OR

FDI in Agriculture

FDI flow in agriculture will increase competition and because of the sheer size of capital, it might create an unequal playing field for the domestic investors. This is where the current hue and cry is coming from.

The government, in December 2020, decided to open up primary agriculture sectors to Foreign Direct Investment (FDI), which had hitherto remained impervious to foreigners. With this change, a foreign investor may now make investment to grow and market crops, animals, fruits, vegetables and derive gains from such an investment. The decision, however, has received some considerable criticism, especially from the domestic private sector, which has even blamed the government of acting on interest of multinationals. Some stakeholders, thus, have called for withdrawal of the new provision.

Stakeholders in Nepal are now divided on whether FDI should be allowed in primary agriculture sectors. Some point to the necessity of FDI for a capital push for this sector to leap forward.

Low investment, low return

The agriculture sector, for ages, has suffered a cycle of low investment, low return, and low saving. Hence, a capital push—regardless of where it is coming from—is a must to reinvigorate this sector and provide growth, livelihood and development outcomes for the people and the country. The Agriculture Development Strategy (ADS) has also recognized this particular need and hence aims to facilitate and regulate FDI in collaboration with the Investment Board and others. ADS, in the meantime, appears skeptical to FDI in the primary agriculture sectors and seems concerned with the rights of domestic farmers.

Thus what appears here is the stakeholders agree on the necessity of a capital push for agriculture sector to grow and provide developmental outcomes but differ on the source. The fundamental question here is if not from FDI, from where? Are we aiming for the public funds, which are already in the kleptocratic trap or are we looking at the domestic private sector investment? Looking at the current trend and recent history, neither the public expenditure nor the private investment is likely to fill the dearth of capital facing the sector currently. In lack of public funds and apathy of the private sector investment (leaving few exceptions aside), it is almost sure that the sectoral performance and competitiveness will deteriorate over time and we will continue exporting people and importing remittance. Choice is ours!

What FDI brings

In addition to the capital push, foreign investment is believed to bring technology, inputs, and extension services, which so far have remained inadequate, unavailable, untimely, and unaffordable. Poor technology, inputs, mechanization, extension services are other factors contributing to an abysmal performance of this sector, which provides livelihoods to over 60 percent of population and contributes to more than a quarter of the Gross Domestic Product (GDP). Stakeholders, here, unanimously agree on the need to bring appropriate technology and inputs but are selective on the source—some even regard FDI as an instrument to further monopolize agriculture value chains by allowing companies to monopolize the production/farming node. They believe that these companies have already monopolized the start and end of the agricultural value chains—such as inputs (seeds) and end market (supermarkets)—and now with their tentacles on the production/farming, multinational corporations (MNCs) will seize the entire chain.

Moving further and related to the inputs, one stream of argument is related to business at the base of the pyramid (BOP). This group of advocates believes that allowing FDI in primary sector is equivalent to leaving the fate of smallholders at the mercy of callous corporations. Implicit to this argument is the extraction and exploitation, which, however, does not necessarily apply to foreign investors/companies only. This is equally applicable to the domestic private sector/companies, especially the comprador capitalist. There are, however, some business models that can be tested to see to what extent they benefit the poor and small holders.

Inclusive business is one of those ideas that aims to integrate smallholder producers in the supply chain of larger companies—on both demand and supply sides. Central to these models is the business viability of integration where companies ‘strategically’ invest in building smallholder capacities to strengthen their backward linkages and absorb their production and in doing so the company and small holders experience a win-win. These sorts of innovative models can be tried and weighed before grossly rejecting foreign investments.

Another thread of resentment with the foreign investment comes from its implication on food security and agroecology, which is in fact an issue. The food security argument comes from the fact and experience that foreign investors are, to a larger extent, interested in the high value crops, plantations (such as tea) and biofuels, which might not necessarily serve to the food and nutrition security needs of the country. With the profit margin from these crops surpassing others, the country’s food dependency is likely to further exacerbate and trade disruptions (like that of onion in the recent past) might create detrimental effects on food and nutrition security.

Regarding the implication on agroecology, long-term harm to the soil and environment in quest of quick returns and lack of incentives for sustainable productivity enhancement are evident in many parts of the world.

FDI flow will increase competition and because of the sheer size of capital, it might create an unequal playing field for the domestic investors/private sector, and this is where the current hue and cry is coming from. However, the condition of 75 percent export requirement for foreign investors is a cushion for the domestic private sector. In addition to the capital, equally important is the technology, inputs, productivity gains, and employment benefits that foreign investment can bring. So, tradeoff is important. On the other hand, safeguarding smallholder producers, ensuring food security, and maintaining agroecology, are other concerns for which the state should play a role. Letting the markets and investors (be it domestic or foreign) decide the fate of small holders, consumers, and the environment is not what we definitely want. While market should be allowed to function, the state should fulfill its role as a facilitator and a regulator, wherever needed.

You May Like This

What’s the cause behind fertilizer shortage? What can be done?

Nepal needs to explore both short-term and long-term solutions to mitigate fertilizer shortage that has hindered the country’s agriculture productions... Read More...

Agriculture sector being ruined for the last 40 years, new system will ensure farmers' security: Minister Bhusal

KATHMANDU, June 27: Minister for Agriculture and Livestock Development, Ghanashayam Bhsual has said that the agriculture sector is being ruined... Read More...

Agriculture Minister highlights China's support to promote Nepal's tea industry

KATHMANDU, Oct 29: Minister for Agriculture, Land Management and Cooperatives, Chakrapani Khanal, has underlined the need of making efforts to follow... Read More...

Just In

- Nepalgunj ICP handed over to Nepal, to come into operation from May 8

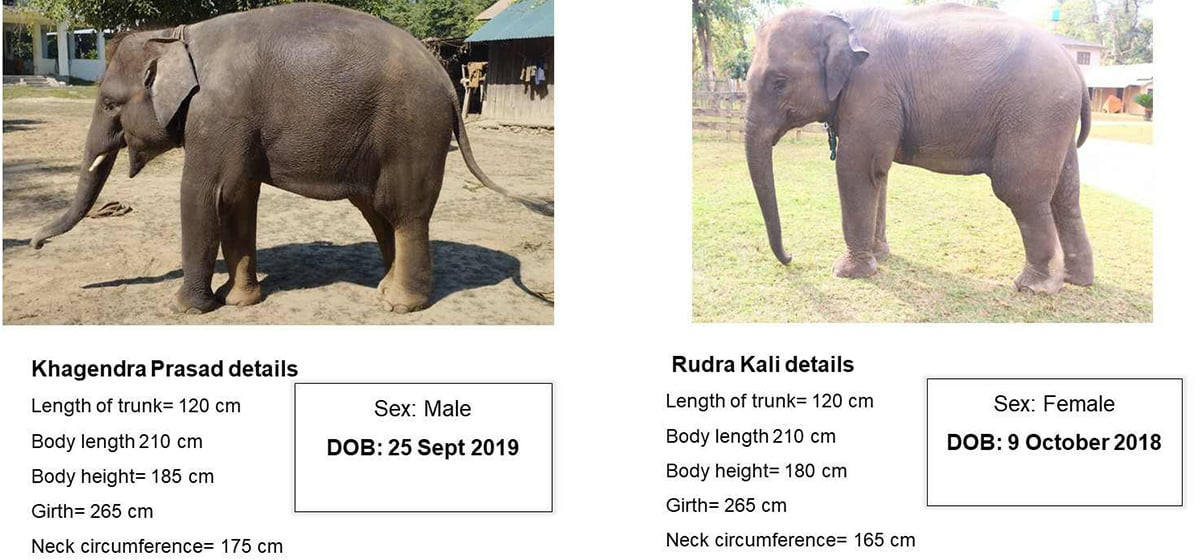

- Nepal to gift two elephants to Qatar during Emir's state visit

- NUP Chair Shrestha: Resham Chaudhary, convicted in Tikapur murder case, ineligible for party membership

- Dr Ram Kantha Makaju Shrestha: A visionary leader transforming healthcare in Nepal

- Let us present practical projects, not 'wish list': PM Dahal

- President Paudel requests Emir of Qatar to initiate release of Bipin Joshi

- Emir of Qatar and President Paudel hold discussions at Sheetal Niwas

- Devi Khadka: The champion of sexual violence victims

_20240423174443.jpg)

Leave A Comment