OR

Banks can now count subsidized edu loans as deprived sector credit

Published On: July 12, 2018 05:35 AM NPT By: Republica | @RepublicaNepal

KATHMANDU, July 12: The Nepal Rastra Bank (NRB) has introduced a provision in the Monetary Policy for Fiscal Year 2018/19 which allows banks to count loans against academic certificates, and higher education loans for students of marginalized and Dalit community, among others, as deprived sector lending.

The provision provides a sigh of relief to commercial banks which are struggling to meet the deprived sector lending requirement. The central bank requires banks to lend 5 percent of their total loan portfolio to deprive sectors.

The government has introduced these subsidized lending schemes through the budget for FY2018/19.

Unveiling Monetary Policy for FY2018/19 in Kathmandu, Nepal Rastra Bank (NRB) introduced a provision to implement programs introduced by government through the budget speech and also made it easier for banks to meet the mandatory lending requirement.

In the budget speech, the government announced to provide loans of up to Rs 700,000 at five percent subsidized interest rates against academic certificates as collateral in order to encourage youths to start business ventures. Similarly, the government has also announced to provide loans of up to Rs 1 million at five percent interest rate on group guarantee to Dalit community so that they can run businesses through cooperative or community-based productions.

Likewise, the government has announced a policy of providing education loans at five percent interest to students from economically deprived and marginalized community, and other targeted sector so that they can get higher education without any difficulty.

You May Like This

Flood, fire victims to get subsidized loans loans to rebuild house, run business

KATHMANDU, Jan 10: At a time when earthquake victims are struggling to get subsidized loans from bank and financial institutions... Read More...

Deprived sector receives loans worth Rs 100 billion

KATHMANDU, June 27: Bank and financial institutions (BFIs) floated a total of Rs 99.34 billion in deprived sector loans in the... Read More...

Banks told to make deprived sector lending in phase-wise manner

KATHMANDU, Aug 30: Nepal Rastra Bank (NRB) has instructed commercial banks to disburse at least two percent of their total... Read More...

Just In

- Taylor Swift releases ‘The Tortured Poets Department’

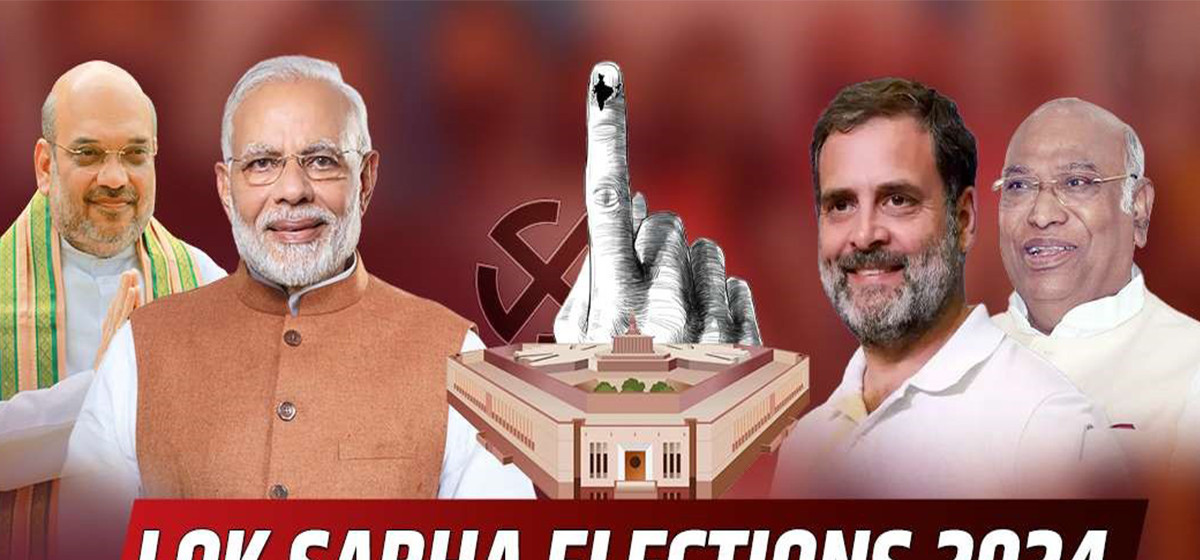

- India starts voting in the world’s largest election as Modi seeks a third term as prime minister

- EC seeks cooperation for free and fair by-election

- Bus carrying wedding procession attendees meets with accident in Sindhupalchowk claiming three live

- CPN (Unified Socialist) to hold its Central Committee meeting on May 10-11

- Over 16,000 paragliding flights conducted in one year in Pokhara

- MoPIT prepares draft of National Road Safety Act, proposes rescue within an hour of an accident

- Light rainfall likely in hilly areas of Koshi, Bagmati, Gandaki and Karnali provinces

Leave A Comment