OR

Opinion

The case against reopening export of sand

Published On: July 13, 2021 04:54 PM NPT By: Prience Shrestha

Prience Shrestha

Prience Shrestha is a researcher at Samriddhi Foundation, an independent research and educational public policy institute based in Kathmandu.prience@samriddhi.org

Apart from the environment-based argument and identification of the perceived rent-seeking political economic incentive behind the new budgetary policy raised by various media outlets, there are least spoken but vital arguments that either challenge the premise behind the proposed policy or observe likely chances of the policy to encroach upon sub-national jurisdiction in the governing transactions of sand, gravel, and stones.

The federal budget for FY 2021/22 has recently opened the export of sand, gravel, and stones useful for construction purposes to countries where demand supposedly exists. The policy effectively reverses the ban on the sale of sand, gravel, and stone resources implemented by the Ministry of Commerce and Supplies 11 years ago, following the order of the Supreme Court. The permission is also accompanied by the liberal policy to exempt customs duty on materials to be imported in order to build ropeway infrastructure between the quarrying area, where such earth-based resources are to be extracted, and the export depot.

This decision of the federal government has been met with criticisms from several environmentalists, geologists, economists, politicians, and even other state actors especially given its tendency to propagate unchecked mining activities in the Chure/Siwalik belt. Experts fear that such a mining boom can naturally lead to the ecological destruction and disservices in the Chure region and the downstream Terai belt. On the very note, the Supreme Court had also recently issued an interim order to sustain the ban on the export of earth resources useful for construction purposes after receiving several petitions for the same.

However, apart from the environment-based argument and identification of the perceived rent-seeking political economic incentive behind the new budgetary policy raised by various media outlets, there are least spoken but vital arguments that either challenge the premise behind the proposed policy or observe likely chances of the policy to encroach upon sub-national jurisdiction in the governing transactions of sand, gravel, and stones.

First of all, a growing argument that renounces the global treatment of receipt from the sale of exhaustible natural resources as “resource revenue” or more specifically “windfall revenue” directly refutes the premise behind the current policy. The argument questions the treatment of the sale of exhaustible natural resources as potential “export revenue”, which is expected to reduce the trade imbalance of the national economy that currently stands at $9.39 billion. It is because the argument specifically recognizes the proportion of the receipt from the sale of such mineral resource that represents its in-situ value to be treated as “sale of natural capital” rather than “generation of resource revenue”. Meanwhile, the mineral resources in question are in fact natural capital because such resources retain substantial construction value especially for developing economies like Nepal. Such resources pose a higher marginal benefit of added public infrastructures while infrastructural deficit persists in the economy.

This argument demanding a change beginning from the metaphor describing mineral resource transactions is based on the “exhaustible” and “depletable” characteristics of natural resources. This causes it to be different from the sale of processed goods and services that can be manufactured indefinitely. As such, the significant proportion of the receipt from the sale of natural resources regarded as “natural resource rent” or “in-situ value of the natural resources” needs to be accounted as capital outflow, and thus be treated under capital account than being treated as export revenue generally treated under current account. The urgency of such accounting correction is more significant in the current context of the stipulated policy given the massive scale of the extraction work speculated in order to balance the size of the trade deficit. Especially when the expected extraction work keeps a substantial amount of the mineral resources in question at stake likely to face expedited depletion rate.

The substance of the argument, however, does not necessarily invalidate the premise of the policy to propel minerals-based export revenue and improve trade imbalance on technical grounds as Nepal officially treats the sale of mineral resources as revenue, and therefore shall be reflected in the current accounts. But the argument does highlight the dependency of the premise of the policy over a global accounting practice that requires serious amendments.

Second of all, the decision of the federal government to reopen the pathway for the export of sand, gravel, and stones likely to be followed by the role of the federal government in exploring potential mines and issuing extraction licenses can be interpreted as encroachment of the provincial and local jurisdictions in earth-based mineral resources. At present, provincial and local governments have been duly involved in the entire governance of earth-based mineral resources including the issuance of extraction licenses based on environmental assessment, determination of royalty rates, raising of royalty from the extracted resources, and sharing of such royalties between the provincial and local governments as also being repeatedly interpreted in provincial finance acts. Hence, the involvement of the federal government in areas of earth-based mineral resources can trigger likely events of jurisdictional encroachment among the sub-national level of governance. This may even cause fiscal repercussions because the provincial and local governments might require sharing a proportion of the royalty emanating from the sale of sand, gravel, and stones with the federal government possibly in the form of export taxation.

However, the response of the concerned provincial governments geologically representing the Chure and Terai belt in regard to the policy concerned has remained mixed until yet. While the Lumbini Province has welcomed the federal decision, Province 2 recently published a notice evoking disagreement of the provincial government with the federal decision on ecological grounds. Furthermore, the prevalence of legislative incoherence between the levels of government in areas of earth-based mineral resources is unlikely to make it any easier to provide legal recourse to resolve the likely inter-jurisdictional tension regarding the current decision.

Lastly, prominent schools of economic thought have often regarded balance of trade as an irrelevant indicator to determine national economic performance although in the context of a completely open economy. As such, the economy is considered to be better off until it is engaged in sufficient trading activity regardless of its balance. Hence, such an idea also renounces the decision to open exports of mineral resources solely for the purpose of improving trade balance at the expense of the regional ecology.

Of course, liberal trade policies are a key to the prosperity of a nation’s economy. But, policies to specifically target trade imbalance can be misleading at least with support of elements that are not supposed to be accounted as revenue in the first place. More so when such a policy is detrimental to the ecology and might breed inter-jurisdictional tensions in future.

(Prience Shrestha is a researcher at Samriddhi Foundation, an independent research and educational public policy institute based in Kathmandu. He can be reached at prience@samriddhi.org)

You May Like This

COVID- 19 and Nepali Tourism Industry

Nepal needs to start thinking about post-COVID tourism strategies as a country with considerable dependence on tourism income. ... Read More...

Nepal is on sick leave, but what next?

Hi everyone, my name is Nepal. COVID-19 has forced me to take sick days. I am on my 35th sick... Read More...

Wrong economic vision

Prosperity doesn’t come just from wishing or planning for high growth. But this is precisely what the governments of Nepal... Read More...

Just In

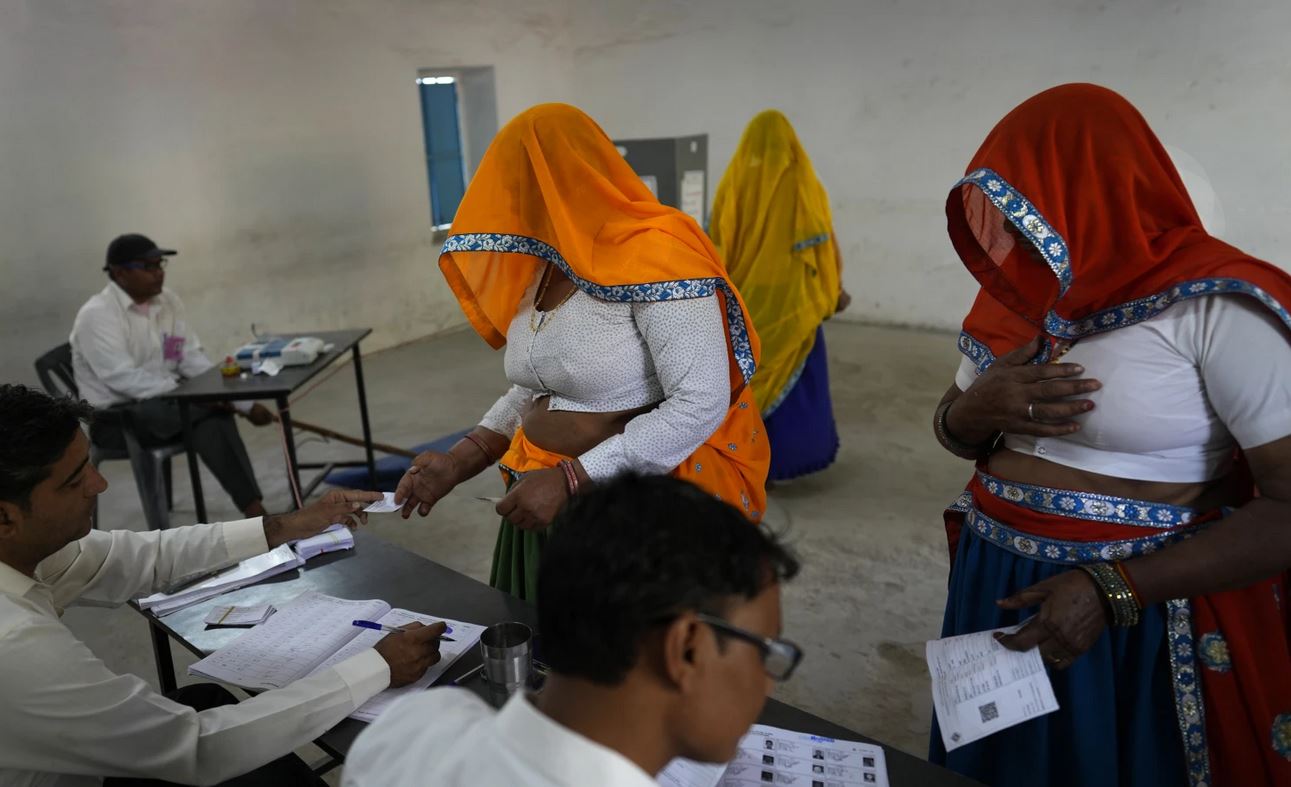

- Indians vote in the first phase of the world’s largest election as Modi seeks a third term

- Kushal Dixit selected for London Marathon

- Nepal faces Hong Kong today for ACC Emerging Teams Asia Cup

- 286 new industries registered in Nepal in first nine months of current FY, attracting Rs 165 billion investment

- UML's National Convention Representatives Council meeting today

- Gandaki Province CM assigns ministerial portfolios to Hari Bahadur Chuman and Deepak Manange

- 352 climbers obtain permits to ascend Mount Everest this season

- 16 candidates shortlisted for CEO position at Nepal Tourism Board

_20220508065243.jpg)

Leave A Comment