OR

#Controversial Provisions in New Budget

UML objects to the provision that does not require disclosing investment source

Published On: September 29, 2021 10:51 AM NPT By: Dilip Paudel

KATHMANDU, Sept 29: The main opposition party, the CPN-UML, has raised serious objections over the government’s decision to allow investment in areas other than the liquor and tobacco industries without disclosing source of income. The party alleged that the government had tried to legalize black money as it amended the Income Tax Act, 2002 and made it impossible to find an income source of investment in some areas.

Former Prime Minister and CPN-UML Chairman KP Sharma Oli on Tuesday criticized the government for trying to legalize black money through the budget during a meeting held with editors of various media outlets.

Oli opposed the provision of investing without disclosing the source of income. Stating that Nepal is a country that has committed to control money laundering, he said that the provision tries to make Nepal a country to whiten black money. "We are trying to make Nepal a washing machine for washing black money," Oli said. "It does not bring development. It brings a disaster instead."

It has been criticized that the Income Tax Act has been amended with the provision of 'no source of income needed for investment' with the intention of legalizing the money earned illegally by high level political leaders, businessmen and corrupt employees. By amending the Income Tax Act, 2002, Article 11 has made provision for 'no source of income for investment in industries other than tobacco and alcohol'.

CPN-UML Member of Parliament Khagraj Adhikari also accused the government of trying to blacklist the country. He warned that the country could be blacklisted for violating international law.

It has been alleged that the Income Tax Act has been amended with the intention of legalizing the illegally earned money. Stakeholders have suggested that such an amendment should be endorsed by parliament only after holding a serious debate as anti-money laundering is a sensitive issue.

Article 11 of the Income Tax Act 2058 contains the phrase, "except for sectors related to cigarettes, bindi, and cigars, edible tobacco, betel leaf and spices, no source of income will be sought from the investment made till mid-April 2024."

The Act stipulates that sources should not be disclosed while investing in hydropower projects of national importance, international airports, underground routes and roads, infrastructure development projects such as railways, cement industry, steel industry, agro-based industries and industries related to tourism services.

Nepal should be sensitive as it is a party to international organizations that discourage investment made through money laundering and terrorist activities. Nepal is also a member of the Financial Action Task Force (FATF) and the Asia Pacific Group (APG). Under the leadership of both these organizations, work has been done to discourage investment in money laundering and terrorist activities around the world.

Nepal has been a member of these organizations, but as the membership is not mature but in the evaluation stage, Nepal has been accused of failing to enact necessary laws to curb investment in money laundering and terrorist activities and take action against those who acquire illegal assets. There is a fear that the country will be blacklisted as a result of this.

Rather than introducing an arrangement to restrict money laundering, Finance Minister Janardan Sharma has introduced a new provision that encourages money laundering. Stakeholders have warned that Nepal could be blacklisted internationally if this arrangement is implemented.

You May Like This

CPN-UML calls its CC meeting today

KATHMANDU, August 26: The main opposition party, CPN-UML has summoned its central committee meeting on Thursday. ... Read More...

Consensus with Nepal-led faction likely by tomorrow: Pradeep Gyawali

KATHMANDU, July 7: The ruling CPN-UML Spokesperson Pradeep Kumar Gyawali has expressed confidence that the dispute seen with Madhav Kumar... Read More...

Oli inspects CPN-UML’s new office building at Thapathali

KATHMANDU, March 24: Prime Minister and Chairman of the ruling CPN-UML, KP Sharma Oli visited and inspected the party's new... Read More...

Just In

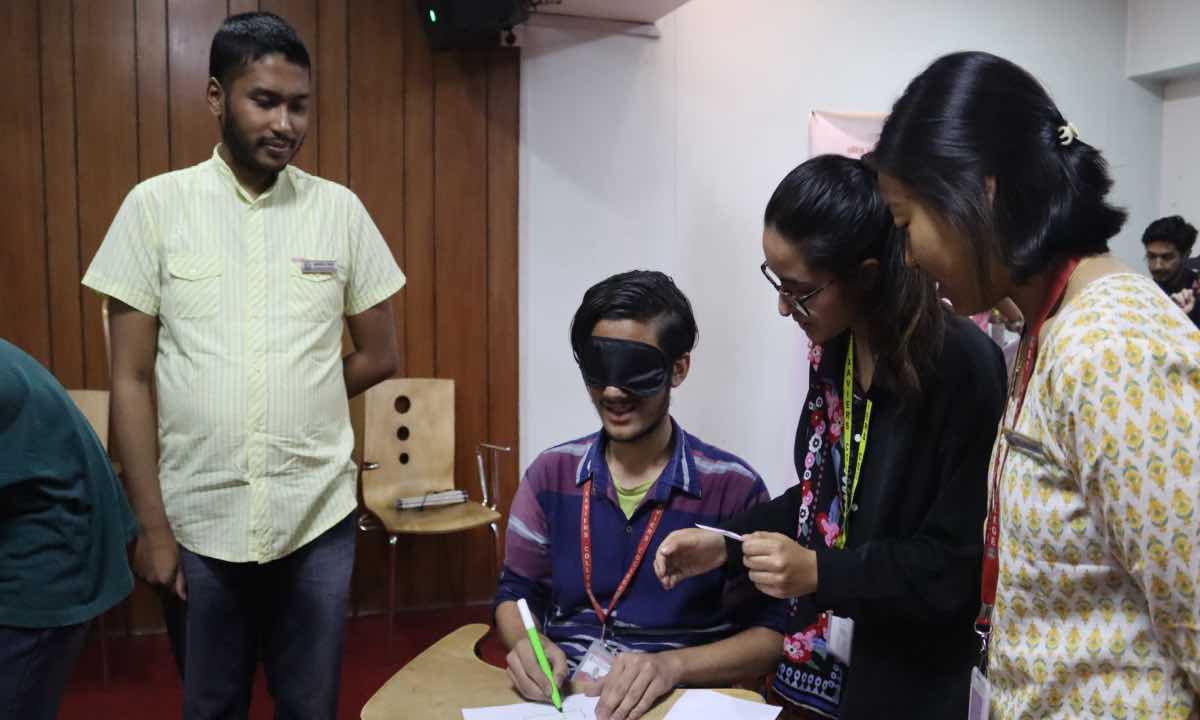

- Chain for Change organizes ‘Project Wings to Dreams’ orientation event for inclusive education

- Gold price decreases by Rs 200 per tola today

- National Development Council meeting underway

- Meeting of Industry, Commerce, Labor and Consumer Welfare Committee being held today

- Nepali announces cricket squad under captaincy of Rohit Paudel for series against West Indies 'A'

- Partly cloudy weather likely in hilly region, other parts of country to remain clear

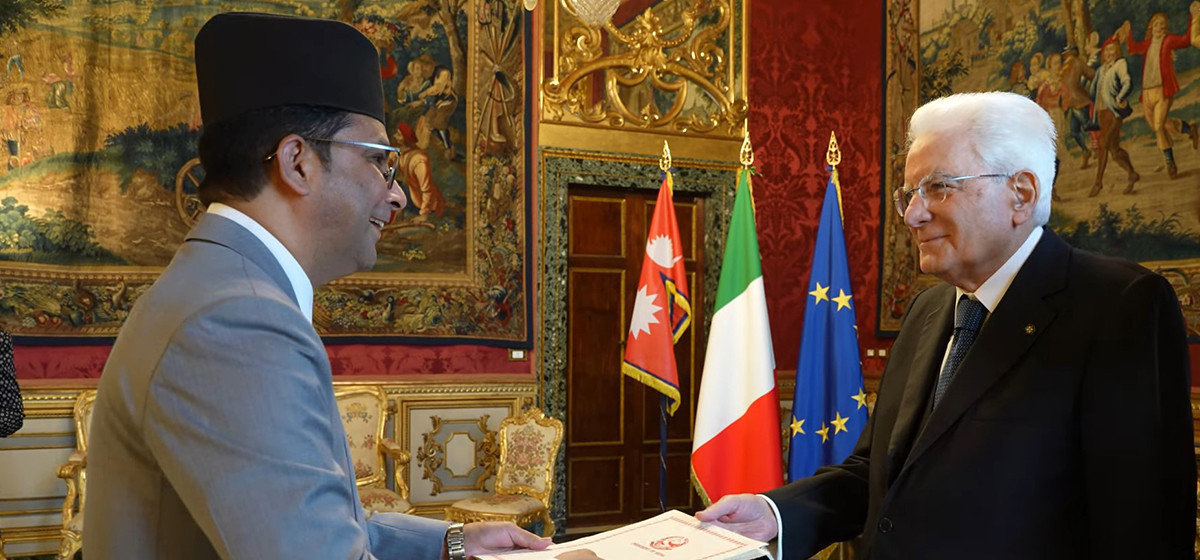

- Nepal’s Non-resident Ambassador to Italy presents Letter of credence to President of Italy

- 104 houses gutted in fire in Matihani (With Photos)

Leave A Comment