OR

Daily Commentary: Stocks end mildly higher to cap volatile week

Published On: December 10, 2020 07:28 PM NPT By: Republica | @RepublicaNepal

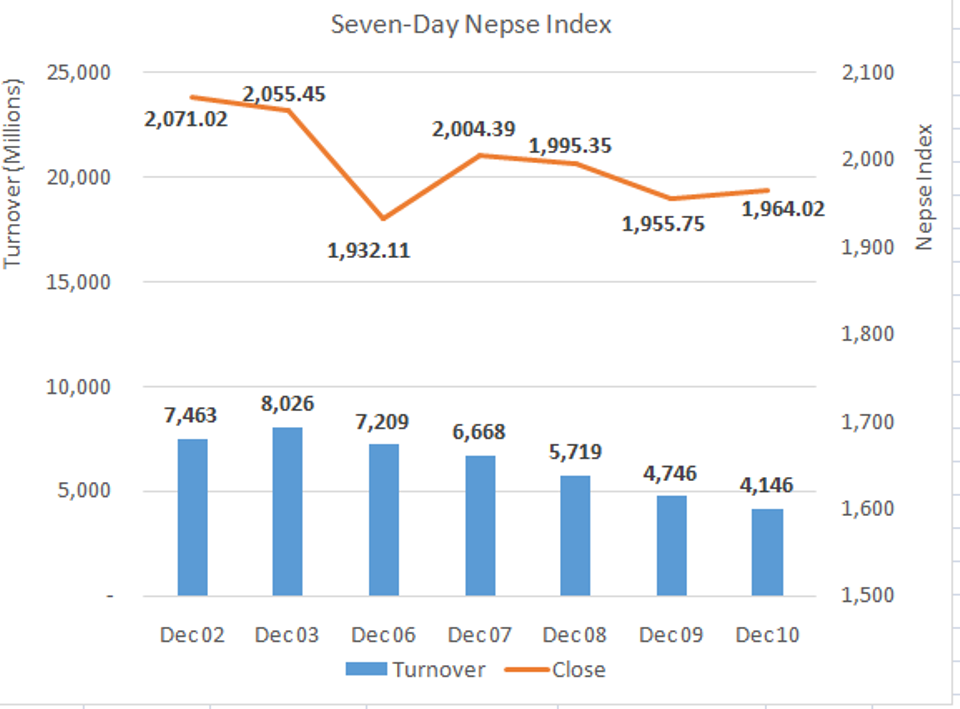

Nepse benchmark index up 8.27 points

KATHMANDU, Dec 10: The local bourse opened Thursday’s trading in the red with the Nepal Stock Exchange (Nepse) dropping 15 points in the morning. After a sharp recovery at mid-day, the index reverted towards the opening level and hovered around the line of 1,950 points. An advance towards the closing hours, finally, saw the index register a gain of 8.27 points to settle at 1,964.02 points.

After opening with serious loss on Sunday, the index found footing on the subsequent trading days. However, lack of clarity persists in the equity market as investors took a more cautious approach to trade in the market. Consequently, turnover also fell for a fifth consecutive session to Rs 4.15 billion.

Manufacturing & Processing sector outperformed the broader market. The group’s sub-index jumped 2.67%. Trading, Life Insurance and Hotel sub-indices also saw gains of over 1% each. All other sectors ended the day higher, barring Hydropower and Development Bank segments with registered losses of 4.13% and 0.18%.

Nepal Life Insurance Company Ltd was the most heavily traded stock on Thursday. The life insurer’s shares worth Rs 373 million changed hands.

Nepal Reinsurance Company Ltd and Global IME Bank Ltd Promoter Share registered turnovers of Rs 353 million and Rs 227 million. Himalayan Distillery Ltd, Nepal Telecom Ltd and Upper Tamakoshi Hydropower Ltd were the other actively traded shares.

Liberty Energy Company Ltd and Narayani Development Bank Ltd were the top gaining scrips with both remaining locked in the upper circuit limit of positive 10%. Himalayan Distillery Ltd’s shares also jumped 9%. Pokhara Finance Ltd, Guheshwori Merchant Bank & Finance Co. Ltd and Gurkhas Finance Ltd posted gains of over 4%.

On the other hand, Upper Tamakoshi Hydropower Ltd tanked to hit the lower circuit of negative 10%. Its counterparts, Rsuwagadhi Hydropower Company Ltd and Sanjen Jalvidhyut Company Ltd, also came under pressure with losses of 8.61% and 6.43% respectively. United Finance Ltd, Sindhu Bikash Bank Ltd and Arun Valley Hydropower Development Co. Ltd were the other major decliners.

On the technical front, the equity index formed a small bullish spinning top candlestick reflecting lack of volatility and indecision in the current scenario. After a dip of around 150 points from the previous week’s peak, selling momentum has also subsided fairly, while buyers are yet to enter the market with conviction. Given the index holds ground above 1,900 point’s mark, some consolidation can be expected in the current scenario. A rebound backed by notable volumes can provide opportunities to go long in the equity market.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

www.arkscapitaladvisors.com

You May Like This

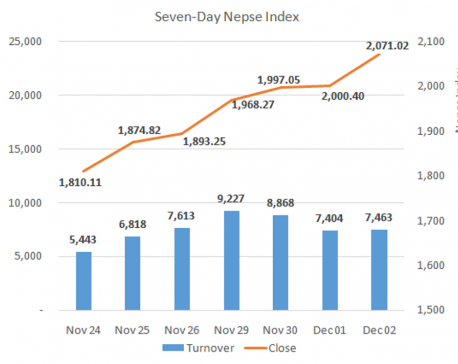

Nepse benchmark index jumps 70 points

Stock market sees turnover of Rs 7.46 billion ... Read More...

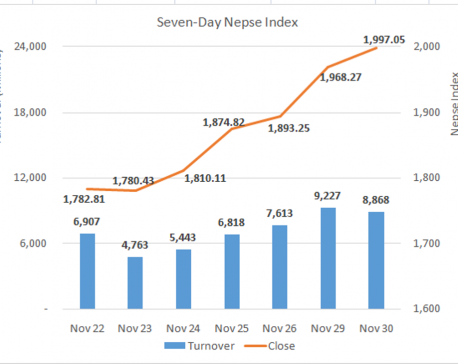

Daily Commentary: Nepse benchmark index jumps 29 points to close at 1,997 points

Stock market record highest daily turnover of Rs 8.87 billion ... Read More...

Daily Commentary: Stocks recoup morning losses to end flat

Nepse benchmark index up by 1.74 points ... Read More...

Just In

- People urged to take caution as Terai region including Lumbini province experiences sweltering heat

- T-20 series: Nepal playing second match against West Indies ‘A’ today

- Investing in Nepal: Challenges and Opportunities

- ‘Nepal should focus on ease and speed of doing business’

- Nepal received FDI of Rs 270 billion in the past three decades

- A Modest Call for a ‘Nepali-First Strategy’

- Nepal Investment Summit 2024: Private Sector's Voice

- Vote counting in Ilam-2 and Bajhang-1(a) to begin today

-1200x560-wm_20240427144118.jpg)

Leave A Comment