OR

Govt proceeds with sovereign credit rating process stalled for three years

Published On: April 28, 2024 08:00 AM NPT By: Republica | @RepublicaNepal

“Provided the country receives credit rating, it will allow govt and private sectors issue bonds in the international market, while building confidence of foreign investors”

KATHMANDU, April 28: The government has initiated the process of Sovereign Credit Rating (SCR) for the country which was stalled for three years.

The SCR serves as a crucial indicator, offering insights into the country's financial situation and credit capacity. It is done to get real information about the country's investment risk situation.

The government move has come up just in the prelude of the Nepal Investment Summit-2024, which kicks off on Sunday. Foreign investors consider the sovereign credit rating as a prerequisite for investment.

Provided the country receives the SCR, it would make it easier for the government as well as the private sector to issue bonds in the international market and raise large amounts of capital for trade or development projects. Due to a lack of credit rating, Nepal as of now has not been able to secure commercial loans for large infrastructural projects from international development partners.

As of now, Afghanistan, Bhutan and Nepal among the SAARC nations do not have sovereign credit ratings. With the aim of increasing foreign investment, the government announced the SCR through the budget of the fiscal year 2018/19. The government had issued a public notice and invited companies for sovereign credit rating.

Three prominent global rating agencies including Fitch Ratings, Moody's, and Standard & Poor's (S&P) Global Ratings submitted their applications for the credit rating of Nepal. Subsequently, the government reached an agreement with Fitch Rating Agency for the credit rating task. Additionally, a separate agreement for technical assistance was forged with the then British International Cooperation Agency, now UK Aid. To oversee the process, Standard Chartered Bank was appointed as the rating consultant.

However, the onset of the COVID-19 pandemic led to economic downturns, prompting the suspension of the rating process for the past three years.

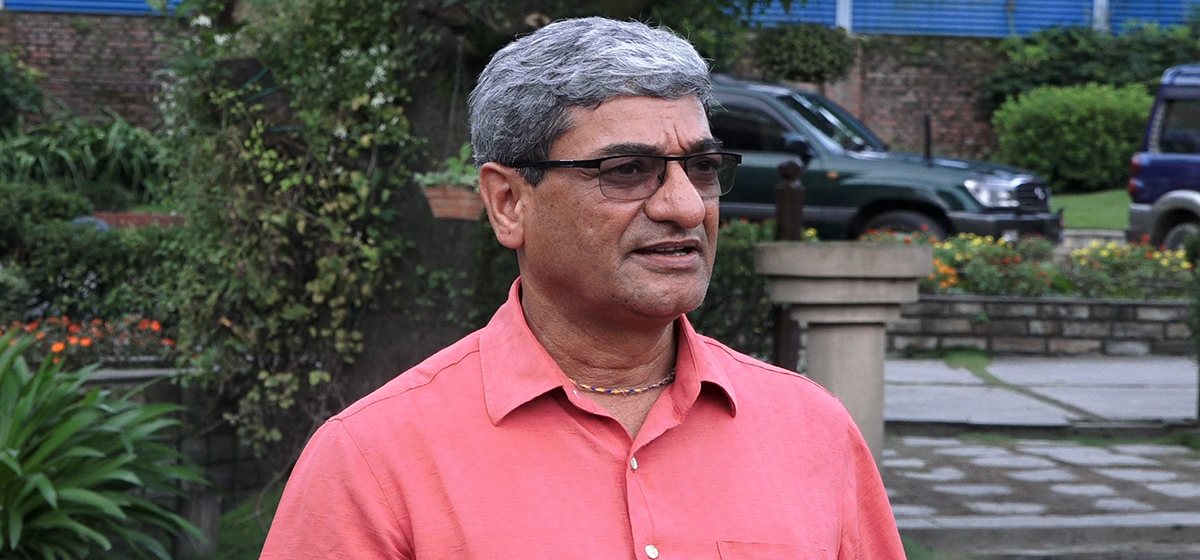

The process of SCR has started again under the leadership of Finance Minister Barshaman Pun. Three years ago, during an international investment conference, foreign investors had emphasized the urgency of expediting the sovereign credit rating.

For that, the Ministry of Finance organized a SCR capacity development workshop with stakeholders in the capital on Friday.

The workshop was attended by Finance Minister Pun, Revenue Secretary Dr Ram Prasad Ghimire, Deputy Governor of the Nepal Rastra Bank Bam Bahadur Mishra, Head of the Financial Sector Management and Corporation Division of the Ministry of Finance Narayan Prasad Risal, Head of the Budget and Programme Division under the Ministry of Finance Ritesh Kumar Shakya, Director General of the Department of Money Laundering Pushpa Raj Shahi, representatives from the Central Bureau of Statistics, UK Aid, and Standard Chartered Bank.

During the inauguration of the workshop, Minister Pun said that the work of rating will proceed without delay. He said that after the credit rating, the world will be able to see the economic face of Nepal and no one should go around telling statistics about the economic situation.

During the workshop's inauguration, Minister Pun affirmed the government's commitment to expedite the rating process without any delay. He said that following the credit rating, the global community would gain insight into Nepal's economic landscape, eliminating the need for speculative discussions on the country's economic situation.

You May Like This

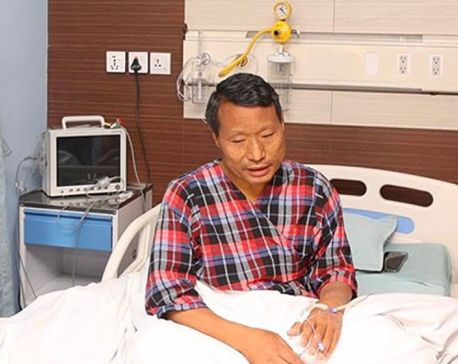

Doctors suggest Maoist Center leader Pun to undergo liver transplant

KATHMANDU, Jan 18: Doctors have suggested to deputy general secretary of the CPN (Maoist Center) Barshaman Pun to undergo a... Read More...

HoR endorses the revised budget

KATHMANDU, September 20: The government on Monday passed the revised budget from the House of Representatives (HoR) amid the lawmakers chanting... Read More...

Just In

- Nepal’s forex reserves surge to Rs 1.911 trillion

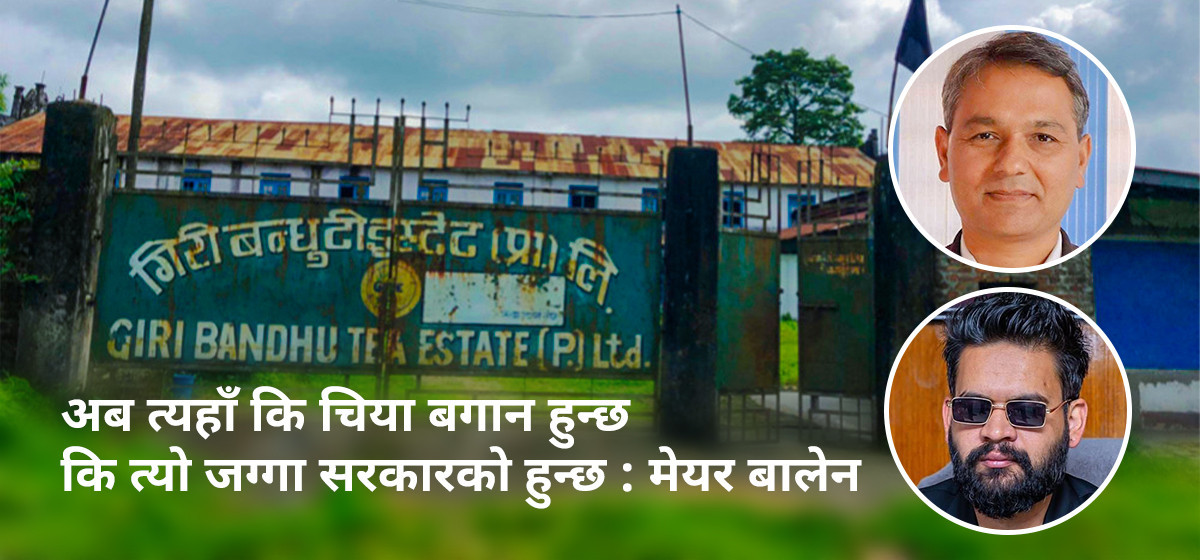

- Balen: ‘Giri Bandhu Tea Estate case is an example of a person’s honesty’

- Police arrest singer Ravi Oad on charge of marital rape

- CIAA to prosecute Security Printing Center's Director Bikal Paudel among others for corruption

- Nepal Mobility Solutions introduces ‘JumJum’, a new ride-sharing platform for Kathmandu

- PM Dahal positive about forming parliamentary probe committee: NC Chief Whip Lekhak

- One arrested on charge of murdering security guard of Nepal Bank Limited Saptari branch

- Kami Rita Sherpa sets new record, climbs Mt Everest for 29th time

Leave A Comment