OR

Nepal received FDI of Rs 270 billion in the past three decades

Published On: April 28, 2024 10:00 AM NPT By: Hari Prasad Sharma

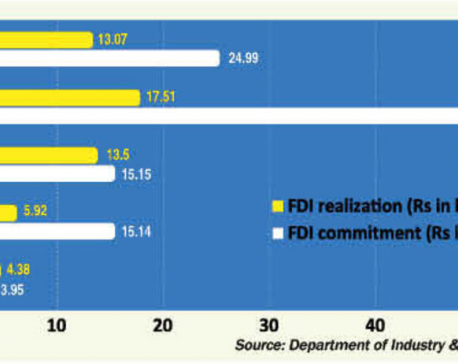

KATHMANDU, April 28: Over the last three decades, promises of foreign direct investment (FDI) totaling around Rs 500 billion have been made, but only Rs 270 billion has been received so far.

According to the Department of Industry, in the fiscal year (1993/94 to 2022/23), foreign investment commitments equal to Rs 474.18 billion were received. However, during the same period, only 56 percent of the commitment, i.e. Rs 270 billion net foreign investment has been received.

Nepal Rastra Bank (NRB) reports that 53.7 percent of the FDI stock received so far represents paid-up capital, while 31.7 percent constitutes reserve capital, and 14.6 percent comprises debt capital. However, there has been a reduction in foreign currency inflows in 2022/23. NRB spokesperson Gunakar Bhatta said that only Rs 5.96 billion was received in foreign funds during the previous year.

However, FDI commitments amounted to Rs 30.69 billion during the same period. In 2021/22, Nepal received foreign investment commitments totaling Rs 54.15 billion, with actual foreign direct investment reaching Rs 18.56 billion. According to NRB, Rs 264 billion of foreign investment was received during the same period.

Targeting to facilitate the potential foreign investors, the government set up the Investment Board Nepal (IBN) in 2011. The high level government agency aims to facilitate public-private partnership and private investments, particularly the foreign direct investment in the country.

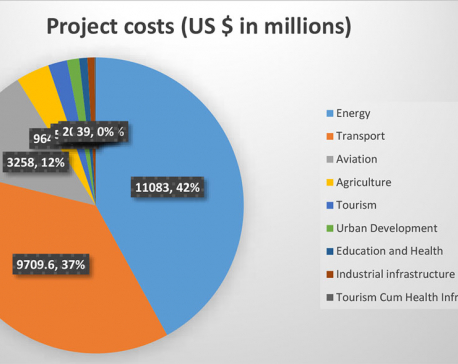

The IBN is responsible for implementation of the projects with an estimated cost of Rs 6 billion and above. The other projects with the capital investment below this threshold are undertaken by the Department of Industry. Over the period since its establishment, the IBN has approved investments totalling Rs 13.50 trillion. Of the 46 projects that it has facilitated, 32 are energy related projects while remaining 14 are from other sectors.

Apart from hydropower, foreign investors have shown interest in various sectors including services, tourism, information technology, agriculture, forestry-based industries, manufacturing, and mining. To invest in small to large industries, foreigners register their companies in the office of the company registrar and take permission from the Department of Industry. Investment commitments from northern neighboring country China have been the highest in recent years, exceeding Rs 212 billion, compared to other countries.

India follows closely in second place, with investment commitments of over Rs 106 billion. The Department of Industry data indicates that FDI commitments have been received from 102 different foreign countries. So far, foreign investors have promised to invest around Rs 161 billion in small industries, Rs 84 billion in medium-sized industries and Rs 232 billion in large-scale industries.

Consequently, the highest investment commitments have been directed towards the energy-based industry, mining, and the service sector. Department of Industry data reveals that Rs 130 billion has been allocated to energy-based industries, Rs 130 billion to the service sector, and Rs 107 billion to the tourism sector thus far. Additionally, there is a rising trend in foreign investment commitments for manufacturing, IT, agriculture, and other sectors. The Department of Industry has indicated that foreign investment has been earmarked for various projects, resulting in the creation of over 322,000 jobs, according to their statistics.

The government is hosting an investment mega event on April 28 and April 29, 2024, aimed at attracting foreign investment. To bolster investor confidence, the government has amended nine different laws through an ordinance ahead of the conference. Amendments have been made to the Lands Act 2021 BS, Land Acquisition Act 2034 BS, National Parks and Wildlife Conservation Act 2029 BS, Electronic Transactions Act 2063 BS, Special Economic Zone Act 2073 BS, Public Private Partnership and Investment Act 2075 BS, Foreign Investment and Technology Transfer Act 2075 BS, Forests Act 2076 BS, and The Industrial Enterprises Act 2076 BS.

During the investment conference, the government will place a priority on indigenous and private sector investors. Collaborating with the private sector, the IBN has prepared a pipeline of over 150 projects.

This marks the first investment conference held by the government aimed at attracting foreign investment. However, as anticipated, the desired influx of foreign investment has not been received. Government officials acknowledge that the shortfall in foreign investment can be attributed to a lack of an investment-friendly environment and procedural complexities.

The government has enacted and implemented the FDI Act. There is immense potential for investment in infrastructure, electricity, tourism, agriculture, information technology, and various other sectors.

As a result of the government's inability to instill confidence in these investment sectors, a sufficient influx of foreign investment has not been achieved. Furthermore, it appears that issues surrounding investment returns, guarantees, as well as legal and procedural matters need to be addressed by specifying investment areas.

NRB spokesperson Bhatta said there is the need to expedite the implementation of financial policies and budget programs introduced by the government to boost foreign investment. He stressed the importance of stability in the institutional mechanism, stating, "We must assure foreign investors that investment will be safeguarded regardless of changes in government." Additionally, he highlighted the necessity of stability in the institutional framework.

The government aims to mobilize foreign capital, technology, skills, and knowledge in key sectors to play a pivotal role in fostering sustainable economic growth and generating employment opportunities through its foreign investment policy. The Department of Industry has devised a strategy to enhance domestic production and productivity by leveraging modern technology and skills, and maximizing the utilization of local resources and skills.

The One Stop Service Center (OSSC) has been established under the Department of Industry to streamline services for both domestic and foreign investors through a unified platform. However, due to constraints in resources, infrastructure, and manpower, the center faces challenges in fully meeting all the service requirements outlined in the Foreign Investment and Technology Transfer Act, 2075 BS.

Foreign investors have the provision to access various facilities such as exemption, concessions, industry registration, foreign loan and investment approval, labor approval, visa facilities, foreign exchange approval, environmental study approval, etc., through a single system provided by the OSSC. However, some argue that placing the burden of all services and performance solely on the OSSC's shoulders presents challenges.

However, according to Yagya Raj Koirala, Director General of the Department of Industry, there are no issues in the workflow and service delivery of the center as per the law. He mentioned that the government is actively undertaking policy reforms to enhance the attractiveness of foreign investment. "We are implementing policy reforms to facilitate foreign investment," he stated. "We have enhanced the efficiency of the entire service process and performance through the OSSC."

Nepal began legally attracting FDI with the enactment of the Foreign Investment and Technology Transfer Act in 1981 (2038 BS). Currently, investment approvals are not only processed through the Department of Industry but also through the IBN. In recent years, Nepal has undertaken legal, structural, and procedural reforms within the industrial sector to foster an investment-friendly environment and attract foreign investment.

From the current year, the government has adopted a more flexible approach to attract foreign investment by lowering the minimum investment threshold. Previously set at Rs 50 million, the minimum limit has now been reduced to Rs 20 million. In amending the previous policy, which demanded substantial investment, the government has announced that the minimum foreign investment requirement will now vary based on regional basis.

You May Like This

One Stop Center starts issuing approval for repatriation

KATHMANDU, Nov 27: A total of 32 companies operating under foreign direct investment have forwarded applications at the One-Stop Service... Read More...

Only 47% of FDI commitment materialized in 5 years

KATHMANDU, Nov 13: Nepal has seen less than half the pledged amount of foreign direct investment (FDI) materialize in each... Read More...

Energy tops government’s FDI priority for investment summit

KATHMANDU, March 17: Energy projects top the government priority for foreign direct investment (FDI) in terms of investment amount, according... Read More...

Just In

- Joint meeting of Federal Parliament to be held on May 14, President to address

- Main opposition party NC takes exception to the role of government and speaker in parliament

- Maoist Center Spokesperson Sapkota bats for national consensus

- Karnali CM Kandel calls an all-party meeting to discuss overall development and prosperity of the province

- Deputy Mayor of Nepalgunj Sub-Metropolitan City to stay with JSP

- Ten Sherpa members scale Mt Everest

- I should get chance to speak in parliament: DPM Lamichhane

- Woman arrested with counterfeit Nepali currency in Rangeli

Leave A Comment