insurance Company have also inked a memorandum of understanding for merger.

You May Like This

Nepal Insurance, IME General Insurance and Prudential Insurance fail to reach agreement for merger

KATHMANDU, Feb 1: Nepal Insurance Authority (NIA) on Wednesday gave an ultimatum of next one week to Nepal Insurance, IME General... Read More...

Prime Life, Union Life and Gurans Life ink a merger agreement

KATHMANDU, May 12: Three life insurance companies—Prime Life, Union Life and Gurans Life—signed an agreement for merger on Thursday. Provided the... Read More...

Global IME and Janata Bank to go into merger

KATHMANDU, July 5: In line with the recent instruction of Nepal Rastra Bank Governor Chiranjivi Nepal, Global IME Bank and... Read More...

Just In

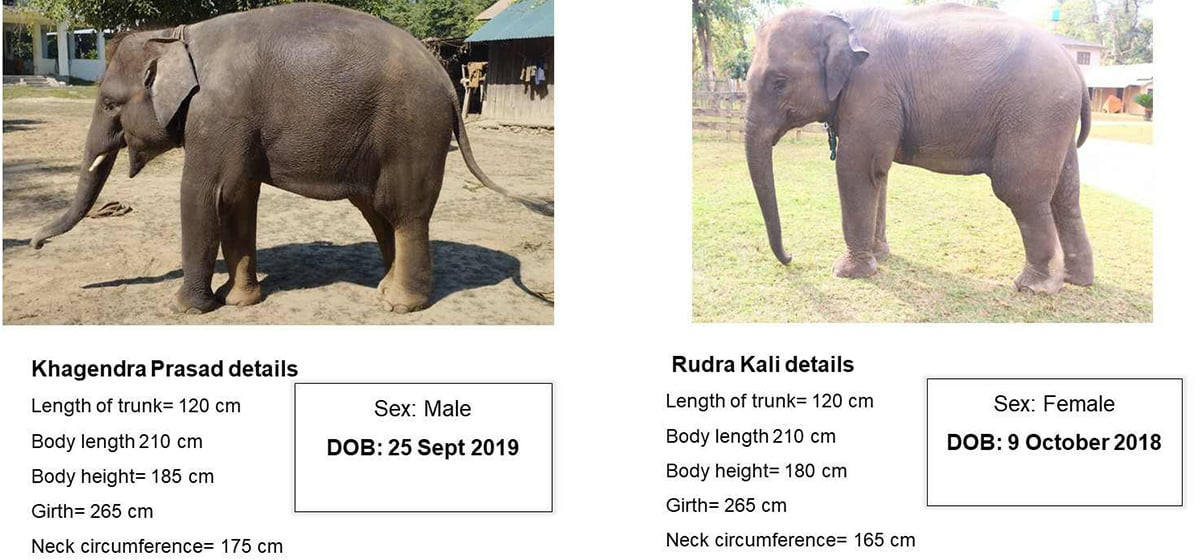

- Nepal to gift two elephants to Qatar during Emir's state visit

- NUP Chair Shrestha: Resham Chaudhary, convicted in Tikapur murder case, ineligible for party membership

- Dr Ram Kantha Makaju Shrestha: A visionary leader transforming healthcare in Nepal

- Let us present practical projects, not 'wish list': PM Dahal

- President Paudel requests Emir of Qatar to initiate release of Bipin Joshi

- Emir of Qatar and President Paudel hold discussions at Sheetal Niwas

- Devi Khadka: The champion of sexual violence victims

- Nagarik Nayak Felicitation (Live)

_20240423174443.jpg)

Leave A Comment