OR

Daily Market Commentary

Stocks recoup prior day gains extending its January rally

Published On: January 13, 2022 10:57 PM NPT By: Republica | @RepublicaNepal

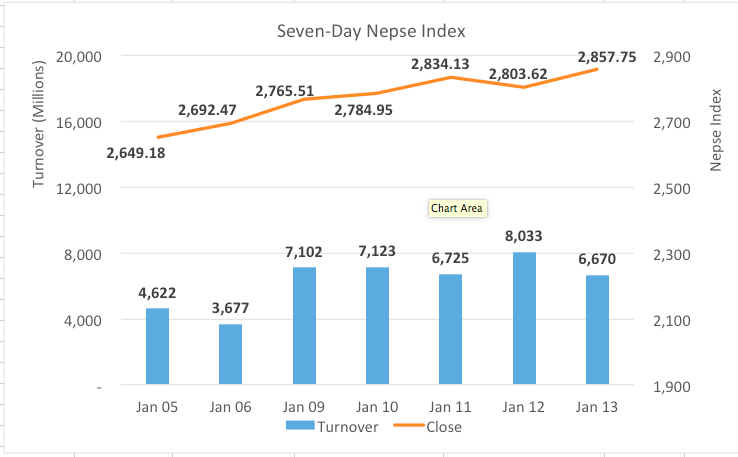

KATHMANDU, Jan 13: The Nepal Stock Exchange (Nepse) index opened in green and continued to trade above 2,800 mark for the entire session on Thursday. A steady rally saw the local bourse end 54.12 points higher at 2,857.75.

The Covid-driven rally is yet to lose its steam with the index continuing to make a sharp move towards the upside for more than 20 trading days. Turnover, however, dropped with aggressive buying remaining absent in the first half of the session. Market participation stood at Rs. 6.66 billion.

All sectors, barring ‘Others’ group, closed in green. Hydropower, Investment and Microfinance sectors led the rally with gains of 4.9%, 3.29% and 3.2%. Heavyweight banks inched marginally higher.

Shares of Upper Tamakoshi Hydropower Ltd were traded the most with turnover of Rs. 343 million. Api Power Company Ltd, Nepal Infrastructure Bank Ltd, Hydroelectricity Investment and Development Company Ltd and Himalayan Distillery Ltd were among other heavily traded shares.

Madhya Bhotekoshi Jalabidhyut Company Ltd, Mountain Hydro Nepal ltd and Karnali Bikas Bank Ltd shot up by almost 10%. Following closely, Shiva Shree Hydropower Ltd and ICFC Finance Ltd rallied 9% apiece.

On the other hand, Narayani Development Bank Ltd and Rastriya Beema Company Ltd fell around 1% each. Standard Chartered bank Ltd, Mailung Khola Jalbidhyut Company Ltd, Laxmi Bank Ltd, Nepal Bangladesh Bank Ltd, Nyadi Hydropower Company Ltd and Bottlers Nepal Terai Ltd fell marginally.

As per the ARKS technical analysis, the index formed another bullish candlestick extending its rally to close exactly at its November high, which can also be taken as a resistance. Hence, some correction can be expected in the current juncture even though momentum indicators still show uptrend in action. On the other hand, a breakout above the current mark with increase in volume can see the index hit 3,000 mark in the near term.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

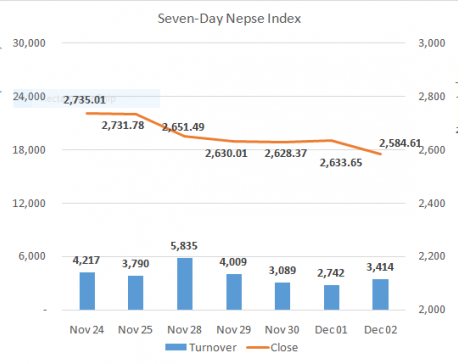

Nepse ends the week on lower note

KATHMANDU, Dec 2: The local bourse started on a positive note but failed to sustain in the positive territory and... Read More...

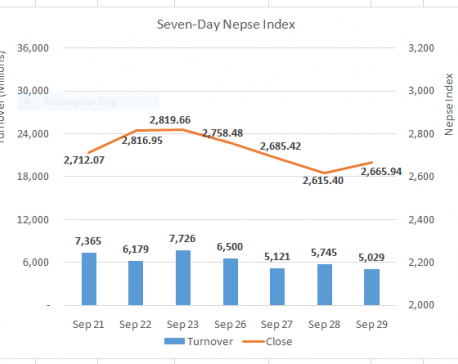

Stocks recoup losses as 2,600 mark holds ground

KATHMANDU, Sept 29: The Nepal Stock Exchange (Nepse) saw strength in the morning on Wednesday with the index climbing around 30... Read More...

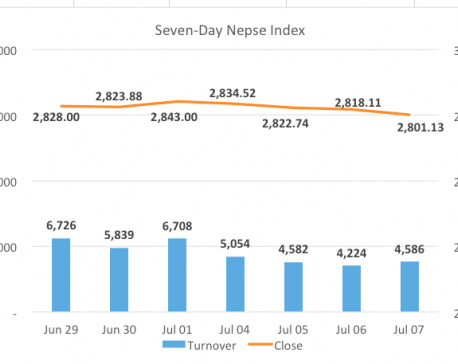

Nepse sees modest losses as quarter end approaches

KATHMANDU, July 7: Stocks traded briefly in green before pulling back towards the opening level in the morning. Subsequently, the benchmark... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

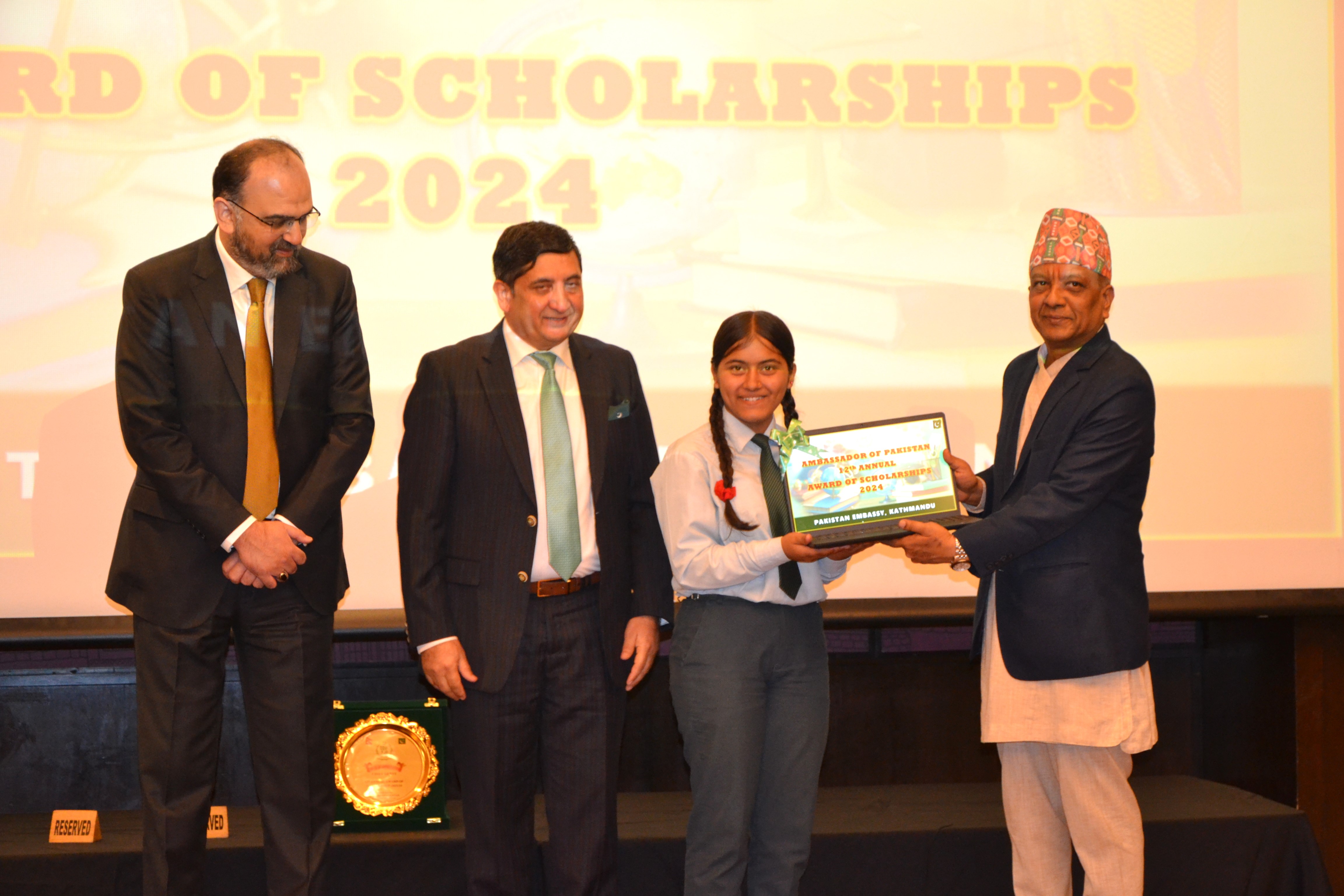

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment