OR

weekly market commentary

Nepse posts modest weekly loss as consolidation continues

Published On: July 28, 2018 07:17 AM NPT By: Republica | @RepublicaNepal

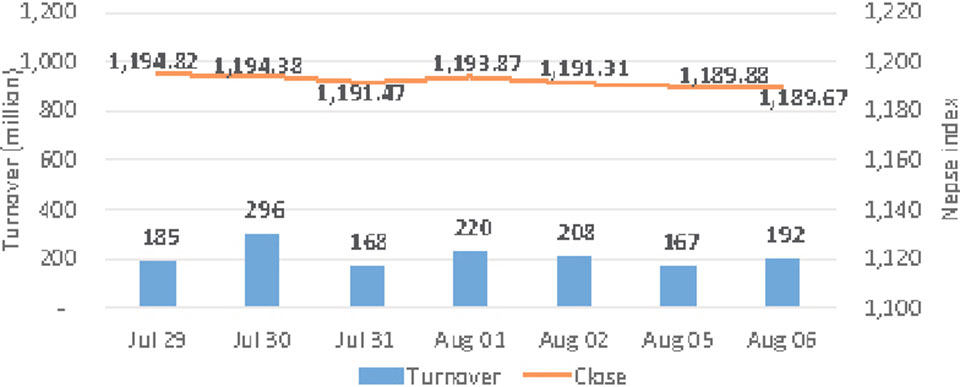

KATHMANDU, July 28: The benchmark Nepal Stock Exchange (Nepse) Index, which started the week at 1193.39 points, suffered the first trading day declining over 8 points. Despite the Nepse Index rebounding on Monday and Tuesday's trading sessions to climb up to almost 1,200-point level, stocks logged in losses in the remaining two sessions. At the end, Nepse index declined by 2.19 points on week-to-week basis to close at 1,191.20 points.

The bourse experienced another week of slow trading. Investors stayed cautious throughout the week as they kept a close eye on earnings reports published by listed companies. Hence, transactions remained subdued as the weekly turnover further dropped by 27.41 percent amounting to Rs. 1,056 million.

Class 'A' stocks also followed the broader market with the Sensitive Index declining 0.46 points or 0.18 percent in the review period. Major sub-indices turned in mixed performance posting modest moves to either side. Significant strength was visible among hotel stocks as its sub-index surged 2.13 percent. Sub-indices of Others, Trading, and Finance segments also showed modest moves to the upside. Meanwhile, Microfinance sub-index posted the highest decline of 1.29 percent. Furthermore, Life Insurance and Non-Life Insurance sub-indices also shed over 1 percent each. Banking sub-index ended almost unchanged in the review period.

In terms of market activity, commercial banks remained mostly active in the week. Nabil Bank Ltd led the list of active stocks as over Rs. 53 million worth of its shares were traded in the exchange. Second on the list, Nepal Investment Bank Ltd scrips registered a turnover of Rs. 38 million. Nepal Credit and Commerce Bank Ltd, Nepal bank Ltd and Sanima Bank Ltd were among other active stocks for the week.

Among the commercial banks, Citizen Bank International Ltd reported a net profit growth of 30.21 percent in its fourth quarterly report. Its current net profit stands at Rs. 1,408 million. Nepal Bank Ltd also published their quarterly financial reports, mentioning an increase in its net profit by 9.04 percent. The bank's net profit amounts to Rs. 3,399 million.

This week, Nepse published a notice urging investors to obtain username and password from broker offices. As of now the investors can view their respective order status and matching process from the online platform. In other news, Nepal Rastra Bank (NRB) has cleared NMB Bank Ltd to receive foreign loan from International Finance Corporation. Funds obtained as such shall be deployed for development projects.

ARKS technical analysis model indicates that the market remained range bound throughout the week as the index swung between 1,180 and 1,200 points level. The resistance of 1,200 points has still held its place as the index could not close above that level despite surging past 1,200 points intraday on Tuesday. Hence, consolidation has persisted where the market still indicates lack of a clear course for the sole equity market.

This column is produced by ARKS Capital Advisors Ltd www.arkscapitaladvisors.com

(Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

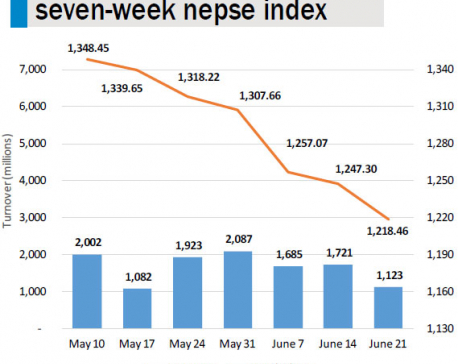

Nepse posts weekly decline as stocks fail to hold ground

KATHMANDU, June 23: The equity market maintained an overall negative bias this week. The Nepal Stock Exchange (Nepse) index posted... Read More...

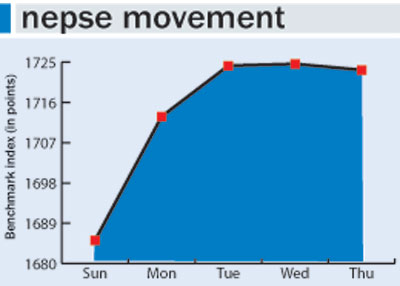

Nepse posts weekly gain of 38 points

KATHMANDU, July 2: Nepal Stock Exchange (Nepse) climbed up 38.06 points this week to close at 1,723.23 points on Thursday... Read More...

Loss of heritage is loss of living culture

KATHMANDU, Nov 28: The idols of goddess Bal Kumari and Rudryani from the Rudrayani Temple in Khokana was stolen on the... Read More...

Just In

- Gandaki Province reports cases of forest fire at 467 locations

- Home ministry introduces online pass system to enter Singha Durbar

- MoLESS launches ‘Shramadhan Call Center’ to promptly address labor and employment issues

- Biratnagar High Court orders Krishna Das Giri to appear before court within one month in disciple rape case

- Ilam by-election update: UML candidate Suhang maintains lead

- Korean embassy and NTB jointly commemorate 50th anniversary of Korea-Nepal diplomatic relations

- SC administration files contempt of court case against SidhaKura

- Second day of Nepal Investment Summit to feature diverse discussions

Leave A Comment